Question

Question 1 There are several factors that could be considered in terms of diversification. Examine the three most common factors. These are: Market sector Market

Question 1

There are several factors that could be considered in terms of diversification. Examine the three most common factors. These are: Market sector Market capitalisation Geographic segment.

a) Prepare a table showing Avocados current share portfolio in terms of market capitalisation (by index), sector and geographic region.

b) Prepare two pie graphs showing a comparison of Avocados current sector allocation compared to the All-Ordinaries asset allocation. Briefly discuss the implications for the portfolio from your graph.

c) Discuss each of the three factors listed above. (250 words maximum)

d) Explain whether Avocados portfolio has appropriate diversification (100 words maximum).

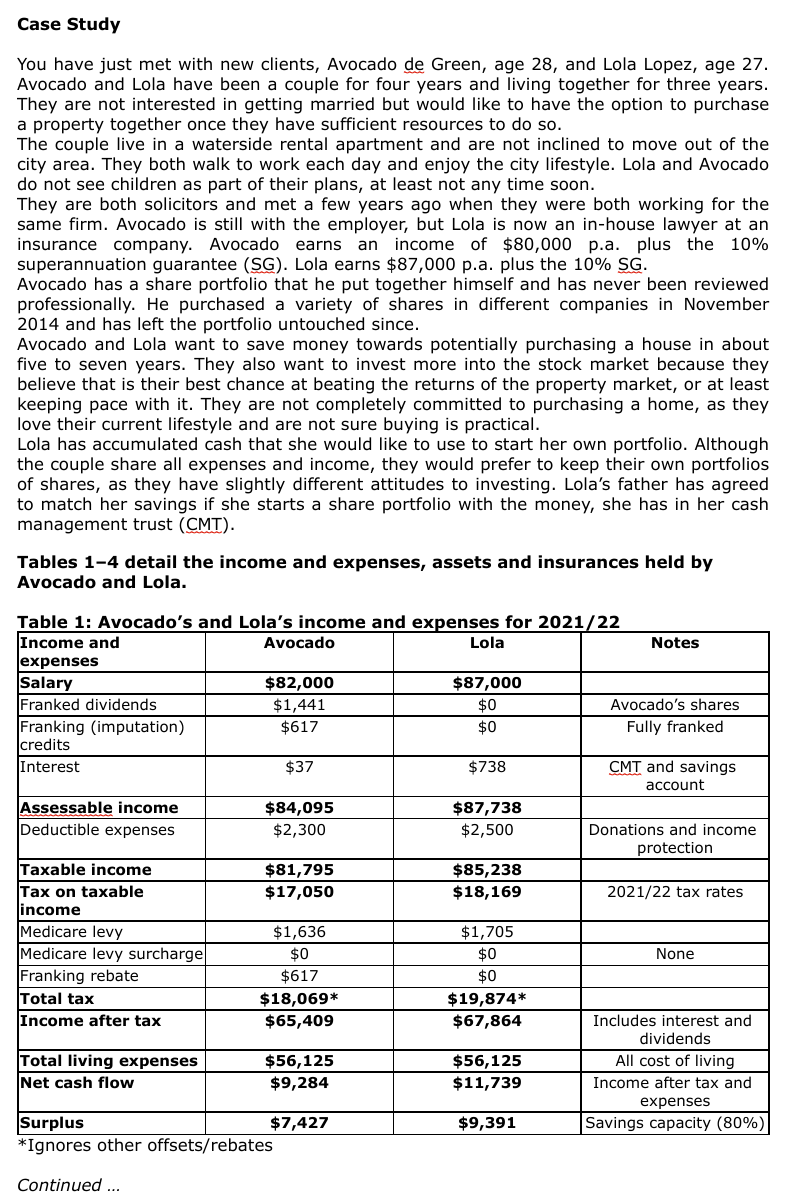

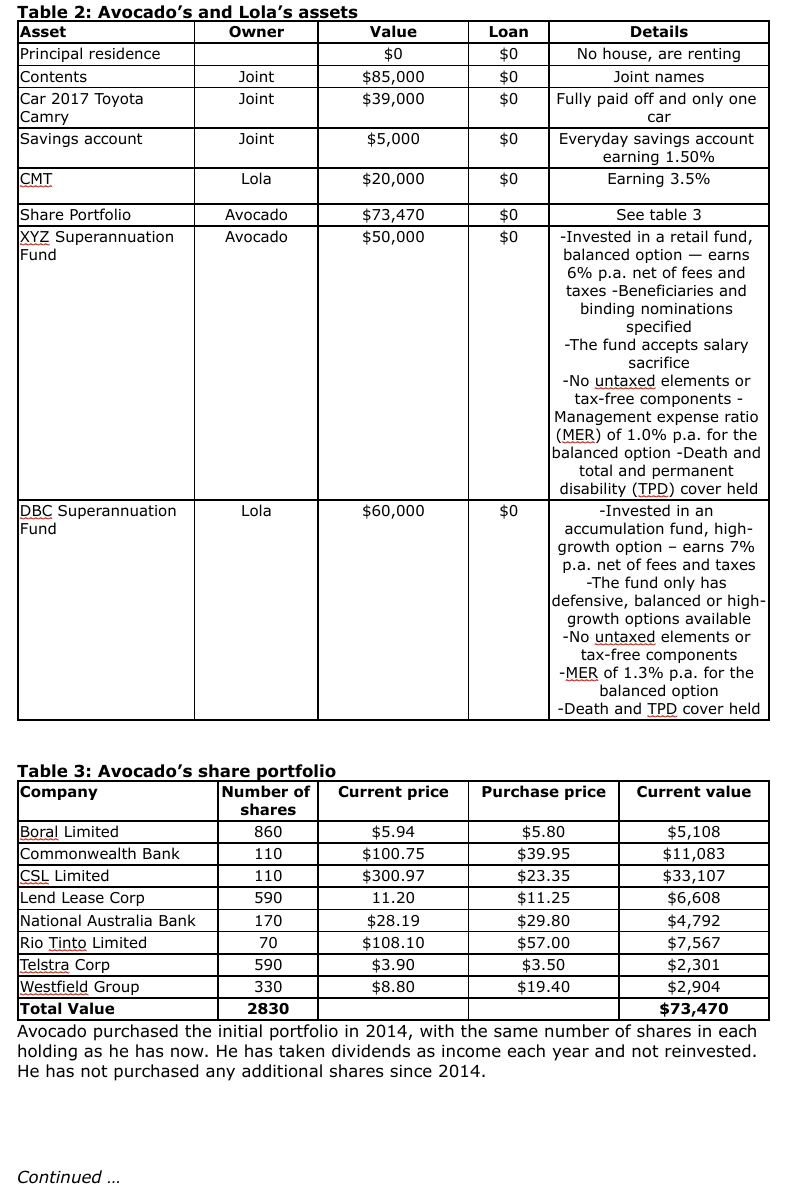

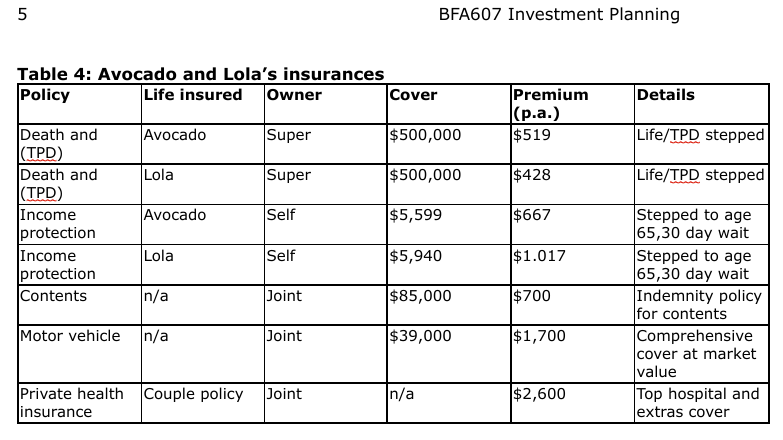

Case Study You have just met with new clients, Avocado de Green, age 28, and Lola Lopez, age 27. Avocado and Lola have been a couple for four years and living together for three years. They are not interested in getting married but would like to have the option to purchase a property together once they have sufficient resources to do so. The couple live in a waterside rental apartment and are not inclined to move out of the city area. They both walk to work each day and enjoy the city lifestyle. Lola and Avocado do not see children as part of their plans, at least not any time soon. They are both solicitors and met a few years ago when they were both working for the same firm. Avocado is still with the employer, but Lola is now an in-house lawyer at an insurance company. Avocado earns an income of $80,000 p.a. plus the 10\% superannuation guarantee (SG). Lola earns $87,000 p.a. plus the 10% SG. Avocado has a share portfolio that he put together himself and has never been reviewed professionally. He purchased a variety of shares in different companies in November 2014 and has left the portfolio untouched since. Avocado and Lola want to save money towards potentially purchasing a house in about five to seven years. They also want to invest more into the stock market because they believe that is their best chance at beating the returns of the property market, or at least keeping pace with it. They are not completely committed to purchasing a home, as they love their current lifestyle and are not sure buying is practical. Lola has accumulated cash that she would like to use to start her own portfolio. Although the couple share all expenses and income, they would prefer to keep their own portfolios of