Answered step by step

Verified Expert Solution

Question

1 Approved Answer

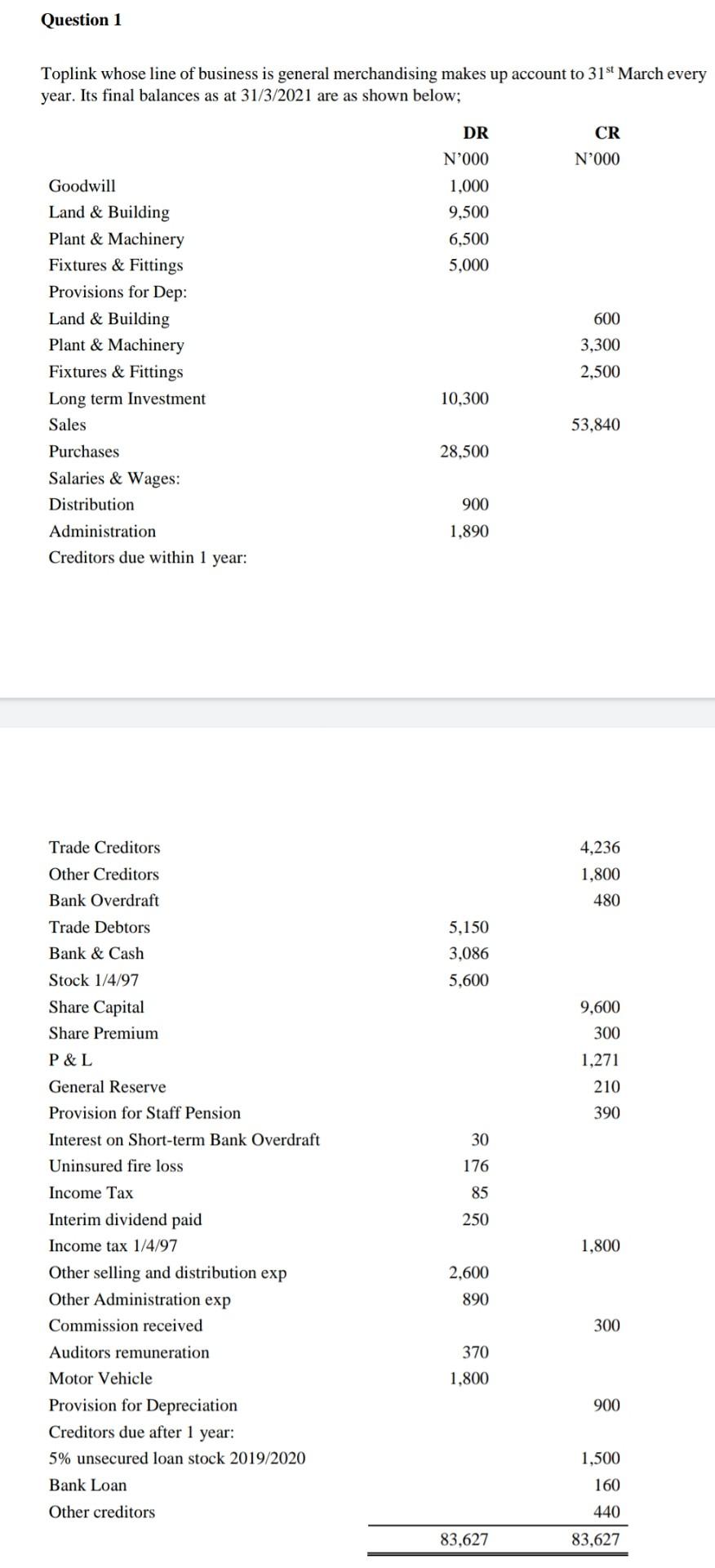

Question 1 Toplink whose line of business is general merchandising makes up account to 31st March every year. Its final balances as at 31/3/2021 are

