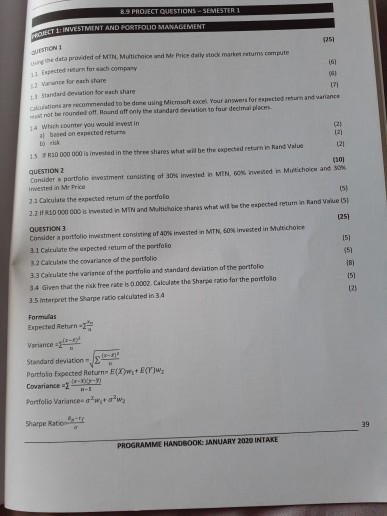

Question: QUESTION 1 Using the data provided of MTN, Multichoice and Mr Price daily stock market returns compute 1.1 Expected return for each company 1.2 Variance

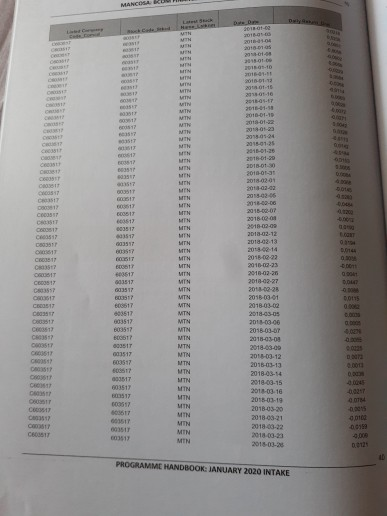

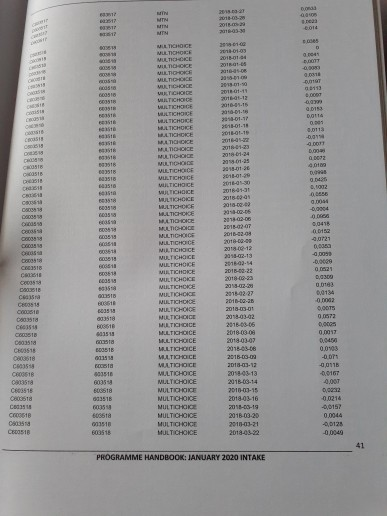

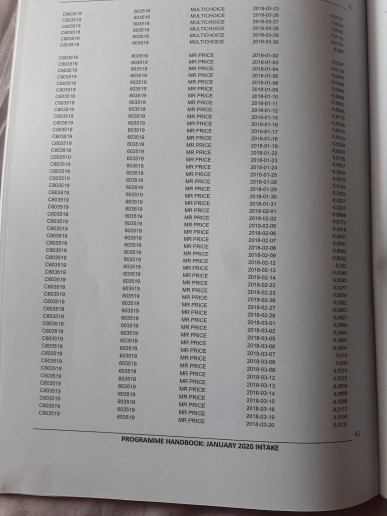

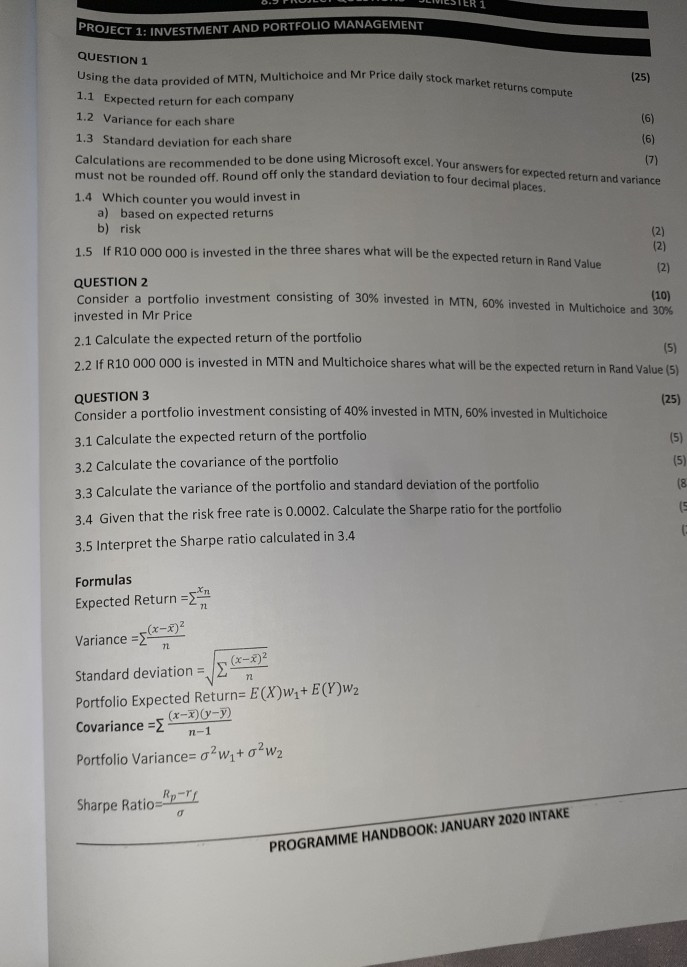

QUESTION 1 Using the data provided of MTN, Multichoice and Mr Price daily stock market returns compute 1.1 Expected return for each company 1.2 Variance for each share 1.3 Standard deviation for each share

Calculations are recommended to be done using Microsoft excel. Your answers for expected return and variance must not be rounded off. Round off only the standard deviation to four decimal places.

1.4 Which counter you would invest in a) based on expected returns b) risk 1.5 If R10 000 000 is invested in the three shares what will be the expected return in Rand Value QUESTION Consider a portfolio investment consisting of 30% invested in MTN, 60% invested in Multichoice and 30% invested in Mr Price

2.1 Calculate the expected return of the portfolio 2.2 If R10 000 000 is invested in MTN and Multichoice shares what will be the expected return in Rand Value QUESTION 3 Consider a portfolio investment consisting of 40% invested in MTN, 60% invested in Multichoice 3.1 Calculate the expected return of the portfolio 3.2 Calculate the covariance of the portfolio 3.3 Calculate the variance of the portfolio and standard deviation of the portfolio 3.4 Given that the risk free rate is 0.0002. Calculate the Sharpe ratio for the portfolio 3.5 Interpret the Sharpe ratio calculated in 3.4