shares, as they have slightly different attitudes to investing. Lola's father has agreed to match her savings if she starts a share portfolio with the money, she has in her cash management trust (CMT). Avocado purchased the initial portfolio in 2014, with the same number of shares in each holding as he has now. He has taken dividends as income each year and not reinvested. He has not purchased any additional shares since 2014 . Continued ... 5 BFA607 Investment Planning Case Study You have just met with new clients, Avocado de Green, age 28, and Lola Lopez, age 27. Avocado and Lola have been a couple for four years and living together for three years. They are not interested in getting married but would like to have the option to purchase a property together once they have sufficient resources to do so. The couple live in a waterside rental apartment and are not inclined to move out of the city area. They both walk to work each day and enjoy the city lifestyle. Lola and Avocado do not see children as part of their plans, at least not any time soon. They are both solicitors and met a few years ago when they were both working for the same firm. Avocado is still with the employer, but Lola is now an in-house lawyer at an insurance company. Avocado earns an income of $80,000 p.a. plus the 10\% superannuation guarantee (SG). Lola earns $87,000 p.a. plus the 10% SG. Avocado has a share portfolio that he put together himself and has never been reviewed professionally. He purchased a variety of shares in different companies in November 2014 and has left the portfolio untouched since. Avocado and Lola want to save money towards potentially purchasing a house in about five to seven years. They also want to invest more into the stock market because they believe that is their best chance at beating the returns of the property market, or at least keeping pace with it. They are not completely committed to purchasing a home, as they love their current lifestyle and are not sure buying is practical. Lola has accumulated cash that she would like to use to start her own portfolio. Although the couple share all expenses and income, they would prefer to keep their own portfolios of shares, as they have slightly different attitudes to investing. Lola's father has agreed to match her savings if she starts a share portfolio with the money, she has in her cash management trust (CMT). Avocado purchased the initial portfolio in 2014, with the same number of shares in each holding as he has now. He has taken dividends as income each year and not reinvested. He has not purchased any additional shares since 2014 . Continued ... 5 BFA607 Investment Planning

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started