Answered step by step

Verified Expert Solution

Question

1 Approved Answer

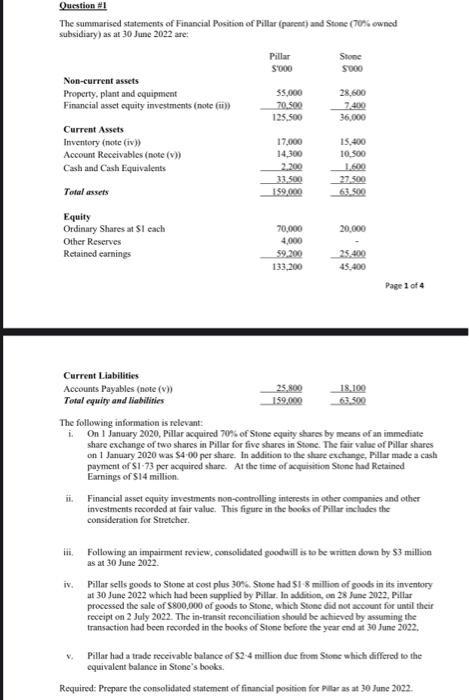

Question #1 The summarised statements of Financial Position of Pillar (parent) and Stone (70% owned subsidiary) as at 30 June 2022 are: Non-current assets

Question #1 The summarised statements of Financial Position of Pillar (parent) and Stone (70% owned subsidiary) as at 30 June 2022 are: Non-current assets Property, plant and equipment Financial asset equity investments (note (ii)) Current Assets Inventory (note (iv)) Account Receivables (note (v)) Cash and Cash Equivalents Total assets Equity Ordinary Shares at $1 each Other Reserves Retained earnings Current Liabilities Accounts Payables (note (v)) Total equity and liabilities The following information is relevant: i. ii. iv. Pillar $'000 V 55,000 70.500 125,500 17,000 14,300 2,200 33,500 159,000 70,000 4,000 59.200 133,200 25,800 159,000 Stone 5000 28,600 7,400 36,000 15,400 10,500 1.600 27.500 63.500 20,000 25.400 45,400 18.100 63.500 Page 1 of 4 On 1 January 2020, Pillar acquired 70% of Stone equity shares by means of an immediate share exchange of two shares in Pillar for five shares in Stone. The fair value of Pillar shares on 1 January 2020 was $4-00 per share. In addition to the share exchange, Pillar made a cash payment of $1-73 per acquired share. At the time of acquisition Stone had Retained Earnings of $14 million. iii. Following an impairment review, consolidated goodwill is to be written down by $3 million as at 30 June 2022. Financial asset equity investments non-controlling interests in other companies and other investments recorded at fair value. This figure in the books of Pillar includes the consideration for Stretcher. Pillar sells goods to Stone at cost plus 30%. Stone had $1-8 million of goods in its inventory at 30 June 2022 which had been supplied by Pillar. In addition, on 28 June 2022, Pillar processed the sale of $800,000 of goods to Stone, which Stone did not account for until their receipt on 2 July 2022. The in-transit reconciliation should be achieved by assuming the transaction had been recorded in the books of Stone before the year end at 30 June 2022. Pillar had a trade receivable balance of $2-4 million due from Stone which differed to the equivalent balance in Stone's books. Required: Prepare the consolidated statement of financial position for Pillar as at 30 June 2022.

Step by Step Solution

★★★★★

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Answer Pillar Consolidated Statement of Financial Positi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started