Formulas Expected Return

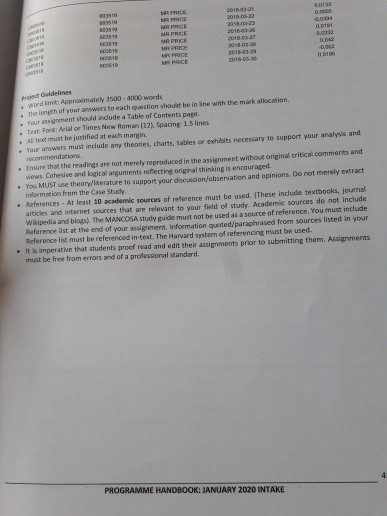

8.9 PROJECT QUESTIONS - SEMESTER I T1: INVESTMENT AND PORTFOLIO MANAGEMENT ESTON 1 the data provided of MIN Multichoice and Mr Price daily stock market ratums compute Expected return for each company Varance for each share Standard deviation for each share utions are recommended to be done using Micraft Excel your answers for expected return and variance not be rounded off Round off only the standard deviation to four decimal places which counter you would invest in al based on expected returns 15 RD DOO 000 is invested in the three shares what will be the expected return in Rand Value QUESTION 2 101 Consider a portfolio nvestment consisting of an invested in MIN OM invited Multichoice and 10% invested in Mr Price 2.3 Calculate the expected return of the portfolio 2.2 HRID 000 000 is invested in MIN and Multichoke shares what will be the expected retum in Rand Value (5) QUESTION 3 (25) Consider a portfolio investment consisting of 40% invested in MTN, 60% invested in Multichoice 3.1 Cnculate the expected return of the portfolio 32 Calculate the covariance of the portfolio 3.3 Calculate the variante of the portfolio and standard deviation of the portfolio 34 Given that the risk free rate is 0.0002. Calculate the Sharpe ratio for the portfolio 2.5 Interpret the Sharpe ratio calculated in 34 Formulas Expected Return Variance Standard deviation Portfolio Expected Return= E(X) Covariance Portfolio Variance w ow +E(V), Sharpe Ratio Buy PROGRAMME HANDBOOK: JANUARY 2020 INTAKE 2010-02-23 2018-02-26 2011.10-28 2018-03-01 2018-03-02 2018-03-01 2018-03-00 0199 2018-03-21 2018-03-22 2018-03-23 2015-03-26 MIN PROGRAMME HANDBOOK: JANUARY 2020 INTAKE 2012 VATICHOICE VELTICHOICE MULTICHOICE 201013 2018-03-14 2012 .16 MULTICHOICE MULTICHOICE MULTICHOICE ICHOICE MULTICHOICE 218.000 M PROGRAMME HANDBOOK: JANUARY 2020 INTAKE PROGRAMME HANDBOOK JANUARY 2020 INTAKE Guidelines d it: Aproximately 1500-4000 words Theth of your answers to each should be in line with the mark allocation Tour assignment should indude a Table of Contents page . Text Font: A rTimes New Roman 12 Sating 15 lines Altext must be justified at each marin Your answers must include any theories, charts, tables or exhibits necessary to support your analysis and Ensure that the readings are not merely reproduced in the assignment without original critical comments and wiews. Cohesive and logical arguments reflecting original thinking is encouraged You MUST use theory/terature to support your d e servation and opinions. Do not merely extract information from the Case Study References - At least 10 de sources of reference must be used. These include textbooks, journal articles and internet sources that are relevant to your field of study. Academic sources do not include Wipedia and blogs. The MANCOSA study puide must not be used as a source of reference. You must include Reference list at the end of your assignment Information quoted/paraphrased from sources listed in your Reference it must be referenced in text. The Harvard system of referencing must be used . It is imperative that students proofread and edit their assements prior to submitting them. Assignments must be free from errors wd of a professional standard, PROGRAMME HANDBOOK: JANUARY 2020 