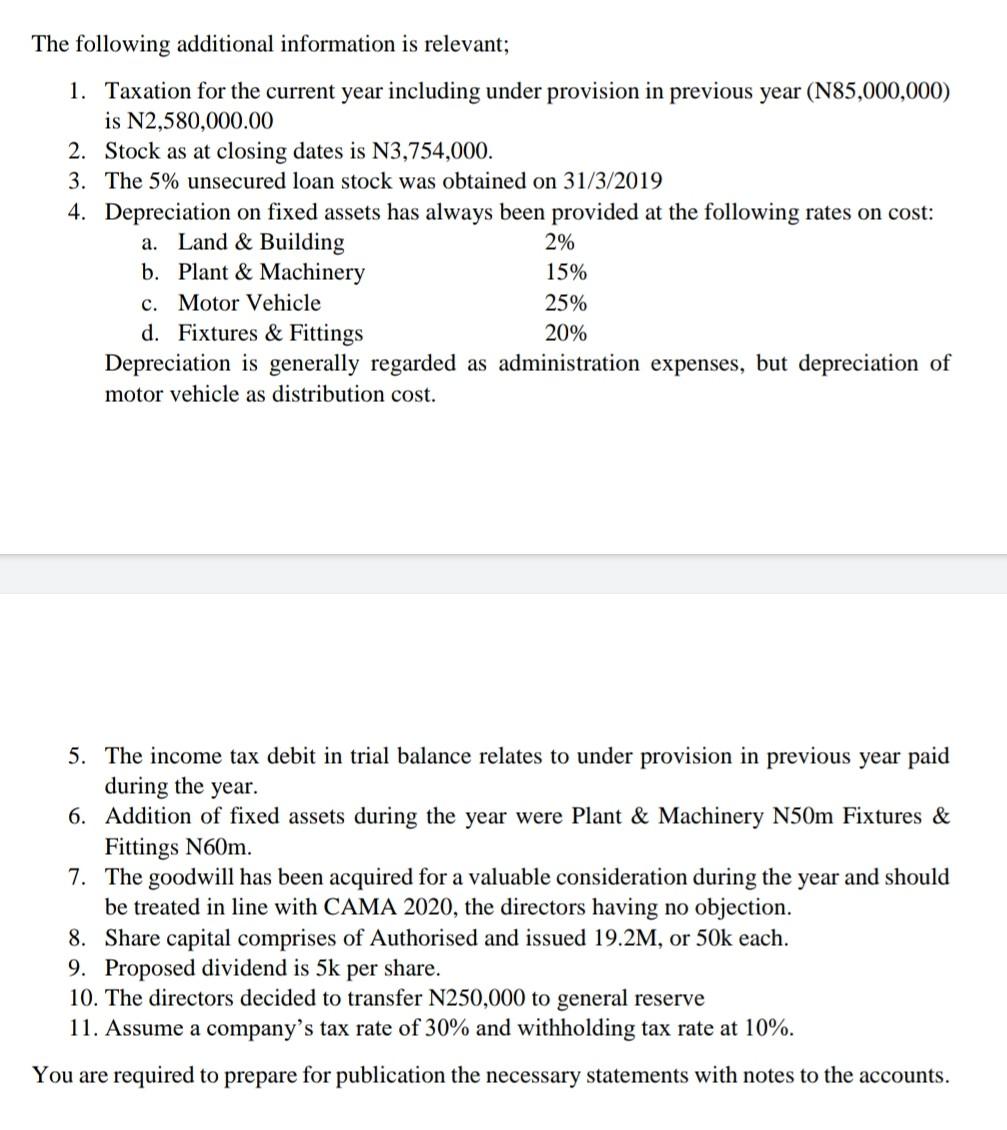

Question 1 Toplink whose line of business is general merchandising makes up account to 31st March every year. Its final balances as at 31/3/2021 are as shown below; CR N'000 DR N'000 1.000 9.500 6,500 5,000 Goodwill Land & Building Plant & Machinery Fixtures & Fittings Provisions for Dep: Land & Building Plant & Machinery Fixtures & Fittings Long term Investment Sales Purchases Salaries & Wages: Distribution Administration Creditors due within 1 year: 600 3,300 2,500 10,300 53.840 28,500 900 1.890 4,236 1,800 Trade Creditors Other Creditors Bank Overdraft Trade Debtors 480 Bank & Cash 5.150 3,086 5,600 Stock 1/4/97 Share Capital Share Premium 9,600 300 P&L 1,271 210 390 30 176 85 250 1,800 2.600 General Reserve Provision for Staff Pension Interest on Short-term Bank Overdraft Uninsured fire loss Income Tax Interim dividend paid Income tax 1/4/97 Other selling and distribution exp Other Administration exp Commission received Auditors remuneration Motor Vehicle Provision for Depreciation Creditors due after 1 year: 5% unsecured loan stock 2019/2020 Bank Loan Other creditors 890 300 370 1,800 900 1,500 160 440 83,627 83,627 The following additional information is relevant; 1. Taxation for the current year including under provision in previous year (N85,000,000) is N2,580,000.00 2. Stock as at closing dates is N3,754,000. 3. The 5% unsecured loan stock was obtained on 31/3/2019 4. Depreciation on fixed assets has always been provided at the following rates on cost: a. Land & Building b. Plant & Machinery 15% c. Motor Vehicle 25% d. Fixtures & Fittings 20% Depreciation is generally regarded as administration expenses, but depreciation of motor vehicle as distribution cost. 2% 5. The income tax debit in trial balance relates to under provision in previous year paid during the year. 6. Addition of fixed assets during the year were Plant & Machinery N50m Fixtures & Fittings N60m. 7. The goodwill has been acquired for a valuable consideration during the year and should be treated in line with CAMA 2020, the directors having no objection. 8. Share capital comprises of Authorised and issued 19.2M, or 50k each. 9. Proposed dividend is 5k per share. 10. The directors decided to transfer N250,000 to general reserve 11. Assume a company's tax rate of 30% and withholding tax rate at 10%. You are required to prepare for publication the necessary statements with notes to the accounts

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started