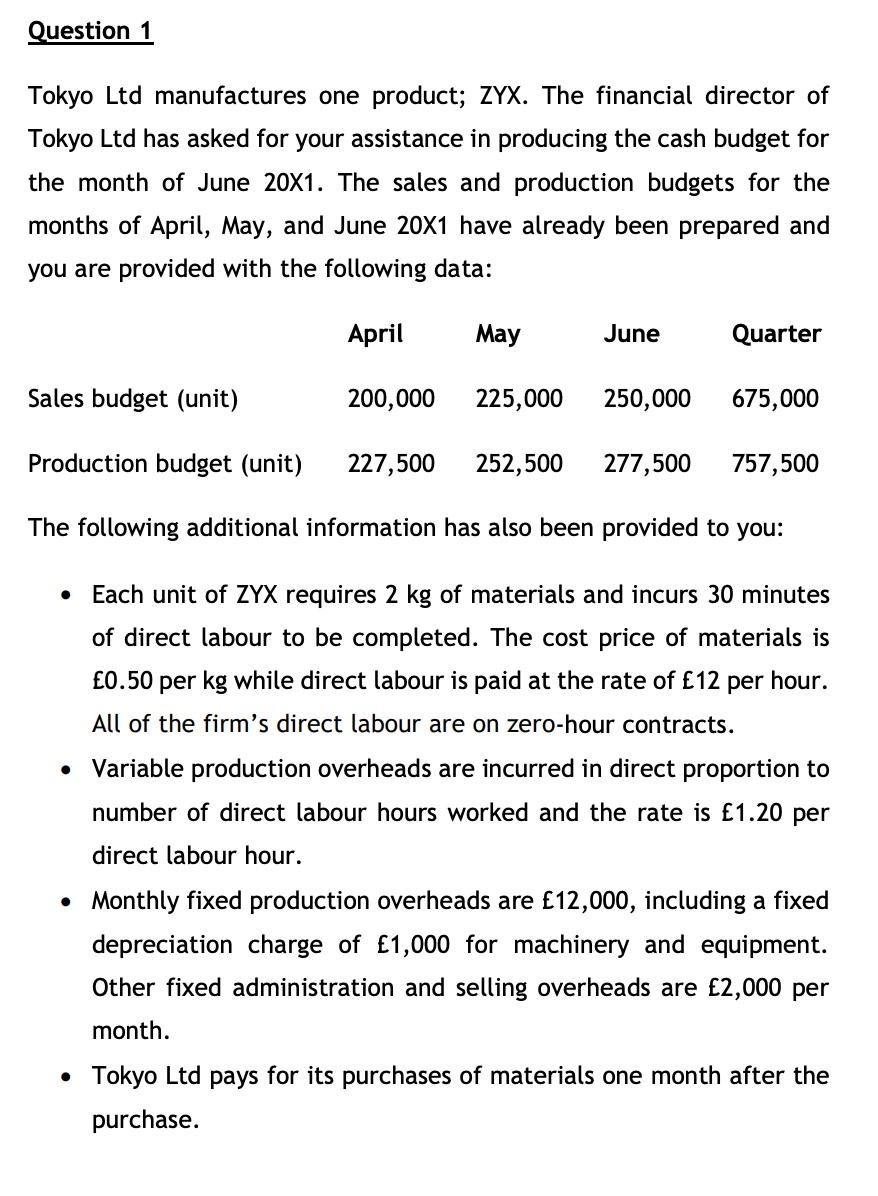

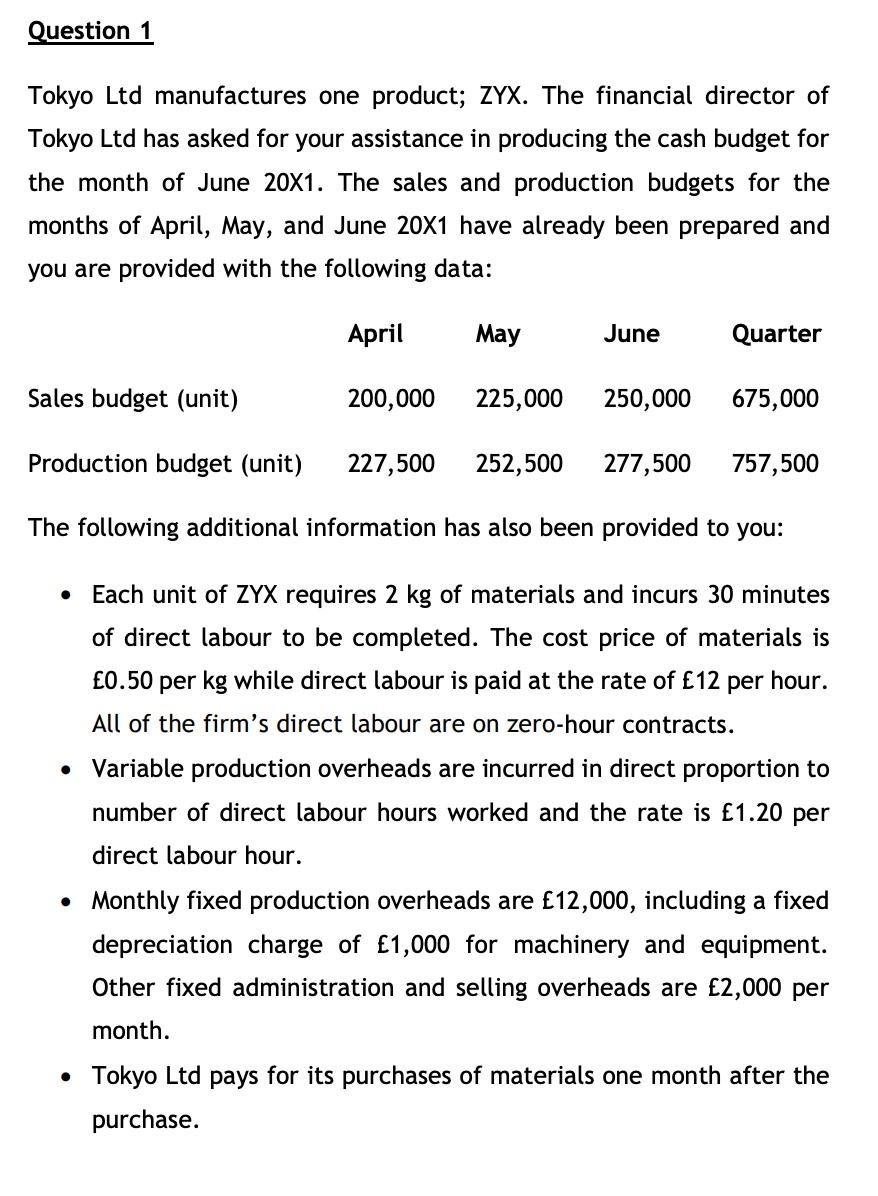

Question 1 Tokyo Ltd manufactures one product; ZYX. The financial director of Tokyo Ltd has asked for your assistance in producing the cash budget for the month of June 20X1. The sales and production budgets for the months of April, May, and June 20X1 have already been prepared and you are provided with the following data: April May June Quarter Sales budget (unit) 200,000 225,000 250,000 675,000 Production budget (unit) 227,500 252,500 277,500 757,500 The following additional information has also been provided to you: . Each unit of ZYX requires 2 kg of materials and incurs 30 minutes of direct labour to be completed. The cost price of materials is 0.50 per kg while direct labour is paid at the rate of 12 per hour. All of the firm's direct labour are on zero-hour contracts. Variable production overheads are incurred in direct proportion to number of direct labour hours worked and the rate is 1.20 per direct labour hour. Monthly fixed production overheads are 12,000, including a fixed depreciation charge of 1,000 for machinery and equipment. Other fixed administration and selling overheads are 2,000 per month. Tokyo Ltd pays for its purchases of materials one month after the purchase. . Question 1 Tokyo Ltd manufactures one product; ZYX. The financial director of Tokyo Ltd has asked for your assistance in producing the cash budget for the month of June 20X1. The sales and production budgets for the months of April, May, and June 20X1 have already been prepared and you are provided with the following data: April May June Quarter Sales budget (unit) 200,000 225,000 250,000 675,000 Production budget (unit) 227,500 252,500 277,500 757,500 The following additional information has also been provided to you: . Each unit of ZYX requires 2 kg of materials and incurs 30 minutes of direct labour to be completed. The cost price of materials is 0.50 per kg while direct labour is paid at the rate of 12 per hour. All of the firm's direct labour are on zero-hour contracts. Variable production overheads are incurred in direct proportion to number of direct labour hours worked and the rate is 1.20 per direct labour hour. Monthly fixed production overheads are 12,000, including a fixed depreciation charge of 1,000 for machinery and equipment. Other fixed administration and selling overheads are 2,000 per month. Tokyo Ltd pays for its purchases of materials one month after the purchase