INTAKE I ULIVIESTER 1 PROJECT 1: INVESTMENT AND PORTFOLIO MANAGEMENT QUESTION 1 orice daily stock market returns compute Using the data provided of MTN, Multichoice and Mr Price daily stock ma 1.1 Expected return for each company 1.2 Variance for each share 1.3 Standard deviation for each share calculations are recommended to be done using Microsoft excel You must not be rounded off. Round off only the standard deviation 1.4 Which counter you would invest in a) based on expected returns b) risk dane using Microsoft excel. Your answers for expected return and variance andard deviation to four decimal places. 15 If R10 000 000 is invested in the three shares what will be the expected return in Rand Value QUESTION 2 Consider a nortfolio investment consisting of 30% invested in MIN, 60% invested in Multichoice and 30 invested in Mr Price 2.1 Calculate the expected return of the portfolio 22 If R10 000 000 is invested in MTN and Multichoice shares what will be the expected return in Rand Value (5) QUESTION 3 Consider a portfolio investment consisting of 40% invested in MTN, 60% invested in Multichoice 3.1 Calculate the expected return of the portfolio 3.2 Calculate the covariance of the portfolio 33 Calculate the variance of the portfolio and standard deviation of the portfolio 34 Given that the risk free rate is 0.0002. Calculate the Sharpe ratio for the portfolio 3.5 Interpret the Sharpe ratio calculated in 3.4 Formulas Expected Return = { Variance ==(x-3)2 (x-2) Standard deviation = Portfolio Expected Return= E(X) Covariance == (x-7)(y-7) lance - n-1 Portfolio Variance= o?w,+ ow2 Sharpe RatioEpary +E(Y)w2 PROGRAMME HANDBOOK: JANUARY 2020 INTAKE 8.9 PROJECT QUESTIONS - SEMESTER I T1: INVESTMENT AND PORTFOLIO MANAGEMENT ESTON 1 the data provided of MIN Multichoice and Mr Price daily stock market ratums compute Expected return for each company Varance for each share Standard deviation for each share utions are recommended to be done using Micraft Excel your answers for expected return and variance not be rounded off Round off only the standard deviation to four decimal places which counter you would invest in al based on expected returns 15 RD DOO 000 is invested in the three shares what will be the expected return in Rand Value QUESTION 2 101 Consider a portfolio nvestment consisting of an invested in MIN OM invited Multichoice and 10% invested in Mr Price 2.3 Calculate the expected return of the portfolio 2.2 HRID 000 000 is invested in MIN and Multichoke shares what will be the expected retum in Rand Value (5) QUESTION 3 (25) Consider a portfolio investment consisting of 40% invested in MTN, 60% invested in Multichoice 3.1 Cnculate the expected return of the portfolio 32 Calculate the covariance of the portfolio 3.3 Calculate the variante of the portfolio and standard deviation of the portfolio 34 Given that the risk free rate is 0.0002. Calculate the Sharpe ratio for the portfolio 2.5 Interpret the Sharpe ratio calculated in 34 Formulas Expected Return Variance Standard deviation Portfolio Expected Return= E(X) Covariance Portfolio Variance w ow +E(V), Sharpe Ratio Buy PROGRAMME HANDBOOK: JANUARY 2020 INTAKE 2010-02-23 2018-02-26 2011.10-28 2018-03-01 2018-03-02 2018-03-01 2018-03-00 0199 2018-03-21 2018-03-22 2018-03-23 2015-03-26 MIN PROGRAMME HANDBOOK: JANUARY 