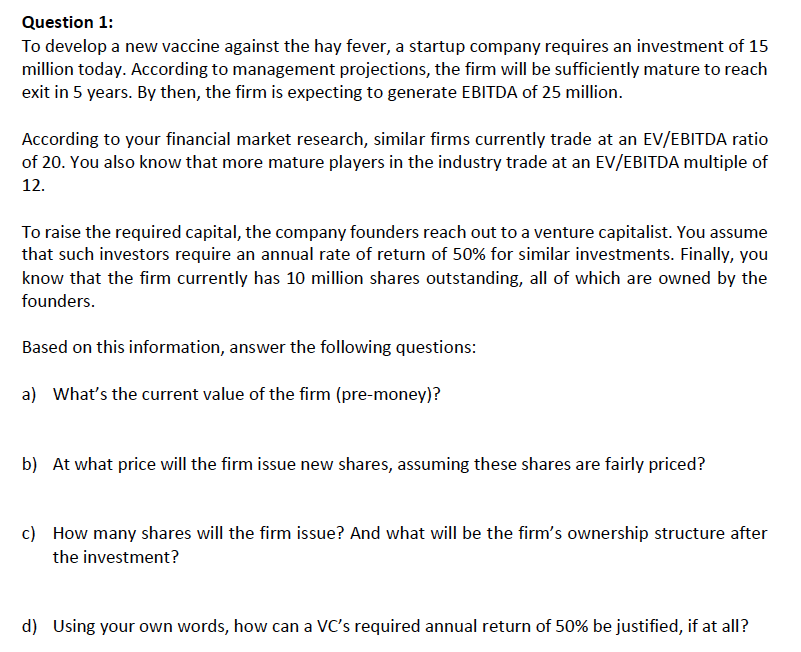

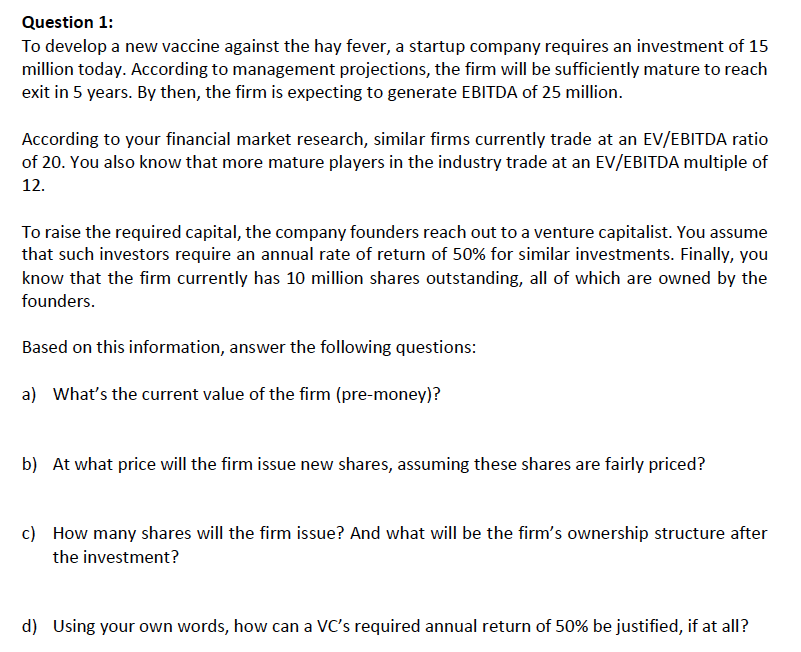

Question 1: To develop a new vaccine against the hay fever, a startup company requires an investment of 15 million today. According to management projections, the firm will be sufficiently mature to reach exit in 5 years. By then, the firm is expecting to generate EBITDA of 25 million. According to your financial market research, similar firms currently trade at an EV/EBITDA ratio of 20. You also know that more mature players in the industry trade at an EV/EBITDA multiple of 12. To raise the required capital, the company founders reach out to a venture capitalist. You assume that such investors require an annual rate of return of 50% for similar investments. Finally, you know that the firm currently has 10 million shares outstanding, all of which are owned by the founders. Based on this information, answer the following questions: a) What's the current value of the firm (pre-money)? b) At what price will the firm issue new shares, assuming these shares are fairly priced? c) How many shares will the firm issue? And what will be the firm's ownership structure after the investment? d) Using your own words, how can a VC's required annual return of 50% be justified, if at all? Question 1: To develop a new vaccine against the hay fever, a startup company requires an investment of 15 million today. According to management projections, the firm will be sufficiently mature to reach exit in 5 years. By then, the firm is expecting to generate EBITDA of 25 million. According to your financial market research, similar firms currently trade at an EV/EBITDA ratio of 20. You also know that more mature players in the industry trade at an EV/EBITDA multiple of 12. To raise the required capital, the company founders reach out to a venture capitalist. You assume that such investors require an annual rate of return of 50% for similar investments. Finally, you know that the firm currently has 10 million shares outstanding, all of which are owned by the founders. Based on this information, answer the following questions: a) What's the current value of the firm (pre-money)? b) At what price will the firm issue new shares, assuming these shares are fairly priced? c) How many shares will the firm issue? And what will be the firm's ownership structure after the investment? d) Using your own words, how can a VC's required annual return of 50% be justified, if at all