Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 Use the following problem statement to answer questions 1-3. 8 pts A bank wants to invest in five types of loans. To

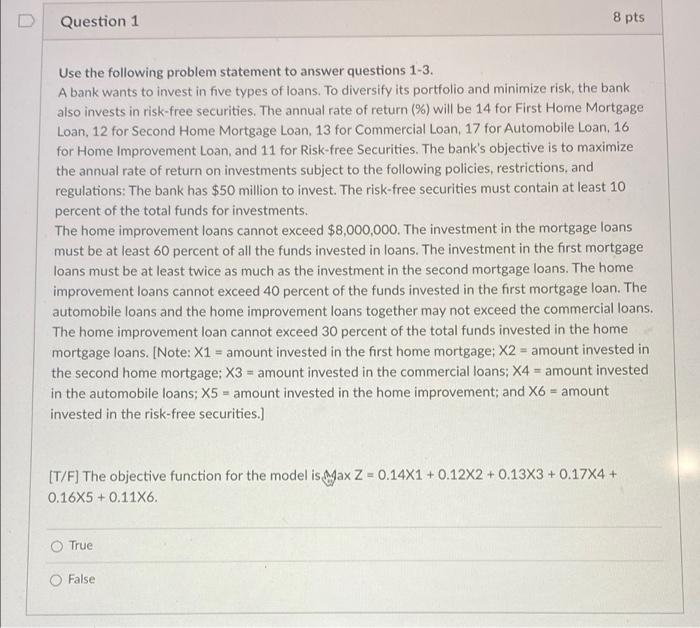

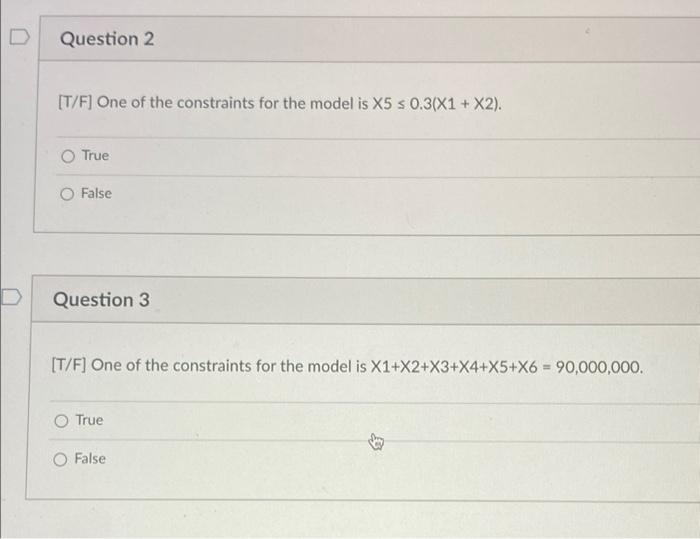

Question 1 Use the following problem statement to answer questions 1-3. 8 pts A bank wants to invest in five types of loans. To diversify its portfolio and minimize risk, the bank also invests in risk-free securities. The annual rate of return (%) will be 14 for First Home Mortgage. Loan, 12 for Second Home Mortgage Loan, 13 for Commercial Loan, 17 for Automobile Loan, 16 for Home Improvement Loan, and 11 for Risk-free Securities. The bank's objective is to maximize the annual rate of return on investments subject to the following policies, restrictions, and regulations: The bank has $50 million to invest. The risk-free securities must contain at least 10 percent of the total funds for investments. The home improvement loans cannot exceed $8,000,000. The investment in the mortgage loans must be at least 60 percent of all the funds invested in loans. The investment in the first mortgage loans must be at least twice as much as the investment in the second mortgage loans. The home improvement loans cannot exceed 40 percent of the funds invested in the first mortgage loan. The automobile loans and the home improvement loans together may not exceed the commercial loans. The home improvement loan cannot exceed 30 percent of the total funds invested in the home mortgage loans. [Note: X1 = amount invested in the first home mortgage; X2 amount invested in the second home mortgage; X3 = amount invested in the commercial loans; X4 amount invested in the automobile loans; X5 amount invested in the home improvement; and X6 = amount invested in the risk-free securities.] [T/F] The objective function for the model is Max Z 0.14X1+ 0.12X2 +0.13X3 + 0.17X4+ 0.16X5+0.11X6. True False

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started