2020 INTAKE 2012 VATICHOICE VELTICHOICE MULTICHOICE 201013 2018-03-14 2012 .16 MULTICHOICE MULTICHOICE MULTICHOICE ICHOICE MULTICHOICE 218.000 M PROGRAMME HANDBOOK: JANUARY 2020 INTAKE PROGRAMME HANDBOOK JANUARY 2020 INTAKE Guidelines d it: Aproximately 1500-4000 words Theth of your answers to each should be in line with the mark allocation Tour assignment should indude a Table of Contents page . Text Font: A rTimes New Roman 12 Sating 15 lines Altext must be justified at each marin Your answers must include any theories, charts, tables or exhibits necessary to support your analysis and Ensure that the readings are not merely reproduced in the assignment without original critical comments and wiews. Cohesive and logical arguments reflecting original thinking is encouraged You MUST use theory/terature to support your d e servation and opinions. Do not merely extract information from the Case Study References - At least 10 de sources of reference must be used. These include textbooks, journal articles and internet sources that are relevant to your field of study. Academic sources do not include Wipedia and blogs. The MANCOSA study puide must not be used as a source of reference. You must include Reference list at the end of your assignment Information quoted/paraphrased from sources listed in your Reference it must be referenced in text. The Harvard system of referencing must be used . It is imperative that students proofread and edit their assements prior to submitting them. Assignments must be free from errors wd of a professional standard, PROGRAMME HANDBOOK: JANUARY 2020 INTAKE I ULIVIESTER 1 PROJECT 1: INVESTMENT AND PORTFOLIO MANAGEMENT QUESTION 1 orice daily stock market returns compute Using the data provided of MTN, Multichoice and Mr Price daily stock ma 1.1 Expected return for each company 1.2 Variance for each share 1.3 Standard deviation for each share calculations are recommended to be done using Microsoft excel You must not be rounded off. Round off only the standard deviation 1.4 Which counter you would invest in a) based on expected returns b) risk dane using Microsoft excel. Your answers for expected return and variance andard deviation to four decimal places. 15 If R10 000 000 is invested in the three shares what will be the expected return in Rand Value QUESTION 2 Consider a nortfolio investment consisting of 30% invested in MIN, 60% invested in Multichoice and 30 invested in Mr Price 2.1 Calculate the expected return of the portfolio 22 If R10 000 000 is invested in MTN and Multichoice shares what will be the expected return in Rand Value (5) QUESTION 3 Consider a portfolio investment consisting of 40% invested in MTN, 60% invested in Multichoice 3.1 Calculate the expected return of the portfolio 3.2 Calculate the covariance of the portfolio 33 Calculate the variance of the portfolio and standard deviation of the portfolio 34 Given that the risk free rate is 0.0002. Calculate the Sharpe ratio for the portfolio 3.5 Interpret the Sharpe ratio calculated in 3.4 Formulas Expected Return = { Variance ==(x-3)2 (x-2) Standard deviation = Portfolio Expected Return= E(X) Covariance == (x-7)(y-7) lance - n-1 Portfolio Variance= o?w,+ ow2 Sharpe RatioEpary +E(Y)w2 PROGRAMME HANDBOOK: JANUARY 2020 INTAKE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts