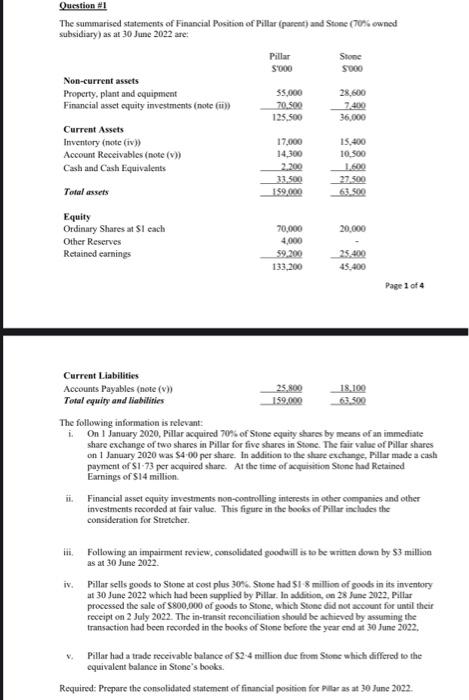

Question #1 The summarised statements of Financial Position of Pillar (pareat) and Stone (TON owned subsidiary) as at 30 June 2022 are: Page 1 of 4 The following information is relevant: i. On 1 January 2020 , Pillar acquired 70% of Stone equity shares by means of an immediate share exchange of two shares in Pillar for five shares in Swose. The fair value of Pillar shares on 1 January 2020 was $400 per share. In addition to the share exchange, Pillar made a cash payment of $173 per aequired share. At the time of acquisition Stone had Retained Earnings of $14 million. ii. Financial asset equity investments non-controlling interests in other companies and other investments recorded at fair value. This figure in the books of Pillar includes the consideration for Stretcher. iii. Following an impairment review, coesolidated goodwill is to be written down by $3 million as at 30 June 2022. iv. Pillar sells goods to Stone at cost plus 30\%. Stone had $18 million of goods in its inventory at 30 June 2022 which had been supplied by Pillar. In addition, on 28 June 2022, Pillar processed the sale of $800,000 of goods to Stone, which Stone did not account for until their receipt on 2 July 2022 . The in-transit recenciliation should be achieved by assuming the transaction had been recorded in the books of Stone befote the year end at 30 June 2022 , v. Pillar had a trade receivable balance of $24 million due from Stone which differed to the equivalent balance in Stone's books. Required- Prepare the consolidated statement of financial position for Pillar as at 30 June 2022. Question #1 The summarised statements of Financial Position of Pillar (pareat) and Stone (TON owned subsidiary) as at 30 June 2022 are: Page 1 of 4 The following information is relevant: i. On 1 January 2020 , Pillar acquired 70% of Stone equity shares by means of an immediate share exchange of two shares in Pillar for five shares in Swose. The fair value of Pillar shares on 1 January 2020 was $400 per share. In addition to the share exchange, Pillar made a cash payment of $173 per aequired share. At the time of acquisition Stone had Retained Earnings of $14 million. ii. Financial asset equity investments non-controlling interests in other companies and other investments recorded at fair value. This figure in the books of Pillar includes the consideration for Stretcher. iii. Following an impairment review, coesolidated goodwill is to be written down by $3 million as at 30 June 2022. iv. Pillar sells goods to Stone at cost plus 30\%. Stone had $18 million of goods in its inventory at 30 June 2022 which had been supplied by Pillar. In addition, on 28 June 2022, Pillar processed the sale of $800,000 of goods to Stone, which Stone did not account for until their receipt on 2 July 2022 . The in-transit recenciliation should be achieved by assuming the transaction had been recorded in the books of Stone befote the year end at 30 June 2022 , v. Pillar had a trade receivable balance of $24 million due from Stone which differed to the equivalent balance in Stone's books. Required- Prepare the consolidated statement of financial position for Pillar as at 30 June 2022