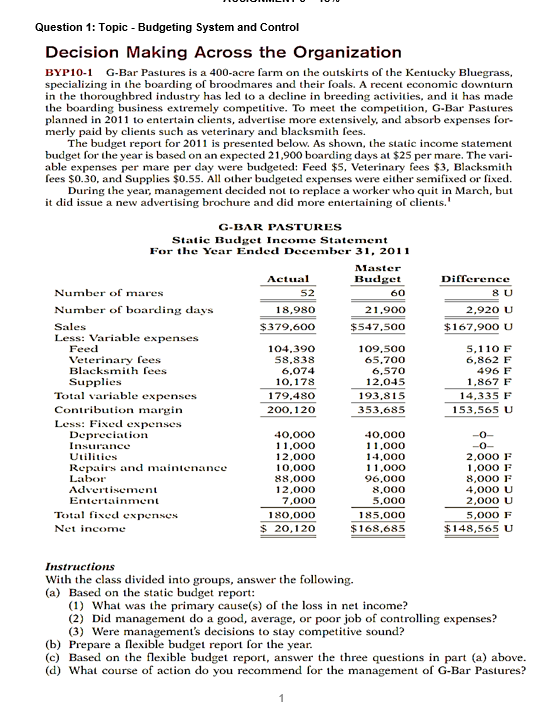

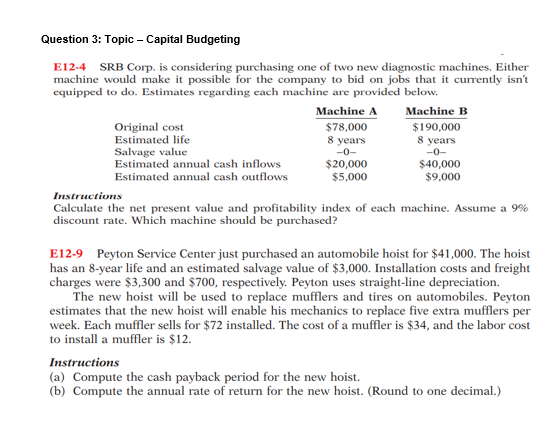

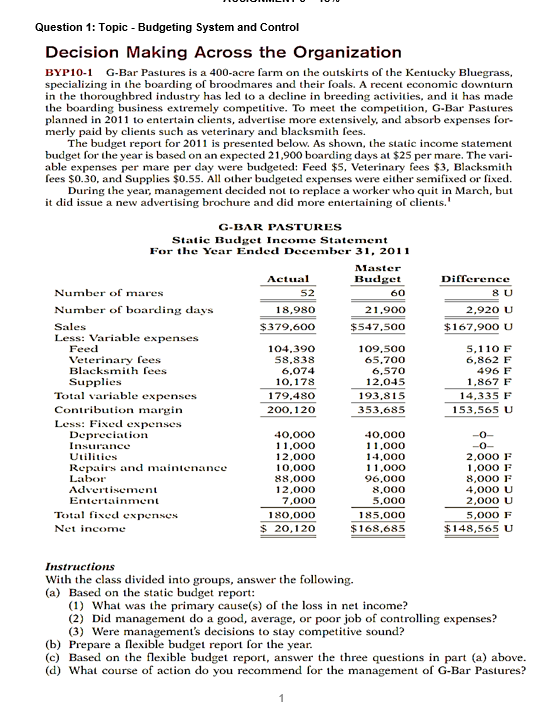

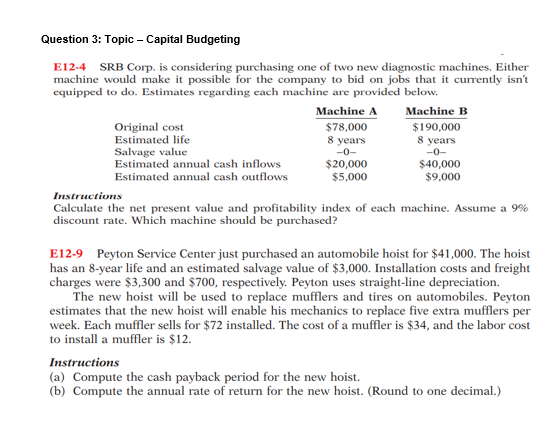

Question 1: Topic - Budgeting System and Control Decision Making Across the Organization BYP10-1 G-Bar Pastures is a 400-acre farm on the outskirts of the Kentucky Bluegrass, specializing in the boarding of broodmares and their foals. A recent economic downturn in the thoroughbred industry has led to a decline in breeding activities, and it has made the boarding business extremely competitive. To meet the competition, G-Bar Pastures planned in 2011 to entertain clients, advertise more extensively, and absorb expenses for merly paid by clients such as veterinary and blacksmith fees. The budget report for 2011 is presented below. As shown, the static income statement budget for the year is based on an expected 21,900 boarding days at $25 per mare. The vari- able expenses per mare per day were budgeted: Feed $5, Veterinary fees $3, Blacksmith ees $0.30, and Supplies $0.55. All other budgeted expenses were either semifixed or fixed. During the year, management decided not to replace a worker who quit in March, but it did issue a new advertising brochure and did more entertaining of clients.' Difference 8U 2,920 U $167.900 U G-BAR PASTURES Static Budget Income Statement For the Year Ended December 31, 2011 Master Actual Budget Number of mares 52 60 Number of boarding days 18,980 21.900 Sales $379,600 $547,500 Less: Variable expenses Feed 104.390 109,500 Veterinary fees 58.838 65,700 Blacksmith fees 6,074 6,570 Supplies 10.178 12.045 Total variable expenses 179,480 193.815 Contribution margin 200,120 353,685 Less: Fixecl expenses Depreciation 40,000 440,000 Insurance 11,000 11.000 Utilities 12,000 144,000 Repairs and maintenance 10,000 11,000 Labor 88,000 96,000 Advertisement 12,000 8,000 Entertainment 7.000 5,000 Total fixed expenses 180,000 185.000 Net income $ 20,120 $168.685 5,110 F 6,862 F 496 F 1,867 F 14,335 F 153,565 U -0- 2,000 F 1,000 F 8,000 F 4,000 U 2,000 U 5,000 F $148,565 U Instructions With the class divided into groups, answer the following. (a) Based on the static budget report: (1) What was the primary cause(s) of the loss in net income? (2) Did management do a good, average, or poor job of controlling expenses? (3) Were management's decisions to stay competitive sound? (b) Prepare a flexible budget report for the year. (c) Based on the flexible budget report, answer the three questions in part (a) above. (d) What course of action do you recommend for the management of G-Bar Pastures? Question 3: Topic - Capital Budgeting E12-4 SRB Corp. is considering purchasing one of two new diagnostic machines. Either machine would make it possible for the company to bid on jobs that it currently isn't equipped to do. Estimates regarding each machine are provided below. Machine A Machine B Original cost $78,000 $190,000 Estimated life 8 years 8 years Salvage value Estimated annual cash inflows $20,000 $40,000 Estimated annual cash outflows $5,000 $9,000 Instructions Calculate the net present value and profitability index of each machine. Assume a 9% discount rate. Which machine should be purchased? -0- -0- E12-9 Peyton Service Center just purchased an automobile hoist for $41,000. The hoist has an 8-year life and an estimated salvage value of $3,000. Installation costs and freight charges were $3,300 and $700, respectively. Peyton uses straight-line depreciation. The new hoist will be used to replace mufflers and tires on automobiles. Peyton estimates that the new hoist will enable his mechanics to replace five extra mufflers per week. Each muffler sells for $72 installed. The cost of a muffler is $34, and the labor cost to install a muffler is $12. Instructions (a) Compute the cash payback period for the new hoist. (b) Compute the annual rate of return for the new hoist. (Round to one decimal.)