Question

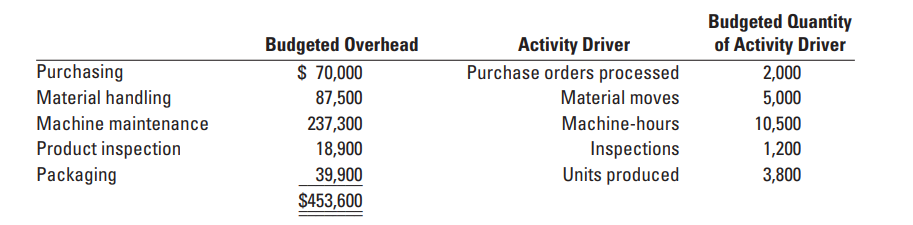

Question 1: The job costing system at Smith's Custom Framing has five indirect cost pools (purchasing, ma+A2:Q94terial handling, machine maintenance, product inspection, and packaging). The

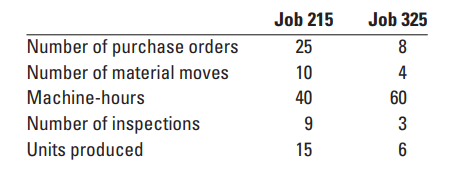

Question 1: The job costing system at Smith's Custom Framing has five indirect cost pools (purchasing, ma+A2:Q94terial handling, machine maintenance, product inspection, and packaging). The company is in the process of bidding on two jobs; Job 215, an order of 15 intricate personalized frames, and Job 325, an order of 6 standard personalized frames. The controller wants you to compare overhead allocated under the current simple job-costing system and a newly-designed activity-based job-costing system. Total budgeted costs in each indirect cost pool and the budgeted quantity of activity driver are as follows: | ||||||

|

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started