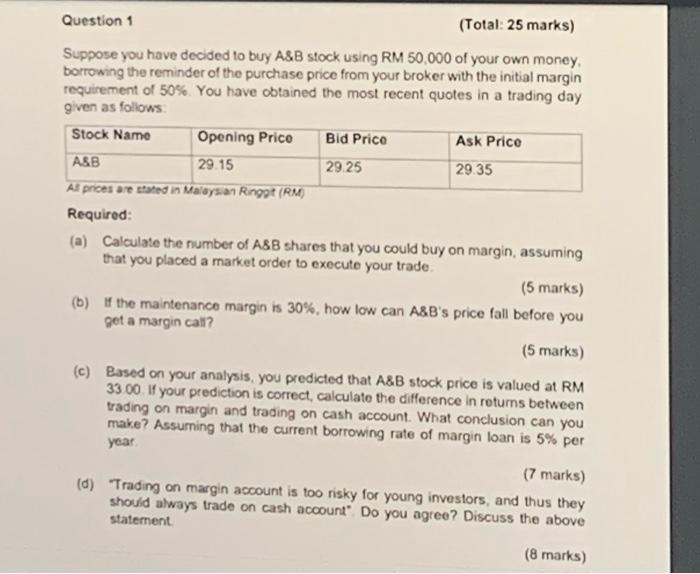

Question 1 (Total: 25 marks) Suppose you have decided to buy AsB stock using RM 50,000 of your own money, borrowing the reminder of the purchase price from your broker with the initial margin requirement of 50%. You have obtained the most recent quotes in a trading day given as follows: Requirod: (a) Calculate the number of ASB shares that you could buy on margin, assuming that you placed a market order to execute your trade. (5 marks) (b) If the maintenance margin is 30%, how low can A\&B's price fall before you get a margin call? (5 marks) (c) Based on your analysis, you predicted that A\&B stock price is valued at RM 3300 . If your prediction is correct, calculate the difference in roturns between trading on margin and trading on cash account. What conclusion can you make? Assuming that the current borrowing rate of margin loan is 5% per year. (7 marks) (d) Trading on margin account is too risky for young investors, and thus they should always trade on cash acoount". Do you agree? Discuss the above statement. (8 marks) Question 1 (Total: 25 marks) Suppose you have decided to buy AsB stock using RM 50,000 of your own money, borrowing the reminder of the purchase price from your broker with the initial margin requirement of 50%. You have obtained the most recent quotes in a trading day given as follows: Requirod: (a) Calculate the number of ASB shares that you could buy on margin, assuming that you placed a market order to execute your trade. (5 marks) (b) If the maintenance margin is 30%, how low can A\&B's price fall before you get a margin call? (5 marks) (c) Based on your analysis, you predicted that A\&B stock price is valued at RM 3300 . If your prediction is correct, calculate the difference in roturns between trading on margin and trading on cash account. What conclusion can you make? Assuming that the current borrowing rate of margin loan is 5% per year. (7 marks) (d) Trading on margin account is too risky for young investors, and thus they should always trade on cash acoount". Do you agree? Discuss the above statement. (8 marks)