Question

QUESTION 1. The Magnetron Company manufactures and markets microwave ovens. Currently, the company produces two models: full-size and compact. Production is limited by the amount

QUESTION 1.

The Magnetron Company manufactures and markets microwave ovens. Currently, the company produces two models: full-size and compact. Production is limited by the amount of labour available in the general assembly and electronic assembly departments, as well as by the demand for each model. Each full-size oven requires 2 hours of general assembly and 2 hours of electronic assembly, whereas each compact oven requires 1 hour of general assembly and 3 hours of electronic assembly. In the current production period, there are 500 hours of general assembly labour available and 800 hours of electronic assembly labour available.

In addition, the company estimates that it can sell at most 220 full-size ovens and 180 compact ovens in the current production period. The earnings contribution per oven is $120 for a full-size oven and $130 for a compact oven. The company would like to find an earnings-maximizing production plan for the current production period.

(a) Formulate the above problem as a linear optimization model.

QUESTION 2.

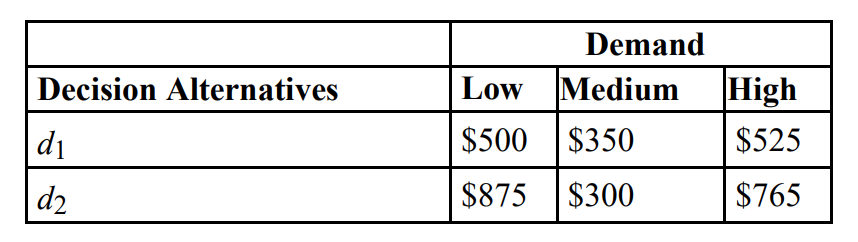

Greentrop Pharmaceutical Products is the world leader in the area of sleep aids. Its major product is Dozealot. The Research-and-Development Division has defined two alternatives to improve the quality of the product. These alternatives involve simple reformulations of the product to (i) minimize the side effects (denoted as d1) and (ii) improve the product efficacy (denoted as d2). To conduct an analysis, management has decided to consider the possible demands for the drug under each alternative. The following payoff table shows the projected profit in millions of dollars.

(a) Construct a decision tree for this problem.

(b) If the decision maker knows nothing about the probabilities of three states of nature, what is the recommended decision using the optimistic, conservative, and minimax regret approaches?

QUESTION 3.

Alice is considering to purchase a critical illness insurance for herself. The policy has an annual cost of $5000. And if Alice has been diagnosed with any critical illness within the year of insurance, she would be compensated up to $150,000 (the maximum claim amount). If there is no insurance coverage, an early stage of critical illness (e.g., cancer) would cost about $10,000; an advance stage of critical illness would cost about $200,000.

Based on Alexs family profile, the estimated probabilities that an early stage of critical illness and an advanced stage of critical illness would occur are around 3% and 1% respectively.

(a) Using the expected value approach, what decision would Alice make?

(b) If Alice chooses to buy the insurance anyway, what would be the most realistic reason for this decision.

Demand Decision Alternatives Low Medium High d d2 $500 $350 $525 $875 $300 $765

Step by Step Solution

There are 3 Steps involved in it

Step: 1

QUESTION 1 a Linear Optimization Model To formulate the problem as a linear optimization model we need to define the decision variables objective func...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started