Question

Question 1 The Sacrifice, a local newspaper, has been considering the replacement of its printing press. The existing press was purchased for $1 200 000

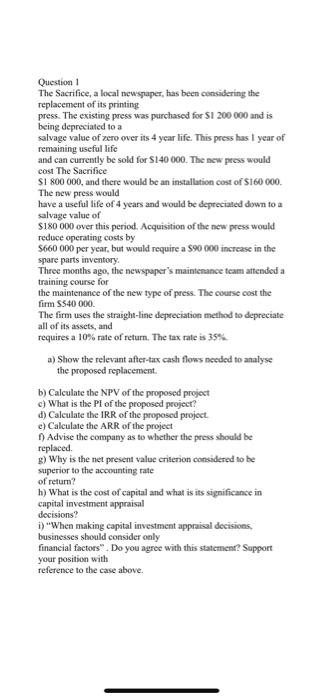

Question 1

The Sacrifice, a local newspaper, has been considering the replacement of its printing

press. The existing press was purchased for $1 200 000 and is being depreciated to a

salvage value of zero over its 4 year life. This press has 1 year of remaining useful life

and can currently be sold for $140 000. The new press would cost The Sacrifice

$1 800 000, and there would be an installation cost of $160 000. The new press would

have a useful life of 4 years and would be depreciated down to a salvage value of

$180 000 over this period. Acquisition of the new press would reduce operating costs by

$660 000 per year, but would require a $90 000 increase in the spare parts inventory.

Three months ago, the newspapers maintenance team attended a training course for

the maintenance of the new type of press. The course cost the firm $540 000.

The firm uses the straight-line depreciation method to depreciate all of its assets, and

requires a 10% rate of return. The tax rate is 35%.

b) Calculate the NPV of the proposed project

c) What is the PI of the proposed project?

d) Calculate the IRR of the proposed project.

e) Calculate the ARR of the project

f) Advise the company as to whether the press should be replaced.

g) Why is the net present value criterion considered to be superior to the accounting rate

of return?

h) What is the cost of capital and what is its significance in capital investment appraisal

decisions?

i) When making capital investment appraisal decisions, businesses should consider only

financial factors . Do you agree with this statement? Support your position with

reference to the case above.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started