Answered step by step

Verified Expert Solution

Question

1 Approved Answer

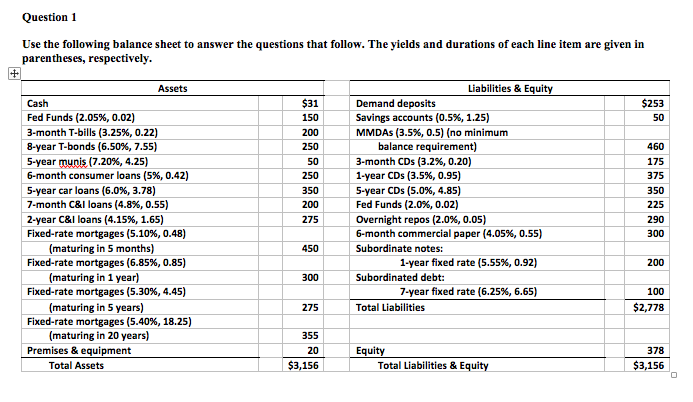

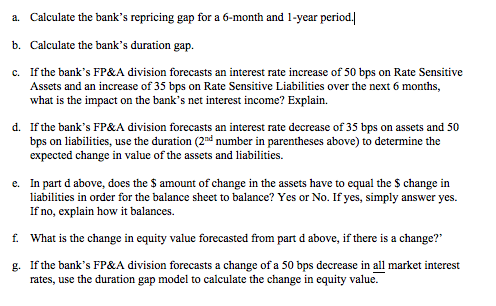

Question 1 Use the following balance sheet to answer the questions that follow. The yields and durations of each line item are given in parentheses,

Question 1 Use the following balance sheet to answer the questions that follow. The yields and durations of each line item are given in parentheses, respectively. $31 $253 150 Assets Cash Fed Funds (2.05%, 0.02) 3-month T-bills (3.25%, 0.22) 8-year T-bonds (6.50%, 7.55) 5-year munis (7.20%, 4.25) 6-month consumer loans (5%, 0.42) 5-year car loans (6.0%, 3.78) 7-month C&I loans (4.8%, 0.55) 2-year C&I loans (4.15%, 1.65) Fixed-rate mortgages (5.10%, 0.48) (maturing in 5 months) Fixed-rate mortgages (6.85%, 0.85) (maturing in 1 year) Fixed-rate mortgages (5.30%, 4.45) (maturing in 5 years) Fixed-rate mortgages (5.40%, 18.25) (maturing in 20 years) Premises & equipment Total Assets 200 250 50 250 350 200 275 Liabilities & Equity Demand deposits Savings accounts (0.5%, 1.25) MMDAs (3.5%, 0.5) (no minimum balance requirement) 3-month CDs (3.2%, 0.20) 1-year CDs (3.5%, 0.95) 5-year CDs (5.0%, 4.85) Fed Funds (2.0%, 0.02) Overnight repos (2.0%, 0.05) 6-month commercial paper (4.05%, 0.55) Subordinate notes: 1-year fixed rate (5.55%, 0.92) Subordinated debt: 7-year fixed rate (6.25%, 6.65) Total Liabilities 450 200 300 100 $2,778 275 355 20 Fauity 378 $3,156 Total Liabilities & Equity $3,156 a. Calculate the bank's repricing gap for a 6-month and 1-year period. b. Calculate the bank's duration gap. c. If the bank's FP&A division forecasts an interest rate increase of 50 bps on Rate Sensitive Assets and an increase of 35 bps on Rate Sensitive Liabilities over the next 6 months, what is the impact on the bank's net interest income? Explain. d. If the bank's FP&A division forecasts an interest rate decrease of 35 bps on assets and 50 bps on liabilities, use the duration (2nd number in parentheses above) to determine the expected change in value of the assets and liabilities. e. In part d above, does the $ amount of change in the assets have to equal the $ change in liabilities in order for the balance sheet to balance? Yes or No. If yes, simply answer yes. If no, explain how it balances. f. What is the change in equity value forecasted from part d above, if there is a change?' g. If the bank's FP&A division forecasts a change of a 50 bps decrease in all market interest rates, use the duration gap model to calculate the change in equity value. Question 1 Use the following balance sheet to answer the questions that follow. The yields and durations of each line item are given in parentheses, respectively. $31 $253 150 Assets Cash Fed Funds (2.05%, 0.02) 3-month T-bills (3.25%, 0.22) 8-year T-bonds (6.50%, 7.55) 5-year munis (7.20%, 4.25) 6-month consumer loans (5%, 0.42) 5-year car loans (6.0%, 3.78) 7-month C&I loans (4.8%, 0.55) 2-year C&I loans (4.15%, 1.65) Fixed-rate mortgages (5.10%, 0.48) (maturing in 5 months) Fixed-rate mortgages (6.85%, 0.85) (maturing in 1 year) Fixed-rate mortgages (5.30%, 4.45) (maturing in 5 years) Fixed-rate mortgages (5.40%, 18.25) (maturing in 20 years) Premises & equipment Total Assets 200 250 50 250 350 200 275 Liabilities & Equity Demand deposits Savings accounts (0.5%, 1.25) MMDAs (3.5%, 0.5) (no minimum balance requirement) 3-month CDs (3.2%, 0.20) 1-year CDs (3.5%, 0.95) 5-year CDs (5.0%, 4.85) Fed Funds (2.0%, 0.02) Overnight repos (2.0%, 0.05) 6-month commercial paper (4.05%, 0.55) Subordinate notes: 1-year fixed rate (5.55%, 0.92) Subordinated debt: 7-year fixed rate (6.25%, 6.65) Total Liabilities 450 200 300 100 $2,778 275 355 20 Fauity 378 $3,156 Total Liabilities & Equity $3,156 a. Calculate the bank's repricing gap for a 6-month and 1-year period. b. Calculate the bank's duration gap. c. If the bank's FP&A division forecasts an interest rate increase of 50 bps on Rate Sensitive Assets and an increase of 35 bps on Rate Sensitive Liabilities over the next 6 months, what is the impact on the bank's net interest income? Explain. d. If the bank's FP&A division forecasts an interest rate decrease of 35 bps on assets and 50 bps on liabilities, use the duration (2nd number in parentheses above) to determine the expected change in value of the assets and liabilities. e. In part d above, does the $ amount of change in the assets have to equal the $ change in liabilities in order for the balance sheet to balance? Yes or No. If yes, simply answer yes. If no, explain how it balances. f. What is the change in equity value forecasted from part d above, if there is a change?' g. If the bank's FP&A division forecasts a change of a 50 bps decrease in all market interest rates, use the duration gap model to calculate the change in equity value

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started