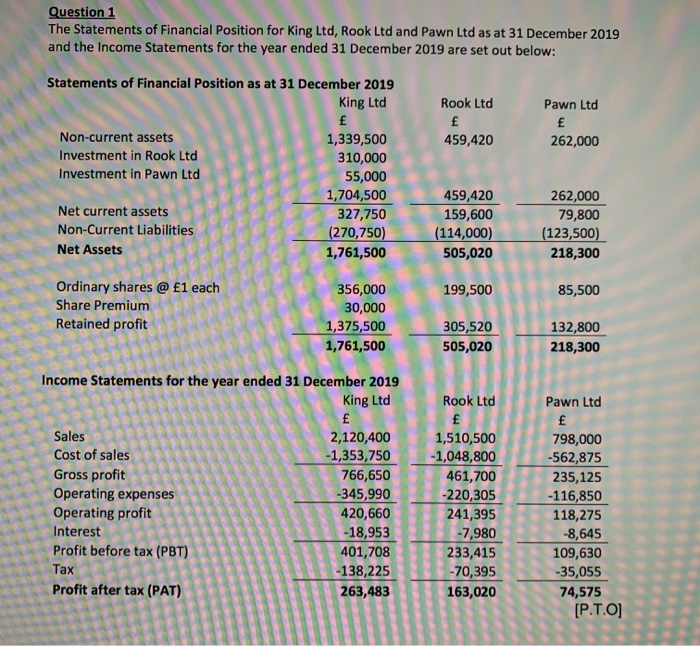

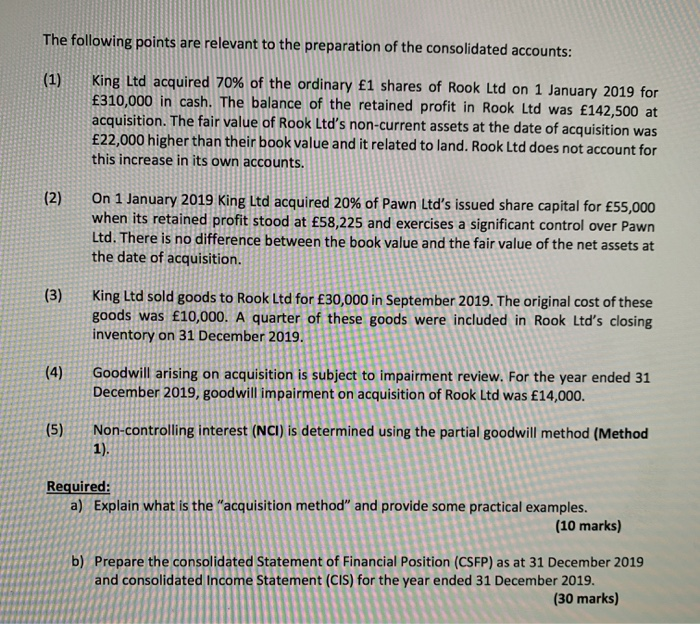

Question 1 The Statements of Financial Position for King Ltd, Rook Ltd and Pawn Ltd as at 31 December 2019 and the Income Statements for the year ended 31 December 2019 are set out below: Rook Ltd 459,420 Pawn Ltd 262,000 Statements of Financial Position as at 31 December 2019 King Ltd Non-current assets 1,339,500 Investment in Rook Ltd 310,000 Investment in Pawn Ltd 55,000 1,704,500 Net current assets 327,750 Non-Current Liabilities (270,750) Net Assets 1,761,500 459,420 159,600 (114,000) 505,020 262,000 79,800 (123,500) 218,300 199,500 85,500 Ordinary shares @ 1 each Share Premium Retained profit 356,000 30,000 1,375,500 1,761,500 305,520 505,020 132,800 218,300 Income Statements for the year ended 31 December 2019 King Ltd Sales 2,120,400 Cost of sales -1,353,750 Gross profit 766,650 Operating expenses -345,990 Operating profit 420,660 Interest -18,953 Profit before tax (PBT) 401,708 Tax -138,225 Profit after tax (PAT) 263,483 Rook Ltd f 1,510,500 -1,048,800 461,700 -220,305 241,395 -7,980 233,415 -70,395 163,020 Pawn Ltd 798,000 -562,875 235,125 -116,850 118,275 -8,645 109,630 -35,055 74,575 [P.T.O] The following points are relevant to the preparation of the consolidated accounts: (1) King Ltd acquired 70% of the ordinary 1 shares of Rook Ltd on 1 January 2019 for 310,000 in cash. The balance of the retained profit in Rook Ltd was 142,500 at acquisition. The fair value of Rook Ltd's non-current assets at the date of acquisition was 22,000 higher than their book value and it related to land. Rook Ltd does not account for this increase in its own accounts. (2) On 1 January 2019 King Ltd acquired 20% of Pawn Ltd's issued share capital for 55,000 when its retained profit stood at 58,225 and exercises a significant control over Pawn Ltd. There is no difference between the book value and the fair value of the net assets at the date of acquisition. (3) King Ltd sold goods to Rook Ltd for 30,000 in September 2019. The original cost of these goods was 10,000. A quarter of these goods were included in Rook Ltd's closing inventory on 31 December 2019. (4) Goodwill arising on acquisition is subject to impairment review. For the year ended 31 December 2019, goodwill impairment on acquisition of Rook Ltd was 14,000. (5) Non-controlling interest (NCI) is determined using the partial goodwill method (Method 1). Required: a) Explain what is the "acquisition method" and provide some practical examples. (10 marks) b) Prepare the consolidated Statement of Financial Position (CSFP) as at 31 December 2019 and consolidated Income Statement (CIS) for the year ended 31 December 2019. (30 marks)