Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 Thomas, a sole proprietor, operates a logistic business in Hong Kong. The business prepares its accounts to 31 August each year. The

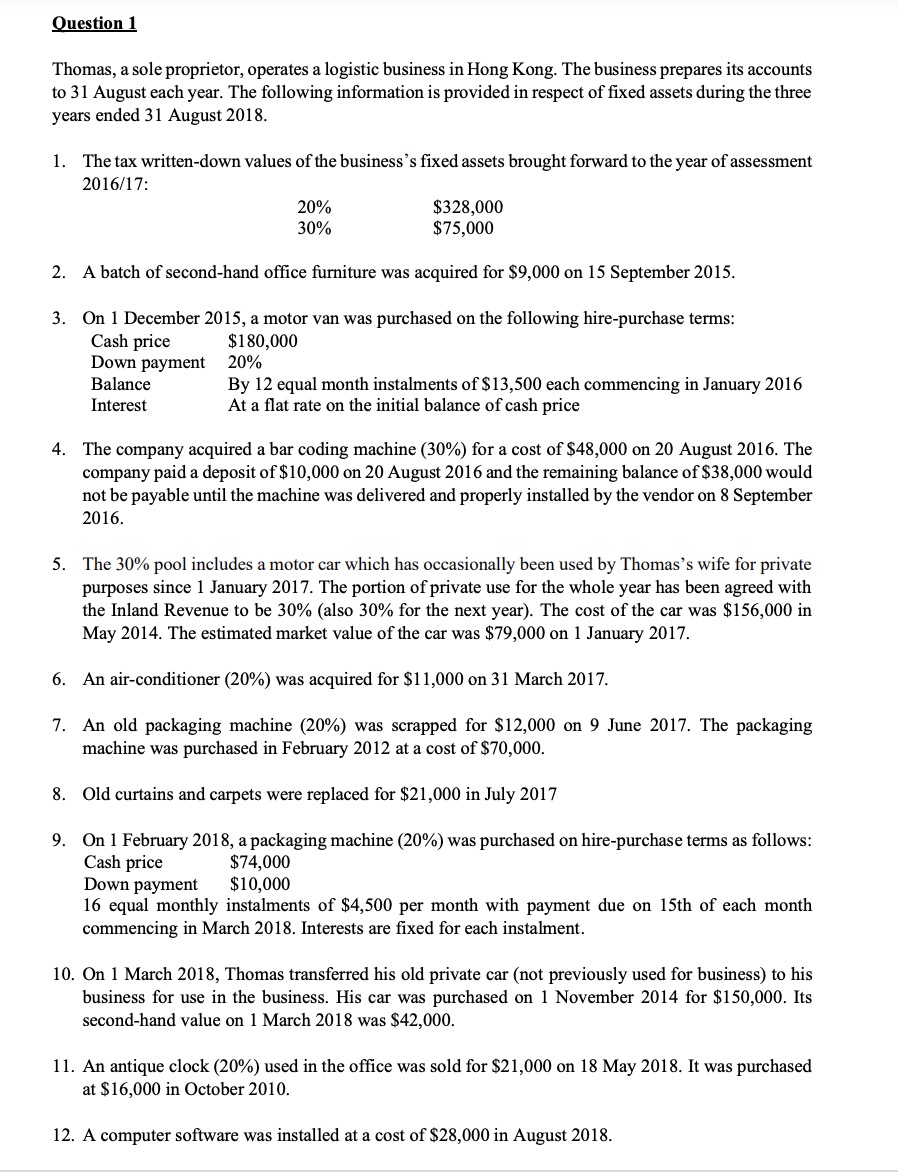

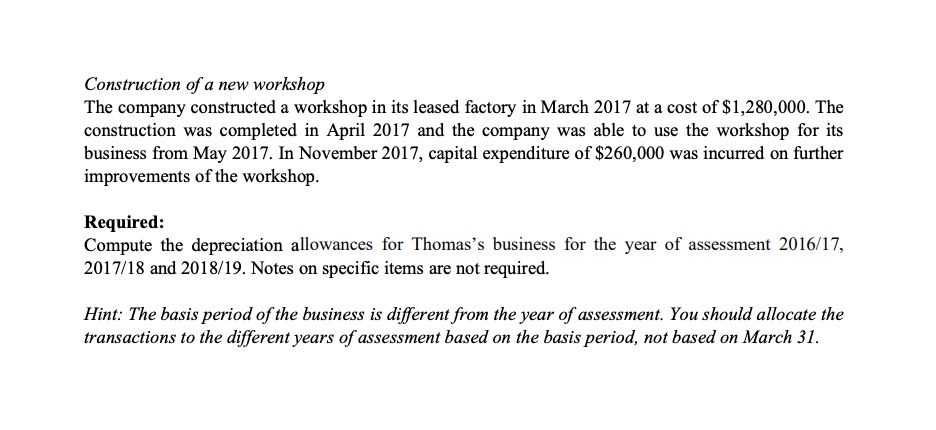

Question 1 Thomas, a sole proprietor, operates a logistic business in Hong Kong. The business prepares its accounts to 31 August each year. The following information is provided in respect of fixed assets during the three years ended 31 August 2018. 1. The tax written-down values of the business's fixed assets brought forward to the year of assessment 2016/17: 20% 30% $328,000 $75,000 2. A batch of second-hand office furniture was acquired for $9,000 on 15 September 2015. 3. On 1 December 2015, a motor van was purchased on the following hire-purchase terms: Cash price $180,000 Down payment Balance Interest 20% By 12 equal month instalments of $13,500 each commencing in January 2016 At a flat rate on the initial balance of cash price 4. The company acquired a bar coding machine (30%) for a cost of $48,000 on 20 August 2016. The company paid a deposit of $10,000 on 20 August 2016 and the remaining balance of $38,000 would not be payable until the machine was delivered and properly installed by the vendor on 8 September 2016. 5. The 30% pool includes a motor car which has occasionally been used by Thomas's wife for private purposes since 1 January 2017. The portion of private use for the whole year has been agreed with the Inland Revenue to be 30% (also 30% for the next year). The cost of the car was $156,000 in May 2014. The estimated market value of the car was $79,000 on 1 January 2017. 6. An air-conditioner (20%) was acquired for $11,000 on 31 March 2017. 