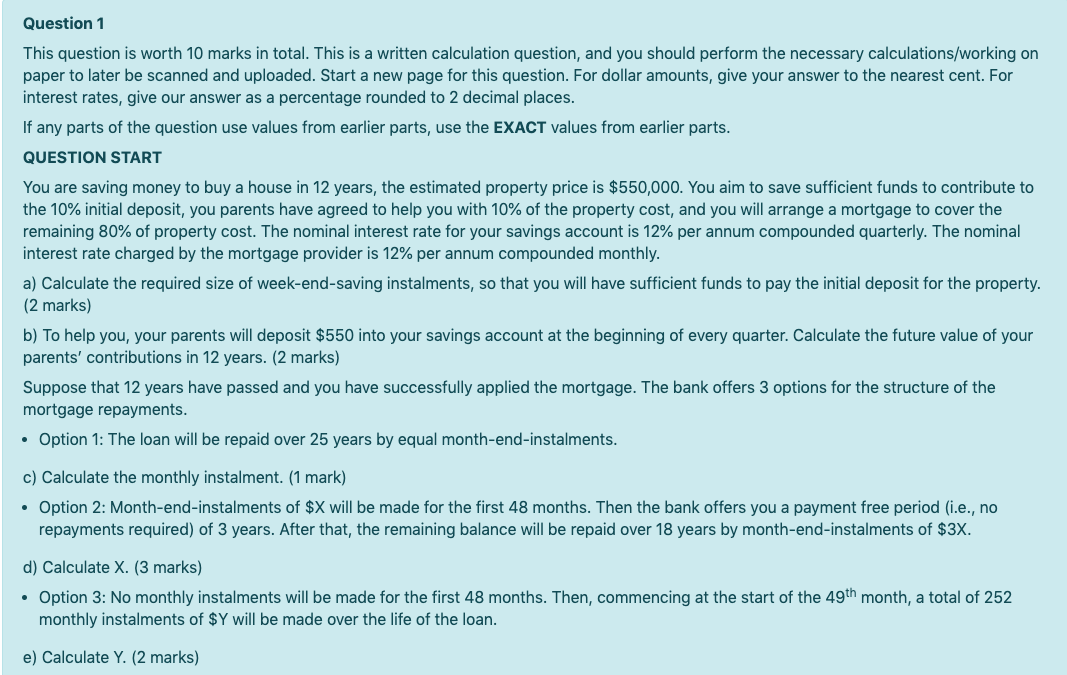

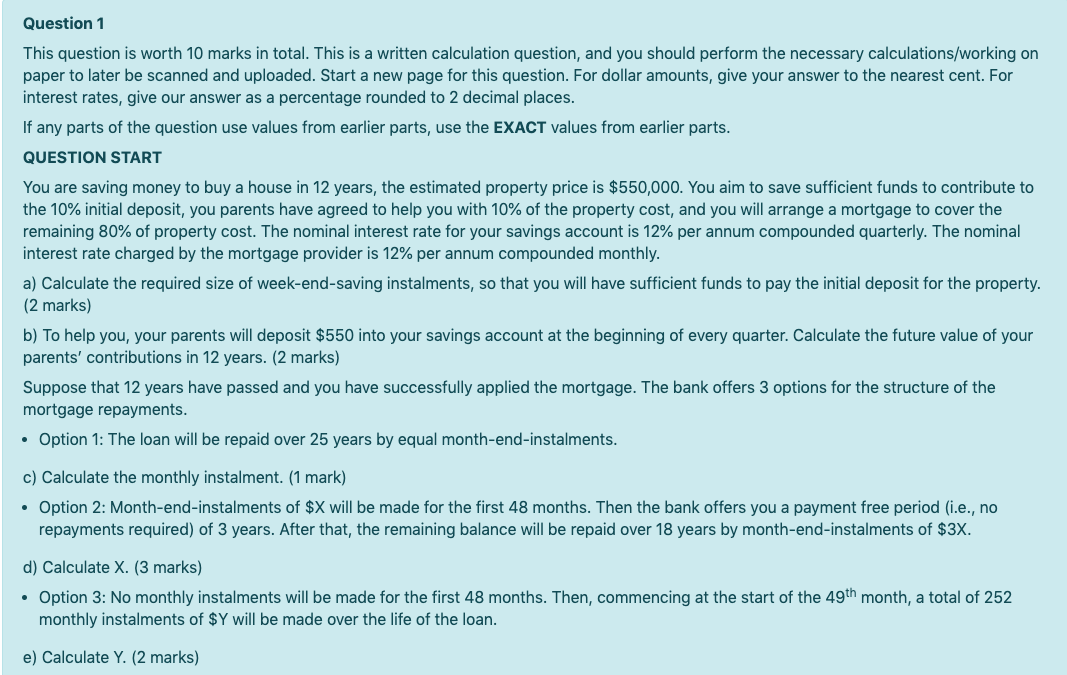

Question 1 This question is worth 10 marks in total. This is a written calculation question, and you should perform the necessary calculations/working on paper to later be scanned and uploaded. Start a new page for this question. For dollar amounts, give your answer to the nearest cent. For interest rates, give our answer as a percentage rounded to 2 decimal places. If any parts of the question use values from earlier parts, use the EXACT values from earlier parts. QUESTION START You are saving money to buy a house in 12 years, the estimated property price is $550,000. You aim to save sufficient funds to contribute to the 10% initial deposit, you parents have agreed to help you with 10% of the property cost, and you will arrange a mortgage to cover the remaining 80% of property cost. The nominal interest rate for your savings account is 12% per annum compounded quarterly. The nominal interest rate charged by the mortgage provider is 12% per annum compounded monthly. a) Calculate the required size of week-end-saving instalments, so that you will have sufficient funds to pay the initial deposit for the property. (2 marks) b) To help you, your parents will deposit $550 into your savings account at the beginning of every quarter. Calculate the future value of your parents' contributions in 12 years. (2 marks) Suppose that 12 years have passed and you have successfully applied the mortgage. The bank offers 3 options for the structure of the mortgage repayments. Option 1: The loan will be repaid over 25 years by equal month-end-instalments. c) Calculate the monthly instalment. (1 mark) Option 2: Month-end-instalments of $X will be made for the first 48 months. Then the bank offers you a payment free period (i.e., no repayments required) of 3 years. After that, the remaining balance will be repaid over 18 years by month-end-instalments of $3X. d) Calculate X. (3 marks) Option 3: No monthly instalments will be made for the first 48 months. Then, commencing at the start of the 49th month, a total of 252 monthly instalments of $Y will be made over the