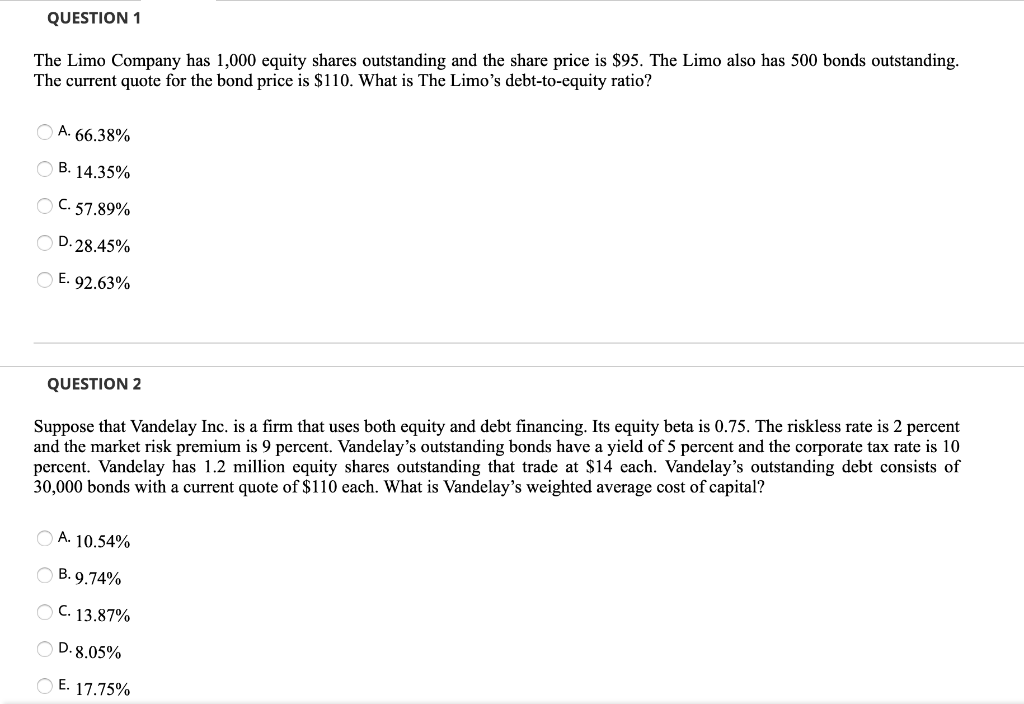

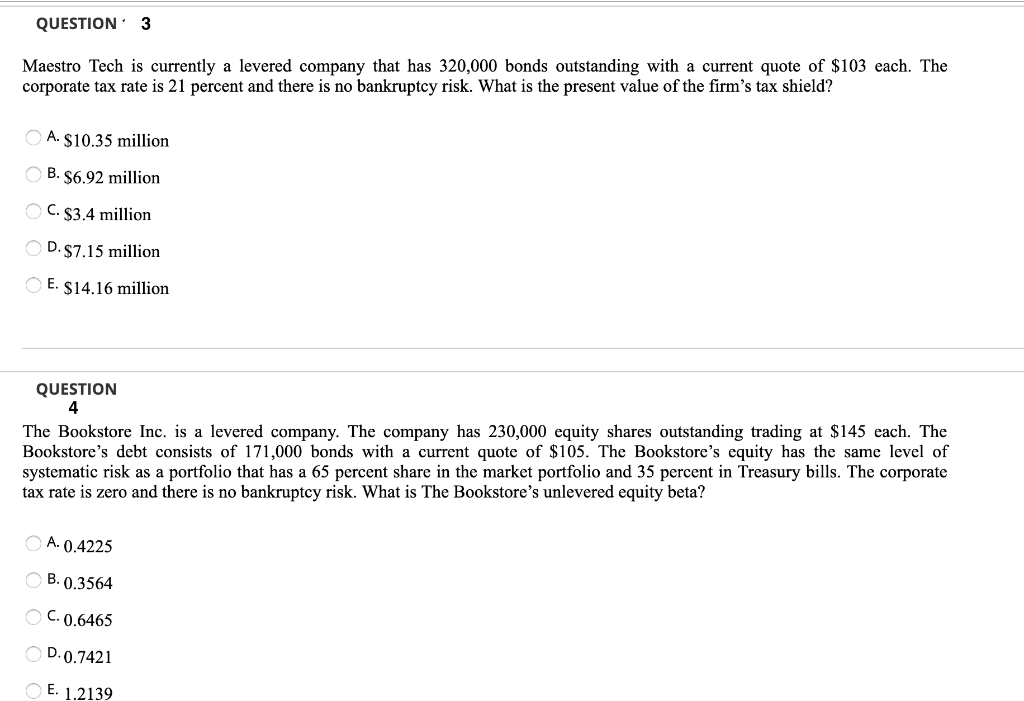

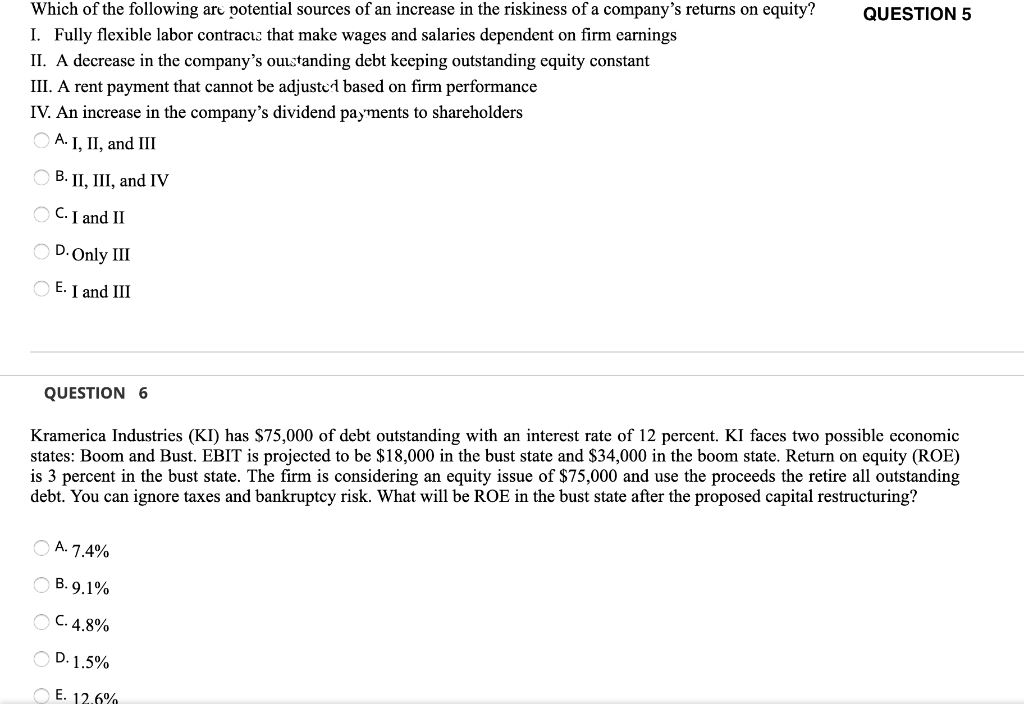

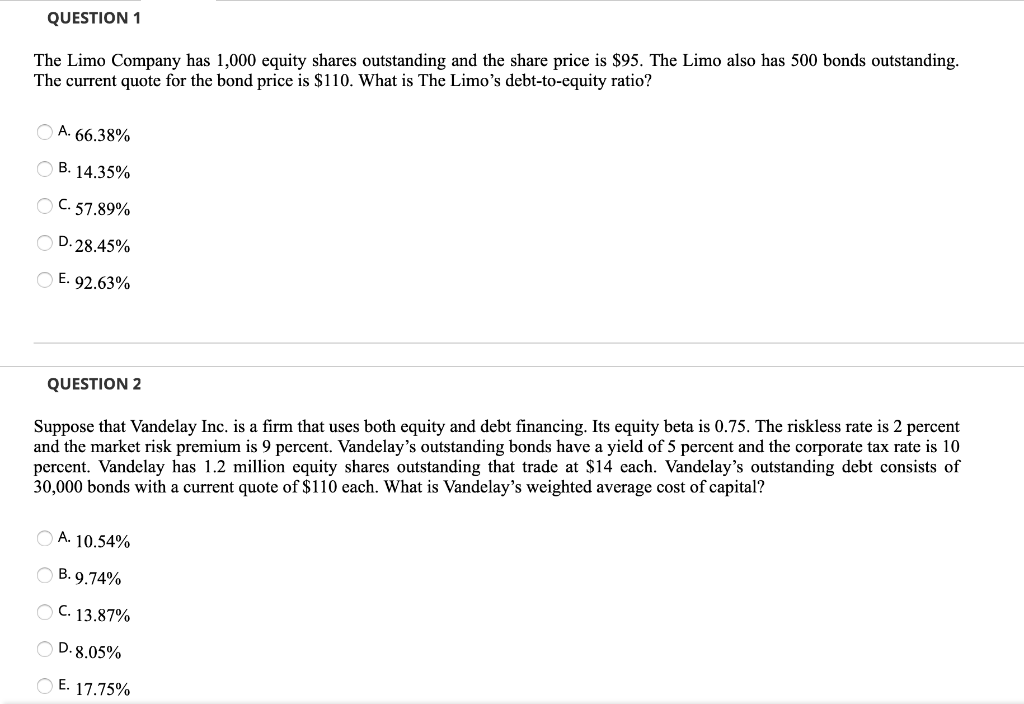

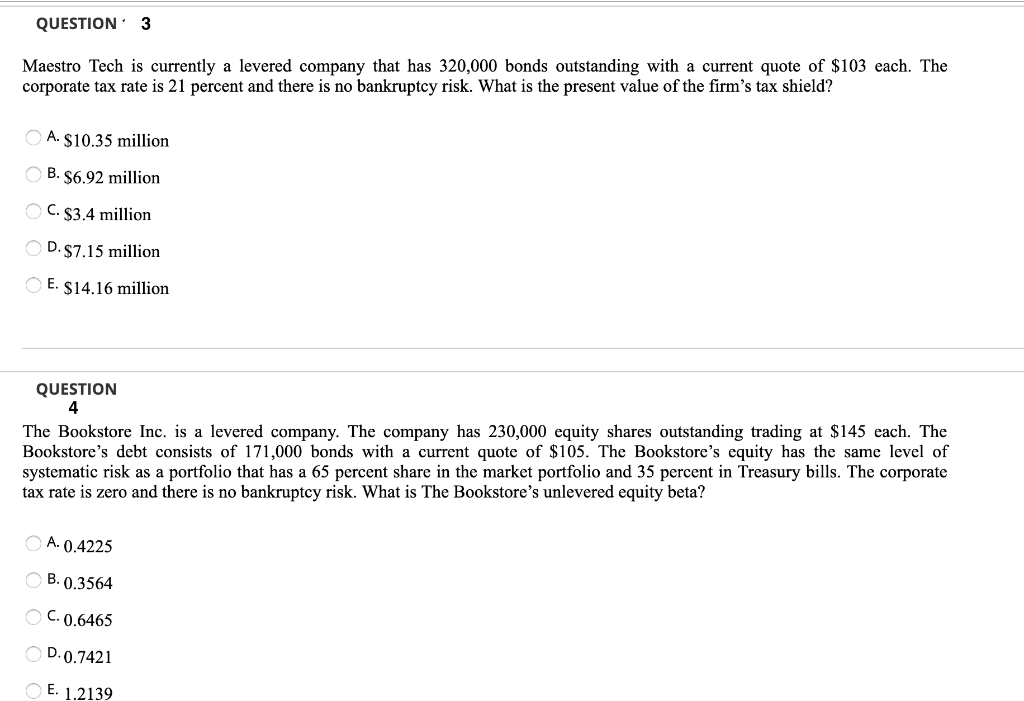

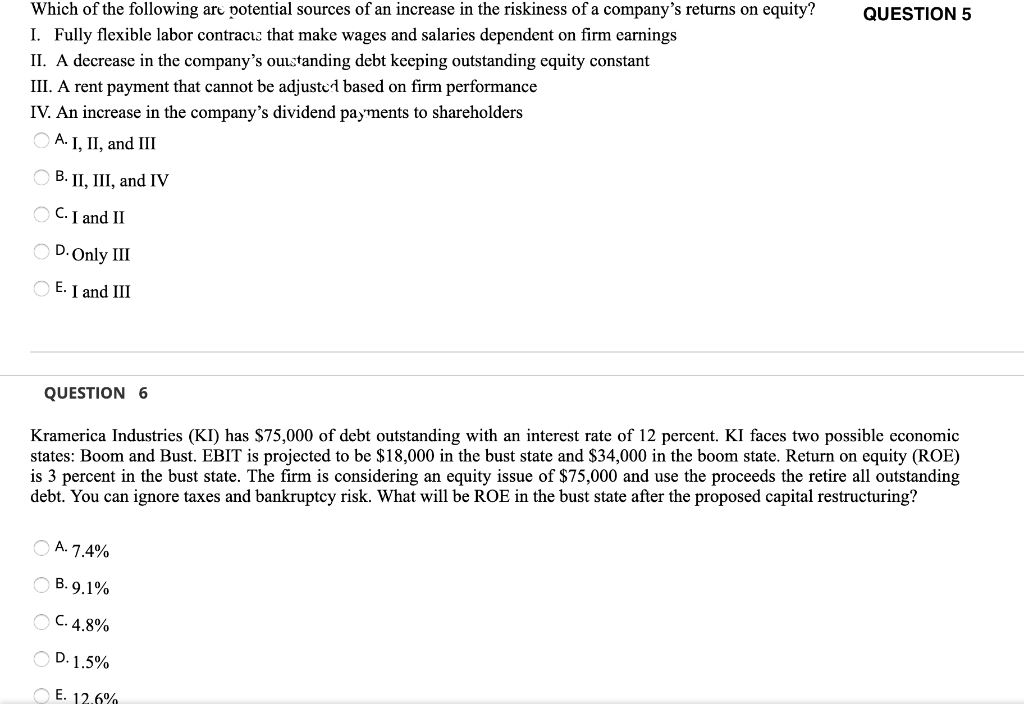

QUESTION 1 The Limo Company has 1,000 equity shares outstanding and the share price is $95. The Limo also has 500 bonds outstanding. The current quote for the bond price is $110. What is The Limo's debt-to-equity ratio? A. 66.38% B. 14.35% C.57.89% D.28.45% E. 92.63% QUESTION 2 Suppose that Vandelay Inc. is a firm that uses both equity and debt financing. Its equity beta is 0.75. The riskless rate is 2 percent and the market risk premium is 9 percent. Vandelay's outstanding bonds have a