Question 1

The total of the sales returns column in the sales returns journal will be posted to the in the general ledger.

-

A. credit side of the sales returns account

-

B. credit side of the credit losses account

-

C. debit side of the sales returns account

-

D. debit side of the credit losses account

-

E. debit side of the trade receivables control

Question 2

Question 3

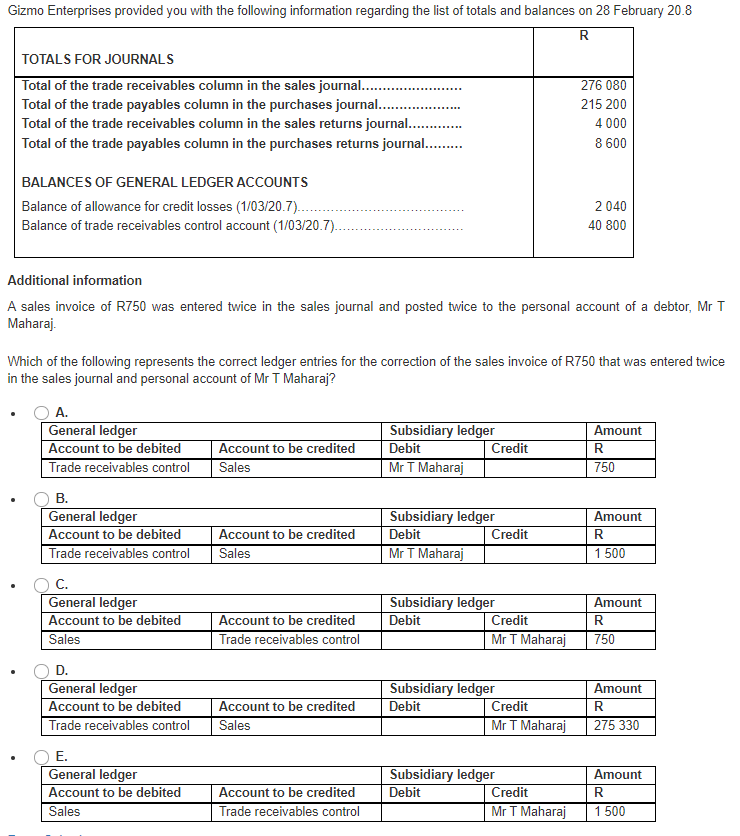

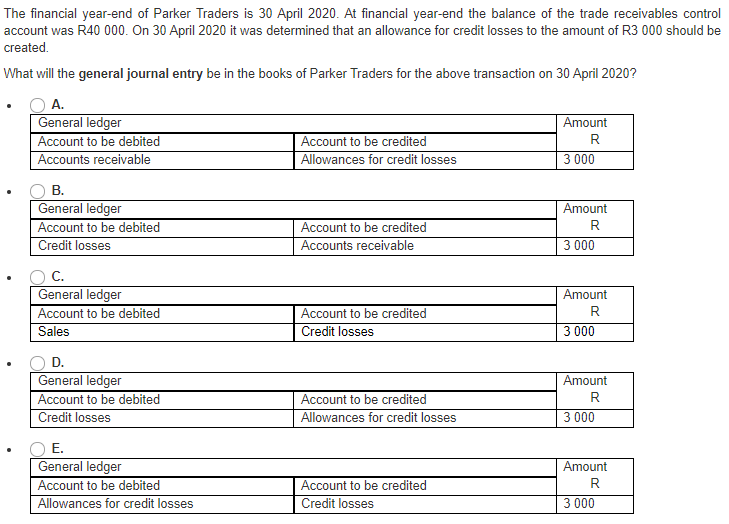

Gizmo Enterprises provided you with the following information regarding the list of totals and balances on 28 February 20.8 R TOTALS FOR JOURNALS Total of the trade receivables column in the sales journal.... 276 080 Total of the trade payables column in the purchases journal... 215 200 Total of the trade receivables column in the sales returns journal... 4 000 Total of the trade payables column in the purchases returns journal......... 8 600 BALANCES OF GENERAL LEDGER ACCOUNTS Balance of allowance for credit losses (1/03/20.7).. Balance of trade receivables control account (1/03/20.7). 2040 40 800 Additional information A sales invoice of R750 was entered twice in the sales journal and posted twice to the personal account of a debtor, Mr T Maharaj Which of the following represents the correct ledger entries for the correction of the sales invoice of R750 that was entered twice in the sales journal and personal account of Mr T Maharaj? A. General ledger Account to be debited Trade receivables control Account to be credited Sales Subsidiary ledger Debit Credit Mr T Maharaj Amount R 750 B. General ledger Account to be debited Trade receivables control Account to be credited Sales Subsidiary ledger Debit Credit Mr T Maharaj Amount R 1 500 C. General ledger Account to be debited Sales Account to be credited Trade receivables control Subsidiary ledger Debit Credit Mr T Maharaj Amount R 750 D. General ledger Account to be debited Trade receivables control Account to be credited Sales Subsidiary ledger Debit Credit Mr T Maharaj Amount R 275 330 E. General ledger Account to be debited Sales Account to be credited Trade receivables control Subsidiary ledger Debit Credit Mr T Maharaj Amount R 1 500 The financial year-end of Parker Traders is 30 April 2020. At financial year-end the balance of the trade receivables control account was R40 000. On 30 April 2020 it was determined that an allowance for credit losses to the amount of R3 000 should be created What will the general journal entry be in the books of Parker Traders for the above transaction on 30 April 2020? A. General ledger Account to be debited Accounts receivable Account to be credited Allowances for credit losses Amount R 3000 OB. General ledger Account to be debited Credit losses Account to be credited Accounts receivable Amount R 3 000 OC. General ledger Account to be debited Sales Account to be credited Credit losses Amount R 3000 D. General ledger Account to be debited Credit losses Account to be credited Allowances for credit losses Amount R 3 000 OE. General ledger Account to be debited Allowances for credit losses Account to be credited Credit losses Amount R 3 000