life of the loan. e) Calculate Y. (2 marks) Question 1 This question is worth 10 marks in total. This is a written calculation question, and you should perform the necessary calculations/working on paper to later be scanned and uploaded. Start a new page for this question. For dollar amounts, give your answer to the nearest cent. For interest rates, give our answer as a percentage rounded to 2 decimal places. If any parts of the question use values from earlier parts, use the EXACT values from earlier parts. QUESTION START You are saving money to buy a house in 12 years, the estimated property price is $550,000. You aim to save sufficient funds to contribute to the 10% initial deposit, you parents have agreed to help you with 10% of the property cost, and you will arrange a mortgage to cover the remaining 80% of property cost. The nominal interest rate for your savings account is 12% per annum compounded quarterly. The nominal interest rate charged by the mortgage provider is 12% per annum compounded monthly. a) Calculate the required size of week-end-saving instalments, so that you will have sufficient funds to pay the initial deposit for the property. (2 marks) b) To help you, your parents will deposit $550 into your savings account at the beginning of every quarter. Calculate the future value of your parents' contributions in 12 years. (2 marks) Suppose that 12 years have passed and you have successfully applied the mortgage. The bank offers 3 options for the structure of the mortgage repayments. Option 1: The loan will be repaid over 25 years by equal month-end-instalments. c) Calculate the monthly instalment. (1 mark) Option 2: Month-end-instalments of $X will be made for the first 48 months. Then the bank offers you a payment free period (i.e., no repayments required) of 3 years. After that, the remaining balance will be repaid over 18 years by month-end-instalments of $3X. d) Calculate X. (3 marks) Option 3: No monthly instalments will be made for the first 48 months. Then, commencing at the start of the 49th month, a total of 252 monthly instalments of $Y will be made over the life of the loan. e) Calculate Y. (2 marks)