yield of 5 percent and the corporate tax rate is 10 percent. Vandelay has 1.2 million equity shares outstanding that trade at $14 cach. Vandelay's outstanding debt consists of 30,000 bonds with a current quote of $110 each. What is Vandelay's weighted average cost of capital? A. 10.54% B.9.74% C. 13.87% D.8.05% E. 17.75% QUESTION 3 Maestro Tech is currently a levered company that has 320,000 bonds outstanding with a current quote of $103 each. The corporate tax rate is 21 percent and there is no bankruptcy risk. What is the present value of the firm's tax shield? A. $10.35 million B. $6.92 million C.$3.4 million D. $7.15 million E. $14.16 million QUESTION The Bookstore Inc. is a levered company. The company has 230,000 equity shares outstanding trading at $145 each. The Bookstore's debt consists of 171,000 bonds with a current quote of $105. The Bookstore's equity has the same level of systematic risk as a portfolio that has a 65 percent share in the market portfolio and 35 percent in Treasury bills. The corporate tax rate is zero and there is no bankruptcy risk. What is The Bookstore's unlevered equity beta? A. 0.4225 B.0.3564 C.0.6465 D.0.7421 E. 1.2139 QUESTION 5 Which of the following art potential sources of an increase in the riskiness of a company's returns on equity? I. Fully flexible labor contracts that make wages and salaries dependent on firm earnings II. A decrease in the company's ouistanding debt keeping outstanding equity constant III. A rent payment that cannot be adjuster based on firm performance IV. An increase in the company's dividend payments to shareholders A. I, II, and III B. II, III, and IV C. I and II D.Only III E. I and III QUESTION 6 Kramerica Industries (KI) has $75,000 of debt outstanding with an interest rate of 12 percent. Kl faces two possible economic states: Boom and Bust. EBIT is projected to be $18,000 in the bust state and $34,000 in the boom state. Return on equity (ROE) is 3 percent in the bust state. The firm is considering an equity issue of $75,000 and use the proceeds the retire all outstanding debt. You can ignore taxes and bankruptcy risk. What will be ROE in the bust state after the proposed capital restructuring? A. 7.4% B.9.1% C. 4.8% D. 1.5% E. 12.6%