7. An old packaging machine (20%) was scrapped for $12,000 on 9 June 2017. The packaging machine was purchased in February 2012 at a cost of $70,000. 8. Old curtains and carpets were replaced for $21,000 in July 2017 9. On 1 February 2018, a packaging machine (20%) was purchased on hire-purchase terms as follows: Cash price $74,000 Down payment $10,000 16 equal monthly instalments of $4,500 per month with payment due on 15th of each month commencing in March 2018. Interests are fixed for each instalment. 10. On 1 March 2018, Thomas transferred his old private car (not previously used for business) to his business for use in the business. His car was purchased on 1 November 2014 for $150,000. Its second-hand value on 1 March 2018 was $42,000. 11. An antique clock (20%) used in the office was sold for $21,000 on 18 May 2018. It was purchased at $16,000 in October 2010. 12. A computer software was installed at a cost of $28,000 in August 2018. Construction of a new workshop The company constructed a workshop in its leased factory in March 2017 at a cost of $1,280,000. The construction was completed in April 2017 and the company was able to use the workshop for its business from May 2017. In November 2017, capital expenditure of $260,000 was incurred on further improvements of the workshop. Required: Compute the depreciation allowances for Thomas's business for the year of assessment 2016/17, 2017/18 and 2018/19. Notes on specific items are not required. Hint: The basis period of the business is different from the year of assessment. You should allocate the transactions to the different years of assessment based on the basis period, not based on March 31.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To compute the depreciation allowances for Thomass business for the year of assessment 201617 201718 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started