Answered step by step

Verified Expert Solution

Question

1 Approved Answer

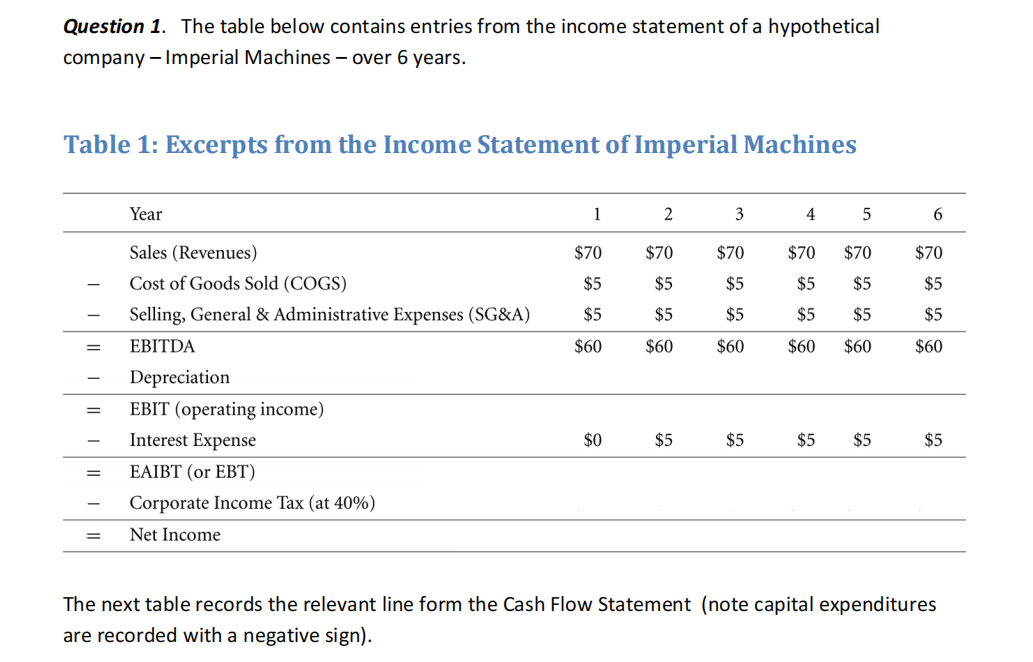

Question 1. The table below contains entries from the income statement of a hypothetical company-Imperial Machines - over 6 years. Table 1: Excerpts from

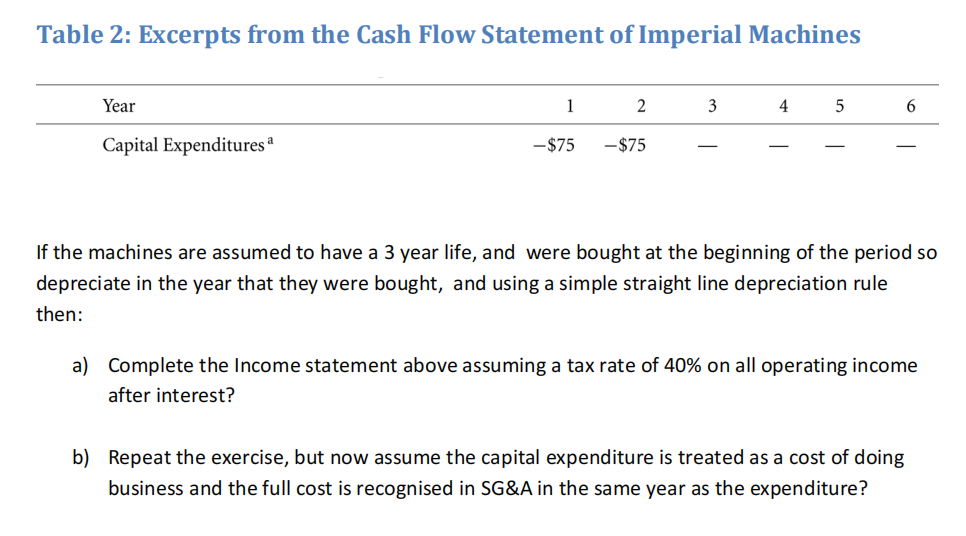

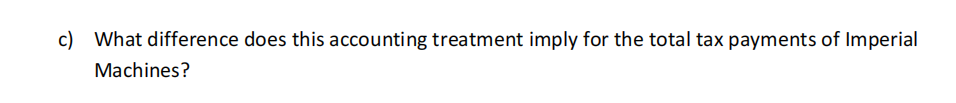

Question 1. The table below contains entries from the income statement of a hypothetical company-Imperial Machines - over 6 years. Table 1: Excerpts from the Income Statement of Imperial Machines Year 1 2 3 4 5 6 Sales (Revenues) $70 $70 $70 $70 $70 $70 Cost of Goods Sold (COGS) $5 $5 $5 $5 $5 $5 Selling, General & Administrative Expenses (SG&A) $5 $5 $5 $5 $5 $5 EBITDA $60 $60 $60 $60 $60 $60 - Depreciation = EBIT (operating income) Interest Expense $0 $5 S5 $5 $5 $5 $5 = EAIBT (or EBT) Corporate Income Tax (at 40%) = Net Income The next table records the relevant line form the Cash Flow Statement (note capital expenditures are recorded with a negative sign). Table 2: Excerpts from the Cash Flow Statement of Imperial Machines Year Capital Expenditures a 1 2 3 4 5 6 -$75 -$75 If the machines are assumed to have a 3 year life, and were bought at the beginning of the period so depreciate in the year that they were bought, and using a simple straight line depreciation rule then: a) Complete the Income statement above assuming a tax rate of 40% on all operating income after interest? b) Repeat the exercise, but now assume the capital expenditure is treated as a cost of doing business and the full cost is recognised in SG&A in the same year as the expenditure? c) What difference does this accounting treatment imply for the total tax payments of Imperial Machines?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started