| Question 1: | Using 10% as your company's cost of capital and assuming the BASE CASE for revenue growth, would you accept the project on an NPV and IRR? Why? |

| Question 2: | Would you accept the project based on the Payback rule if the project cut-off is 3 years? | | | | | | |

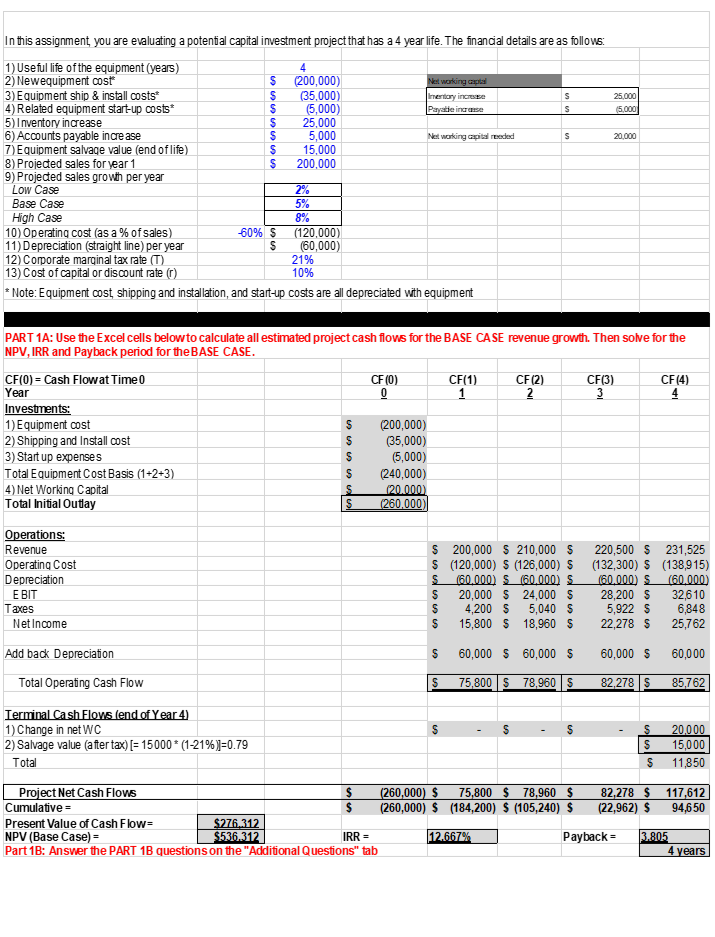

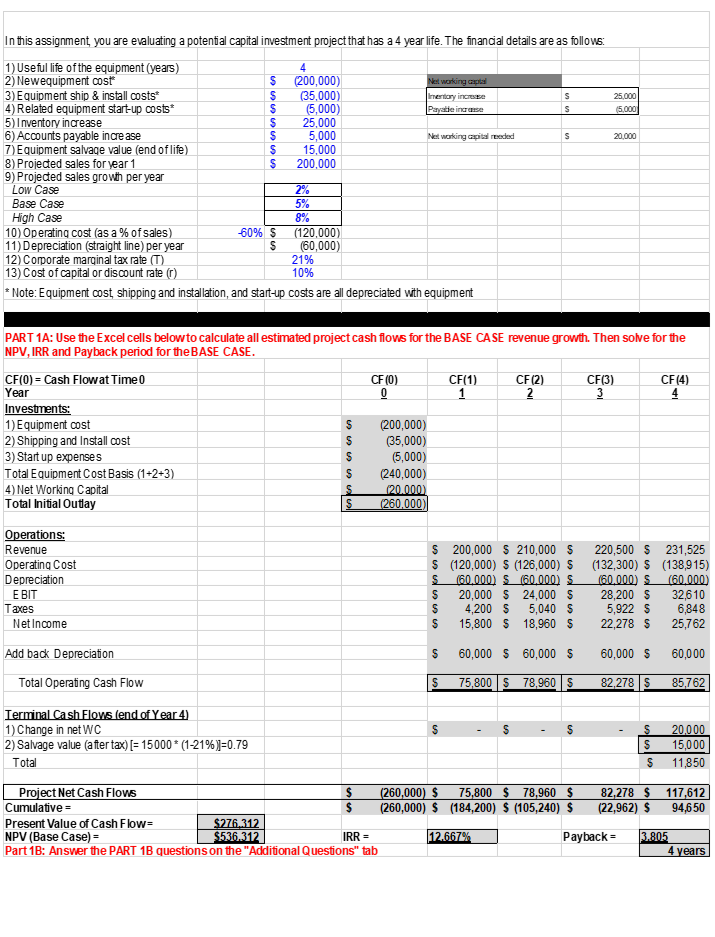

In this assignment, you are evaluating a potential capital investment project that has a 4 year life. The financial details are as follows: 1) Useful life of the equipment (years) 2) Newequipment cost 4 (200,000) (35,000) Networking captal 3) Equipment ship & install costs* Imentary increase S 25,000 (5,000) Payable increase S (5,000) 4) Related equipment start-up costs* 5) Inventory increase 25,000 5,000 6) Accounts payable increase Networking capital reeded S 20,000 7) Equipment salvage value (end of life) 15,000 8) Projected sales for year 1 200,000 9) Projected sales growth per year Low Case 2% Base Case 5% High Case 8% -60% $ 10) Operating cost (as a % of sales) 11) Depreciation (straight line) per year $ (120,000) (60,000) 21% 10% 12) Corporate marginal tax rate (T) 13) Cost of capital or discount rate (r) * Note: Equipment cost, shipping and installation, and start-up costs are all depreciated with equipment PART 1A: Use the Excel cells below to calculate all estimated project cash flows for the BASE CASE revenue growth. Then solve for the NPV, IRR and Payback period for the BASE CASE. CF(0) = Cash Flowat Time 0 CF (0) 0 Year CF(1) 1 CF(2) 2 CF(3) 3 CF(4) 4 Investments: 1) Equipment cost 2) Shipping and Install cost 3) Start up expenses Total Equipment Cost Basis (1+2+3) 4) Net Working Capital Total Initial Outlay Operations: Revenue 231,525 (138,915) Operating Cost Depreciation $ 200,000 $ 210,000 S $ (120,000) $ (126,000) $ (60,000) $ (60,000) S 20,000 $ 24,000 $ 4,200 $ 5,040 S 220,500 $ (132,300) $ (60,000) $ S (60,000) E BIT 28,200 $ 32,610 5,922 $ 6,848 Net Income 15,800 $ 18,960 $ 22,278 S 25,762 Add back Depreciation 60,000 $60,000 $ 60,000 $ 60,000 75,800 $ 78,960 $ 82,278 $ 85,762 S S 20,000 $ 15,000 11,850 117,612 75,800 $ 78,960 $ (184,200) $ (105,240) $ 94,650 4 years Taxes SSSSSSS 65 65 65 $ $ $ $ Total Operating Cash Flow Terminal Cash Flows (end of Year 4) 1) Change in net WC 2) Salvage value (after tax) [= 15000* (1-21%)]=0.79 Total Project Net Cash Flows $ Cumulative= $ Present Value of Cash Flow= $276.312 $536.312 NPV (Base Case) = IRR = Part 1B: Answer the PART 1B questions