Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 (this question has four parts) (20 marks) Part a) (5 marks) Why do you think the company focuses on share price maximisation?

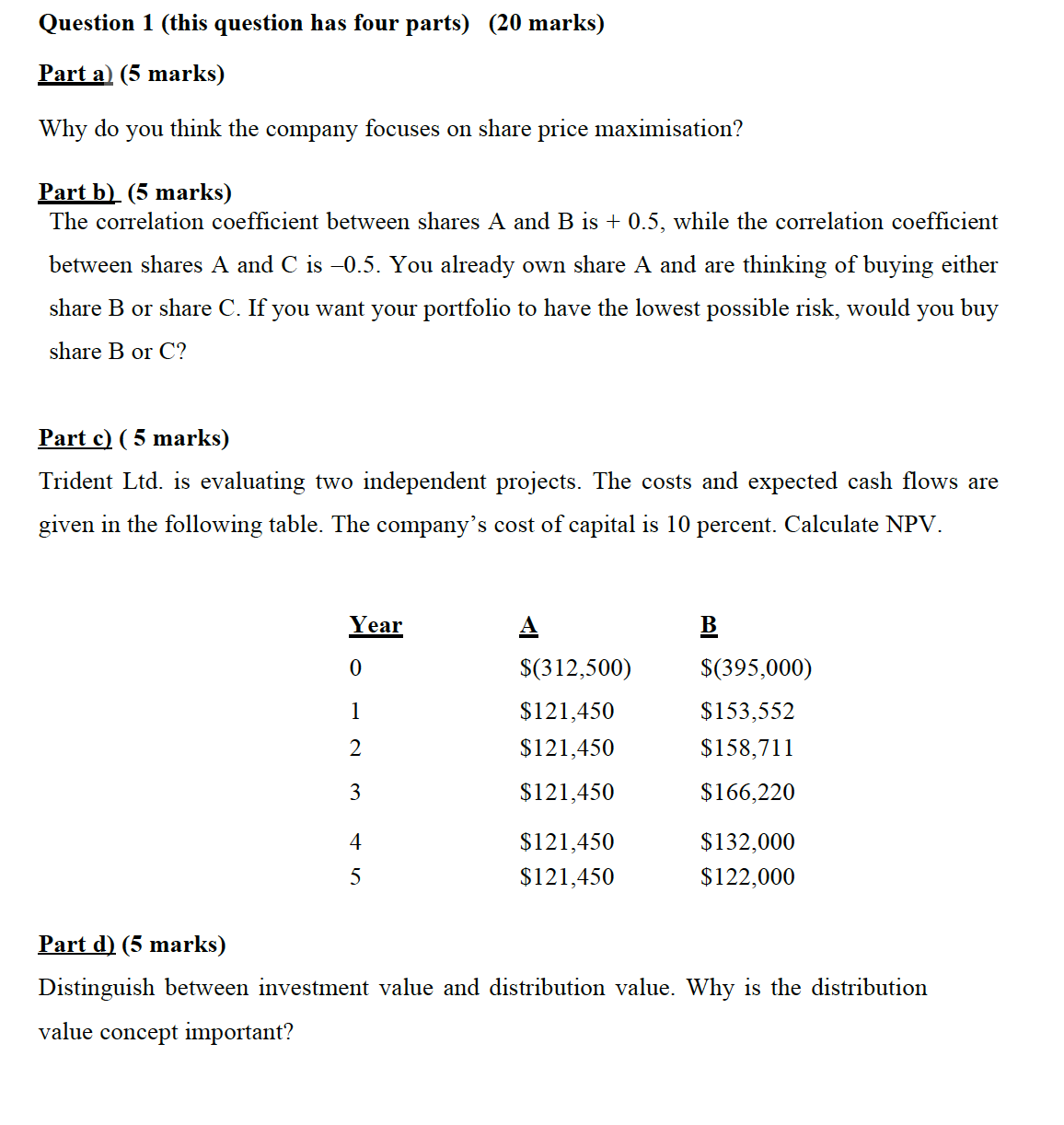

Question 1 (this question has four parts) (20 marks) Part a) (5 marks) Why do you think the company focuses on share price maximisation? Part b) (5 marks) The correlation coefficient between shares A and B is + 0.5, while the correlation coefficient between shares A and C is -0.5. You already own share A and are thinking of buying either share B or share C. If you want your portfolio to have the lowest possible risk, would you buy share B or C? Part c) (5 marks) Trident Ltd. is evaluating two independent projects. The costs and expected cash flows are given in the following table. The company's cost of capital is 10 percent. Calculate NPV. Year A B 0 $(312,500) $(395,000) 1 $121,450 $153,552 2 $121,450 $158,711 3 $121,450 $166,220 4 $121,450 $132,000 5 $121,450 $122,000 Part d) (5 marks) Distinguish between investment value and distribution value. Why is the distribution value concept important?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started