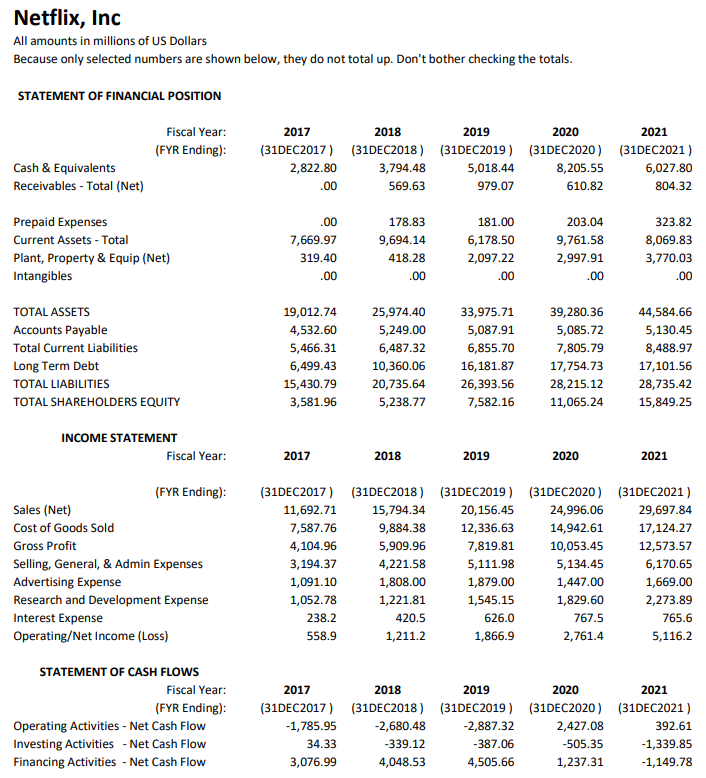

Question: 1) Using the information, calculate the following ratios for the years 2018 to 2021: (ps. you can show the calculation and ratios for 2018, while for the other years, only present the ratios you have calculated) a. Gross profit margin b. Operating profit margin Return on equity d. Average settlement period (Accounts receivable) e. Asset turnover f. Current ratio g. Quick ratio h. Interest coverage ratio i. Debt to equity ratio Netflix, Inc All amounts in millions of US Dollars Because only selected numbers are shown below, they do not total up. Don't bother checking the totals. STATEMENT OF FINANCIAL POSITION Fiscal Year: 2018 2017 (31DEC2017) 2019 (31DEC2019) 2020 (31DEC2020) 2021 (31DEC2021) (FYR Ending): (31DEC2018) 3,794.48 Cash & Equivalents 2,822.80 5,018.44 8,205.55 6,027.80 Receivables - Total (Net) .00 569.63 979.07 610.82 804.32 Prepaid Expenses .00 178.83 181.00 203.04 323.82 Current Assets - Total 7,669.97 9,694.14 6,178.50 9,761.58 8,069.83 Plant, Property & Equip (Net) 319.40 418.28 2,097.22 2,997.91 3,770.03 Intangibles .00 .00 .00 .00 .00 TOTAL ASSETS 19,012.74 25,974.40 33,975.71 39,280.36 44,584.66 Accounts Payable 4,532.60 5,249.00 5,087.91 5,085.72 5,130.45 Total Current Liabilities 5,466.31 6,487.32 6,855.70 7,805.79 8,488.97 Long Term Debt 6,499.43 10,360.06 16,181.87 17,754.73 17,101.56 TOTAL LIABILITIES 15,430.79 20,735.64 26,393.56 28,215.12 28,735.42 TOTAL SHAREHOLDERS EQUITY 3,581.96 5,238.77 7,582.16 11,065.24 15,849.25 INCOME STATEMENT 2017 2018 2019 2020 2021 (31DEC2017) (31DEC2018) (31DEC2019) (31DEC2020) (31DEC2021) Sales (Net) 11,692.71 15,794.34 20,156.45 24,996.06 29,697.84 Cost of Goods Sold 7,587.76 9,884.38 12,336.63 14,942.61 17,124.27 Gross Profit 4,104.96 5,909.96 7,819.81 10,053.45 12,573.57 Selling, General, & Admin Expenses 3,194.37 4,221.58 5,111.98 5,134.45 6,170.65 Advertising Expense 1,091.10 1,808.00 1,879.00 1,447.00 1,669.00 Research and Development Expense 1,052.78 1,221.81 1,545.15 1,829.60 2,273.89 Interest Expense 238.2 420.5 626.0 767.5 765.6 Operating/Net Income (Loss) 558.9 1,211.2 1,866.9 2,761.4 5,116.2 STATEMENT OF CASH FLOWS 2017 2018 2019 2020 (31DEC2017) (31DEC2018) (31DEC2019) (31DEC2020) -1,785.95 -2,680.48 -2,887.32 2,427.08 Operating Activities - Net Cash Flow Investing Activities - Net Cash Flow Financing Activities - Net Cash Flow 34.33 -339.12 -387.06 -505.35 3,076.99 4,048.53 4,505.66 1,237.31 Fiscal Year: (FYR Ending): Fiscal Year: (FYR Ending): 2021 (31DEC2021) 392.61 -1,339.85 -1,149.78