on the "Additional Questions" tab (200,000) (35,000) (5,000) (240,000) (20.000) (260,000) in en en kn en en S $ $ (260,000) $ (260,000) $ 12.667% $ 82,278 $ (22,962) $ Payback = 3.805 In this assignment, you are evaluating a potential capital investment project that has a 4 year life. The financial details are as follows: 1) Useful life of the equipment (years) 2) Newequipment cost 4 (200,000) (35,000) Networking captal 3) Equipment ship & install costs* Imentary increase S 25,000 (5,000) Payable increase S (5,000) 4) Related equipment start-up costs* 5) Inventory increase 25,000 5,000 6) Accounts payable increase Networking capital reeded S 20,000 7) Equipment salvage value (end of life) 15,000 8) Projected sales for year 1 200,000 9) Projected sales growth per year Low Case 2% Base Case 5% High Case 8% -60% $ 10) Operating cost (as a % of sales) 11) Depreciation (straight line) per year $ (120,000) (60,000) 21% 10% 12) Corporate marginal tax rate (T) 13) Cost of capital or discount rate (r) * Note: Equipment cost, shipping and installation, and start-up costs are all depreciated with equipment PART 1A: Use the Excel cells below to calculate all estimated project cash flows for the BASE CASE revenue growth. Then solve for the NPV, IRR and Payback period for the BASE CASE. CF(0) = Cash Flowat Time 0 CF (0) 0 Year CF(1) 1 CF(2) 2 CF(3) 3 CF(4) 4 Investments: 1) Equipment cost 2) Shipping and Install cost 3) Start up expenses Total Equipment Cost Basis (1+2+3) 4) Net Working Capital Total Initial Outlay Operations: Revenue 231,525 (138,915) Operating Cost Depreciation $ 200,000 $ 210,000 S $ (120,000) $ (126,000) $ (60,000) $ (60,000) S 20,000 $ 24,000 $ 4,200 $ 5,040 S 220,500 $ (132,300) $ (60,000) $ S (60,000) E BIT 28,200 $ 32,610 5,922 $ 6,848 Net Income 15,800 $ 18,960 $ 22,278 S 25,762 Add back Depreciation 60,000 $60,000 $ 60,000 $ 60,000 75,800 $ 78,960 $ 82,278 $ 85,762 S S 20,000 $ 15,000 11,850 117,612 75,800 $ 78,960 $ (184,200) $ (105,240) $ 94,650 4 years Taxes SSSSSSS 65 65 65 $ $ $ $ Total Operating Cash Flow Terminal Cash Flows (end of Year 4) 1) Change in net WC 2) Salvage value (after tax) [= 15000* (1-21%)]=0.79 Total Project Net Cash Flows $ Cumulative= $ Present Value of Cash Flow= $276.312 $536.312 NPV (Base Case) = IRR = Part 1B: Answer the PART 1B questions on the "Additional Questions" tab (200,000) (35,000) (5,000) (240,000) (20.000) (260,000) in en en kn en en S $ $ (260,000) $ (260,000) $ 12.667% $ 82,278 $ (22,962) $ Payback = 3.805