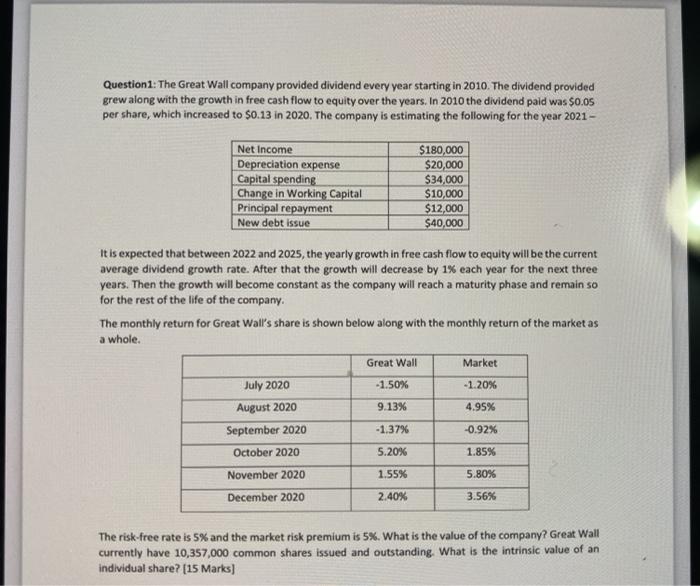

Question 1: The Great Wall company provided dividend every year starting in 2010. The dividend provided grew along with the growth in free cash flow to equity over the years. In 2010 the dividend paid was $0.05 per share, which increased to $0.13 in 2020. The company is estimating the following for the year 2021 - Net Income Depreciation expense Capital spending Change in Working Capital Principal repayment New debt issue $180,000 $20,000 $34,000 $10,000 $12,000 $40,000 It is expected that between 2022 and 2025, the yearly growth in free cash flow to equity will be the current average dividend growth rate. After that the growth will decrease by 1% each year for the next three years. Then the growth will become constant as the company will reach a maturity phase and remain so for the rest of the life of the company. The monthly return for Great Wall's share is shown below along with the monthly return of the market as a whole. Great Wall Market July 2020 - 1.50% -1.20% August 2020 9.13% 4.95% September 2020 -1.37% -0.92% October 2020 5.20% 1.85% November 2020 1.55% 5.80% December 2020 2.40% 3.56% The risk-free rate is 5% and the market risk premium is 5%. What is the value of the company? Great Wall currently have 10,357,000 common shares issued and outstanding. What is the intrinsic value of an individual share? (15 Marks) Question 1: The Great Wall company provided dividend every year starting in 2010. The dividend provided grew along with the growth in free cash flow to equity over the years. In 2010 the dividend paid was $0.05 per share, which increased to $0.13 in 2020. The company is estimating the following for the year 2021 - Net Income Depreciation expense Capital spending Change in Working Capital Principal repayment New debt issue $180,000 $20,000 $34,000 $10,000 $12,000 $40,000 It is expected that between 2022 and 2025, the yearly growth in free cash flow to equity will be the current average dividend growth rate. After that the growth will decrease by 1% each year for the next three years. Then the growth will become constant as the company will reach a maturity phase and remain so for the rest of the life of the company. The monthly return for Great Wall's share is shown below along with the monthly return of the market as a whole. Great Wall Market July 2020 - 1.50% -1.20% August 2020 9.13% 4.95% September 2020 -1.37% -0.92% October 2020 5.20% 1.85% November 2020 1.55% 5.80% December 2020 2.40% 3.56% The risk-free rate is 5% and the market risk premium is 5%. What is the value of the company? Great Wall currently have 10,357,000 common shares issued and outstanding. What is the intrinsic value of an individual share? (15 Marks)