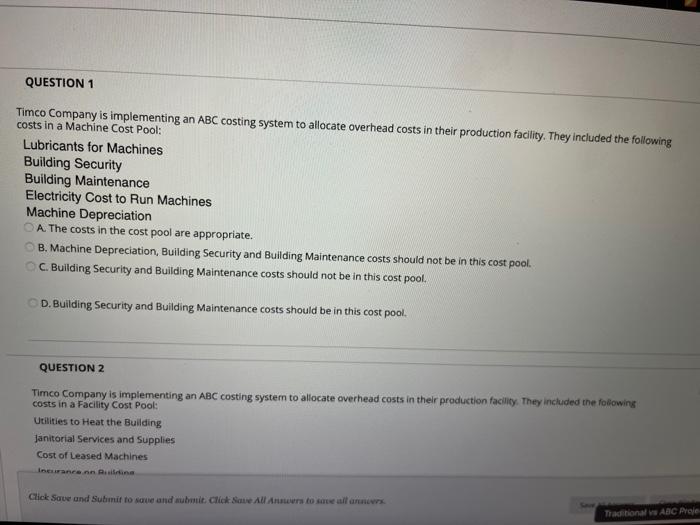

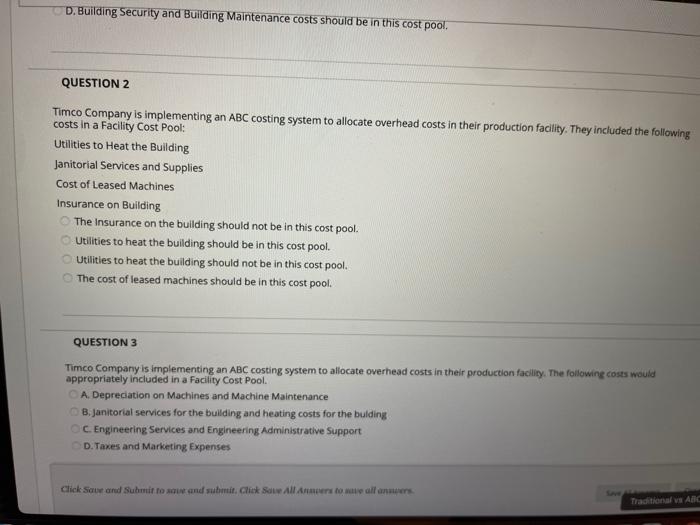

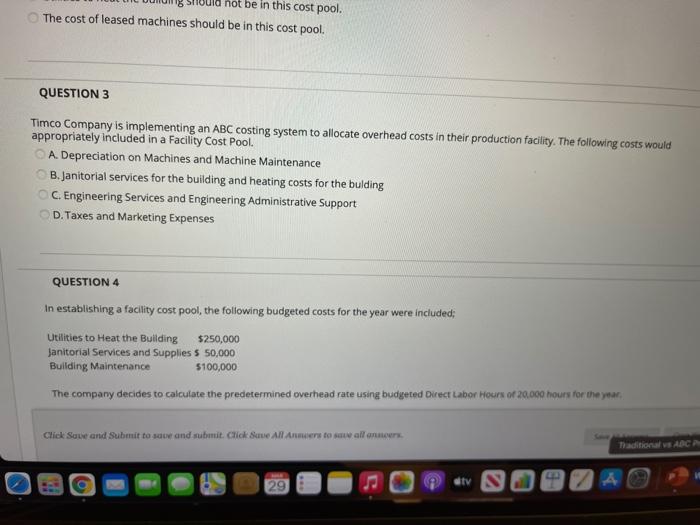

QUESTION 1 Timco Company is implementing an ABC costing system to allocate overhead costs in their production facility. They included the following costs in a Machine Cost Pool: Lubricants for Machines Building Security Building Maintenance Electricity Cost to Run Machines Machine Depreciation A. The costs in the cost pool are appropriate. B. Machine Depreciation, Building Security and Building Maintenance costs should not be in this cost pool. C. Building Security and Building Maintenance costs should not be in this cost pool. D. Building Security and Building Maintenance costs should be in this cost pool. QUESTION 2 Timco Company is implementing an ABC costing system to allocate overhead costs in their production facility. They included the following costs in a Facility Cost Pool: Utilities to Heat the Building Janitorial Services and Supplies Cost of Leased Machines Innrenn Alina Click Save and Submit to save and submit Click San Al Answers to see all news Traditional ABC Prole D. Building Security and Building Maintenance costs should be in this cost pool, QUESTION 2 Timco Company is implementing an ABC costing system to allocate overhead costs in their production facility. They included the following costs in a Facility Cost Pool: Utilities to Heat the Building Janitorial Services and Supplies Cost of Leased Machines Insurance on Building The Insurance on the building should not be in this cost pool. Utilities to heat the building should be in this cost pool. Utilities to heat the building should not be in this cost pool. The cost of leased machines should be in this cost pool. QUESTION 3 Timco Company is implementing an ABC costing system to allocate overhead costs in their production facility. The following costs would appropriately included in a Facility Cost Pool A. Depreciation on Machines and Machine Maintenance B. Janitorial services for the building and heating costs for the bulding C. Engineering Services and Engineering Administrative Support D. Taxes and Marketing Expenses Click Save and Submit to save and submit. Click Saw All Anvers to all anspers Traditional vs ABC be in this cost pool. The cost of leased machines should be in this cost pool. QUESTION 3 Timco Company is implementing an ABC costing system to allocate overhead costs in their production facility. The following costs would appropriately included in a Facility Cost Pool. A. Depreciation on Machines and Machine Maintenance B.Janitorial services for the building and heating costs for the bulding C. Engineering Services and Engineering Administrative Support D. Taxes and Marketing Expenses QUESTION 4 In establishing a facility cost pool, the following budgeted costs for the year were included Utilities to Heat the Building $250,000 Janitorial Services and Supplies S 50,000 Bulding Maintenance $100,000 The company decides to calculate the predetermined overhead rate using budgeted Direct Labor Hours of 20.000 hours for the year, Click Save and submit to save and submit. Click Save All Annere to sew all are Traditional ABC dity 29 A