Answered step by step

Verified Expert Solution

Question

1 Approved Answer

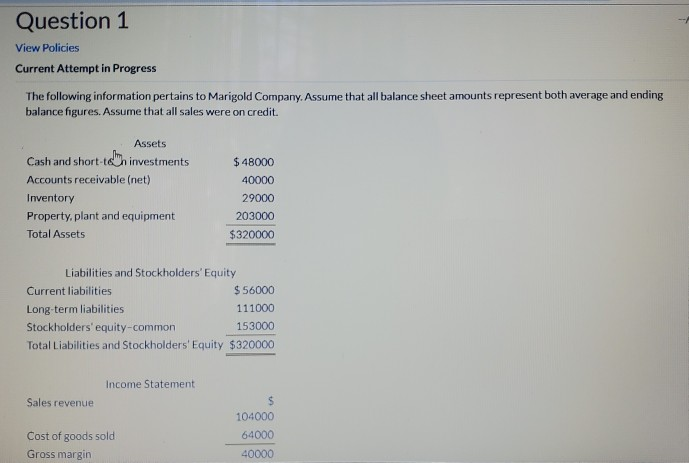

Question 1 View Policies Current Attempt in Progress The following information pertains to Marigold Company. Assume that all balance sheet amounts represent both average and

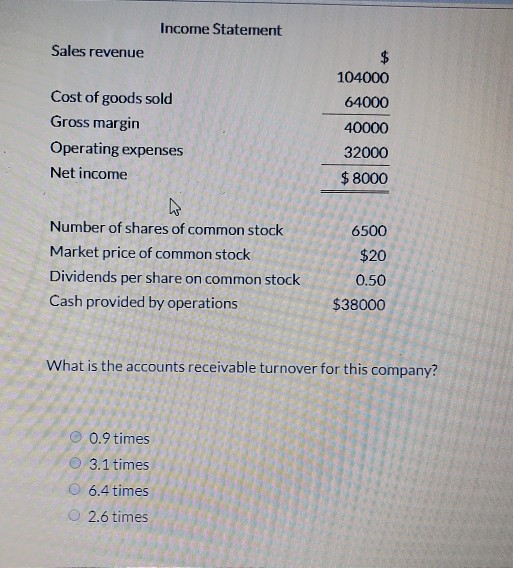

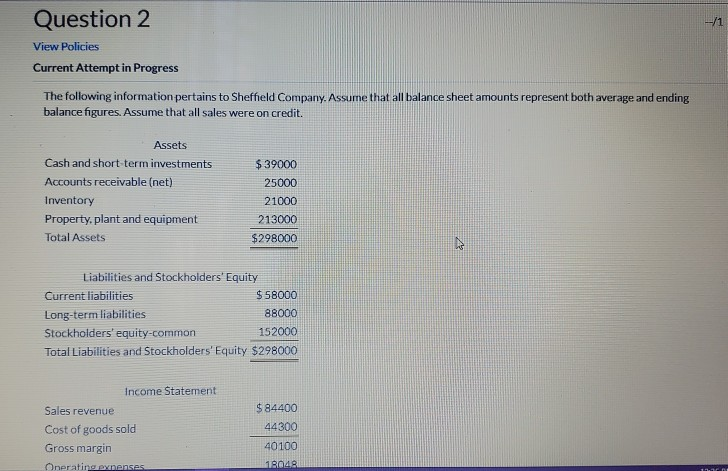

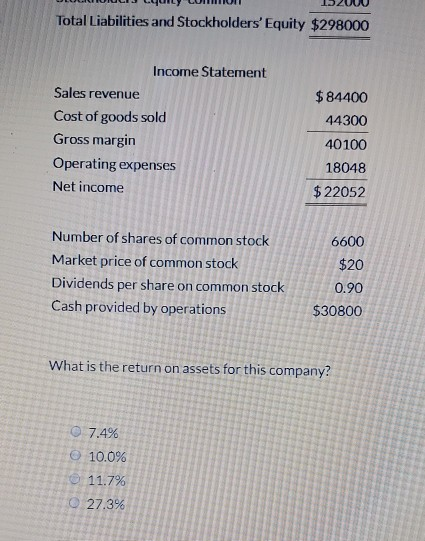

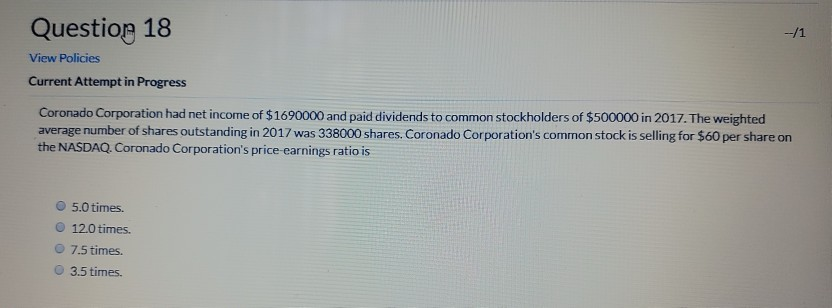

Question 1 View Policies Current Attempt in Progress The following information pertains to Marigold Company. Assume that all balance sheet amounts represent both average and ending balance figures. Assume that all sales were on credit. Assets Cash and short-ten investments Accounts receivable (net) Inventory Property, plant and equipment Total Assets $ 48000 40000 29000 203000 $320000 Liabilities and Stockholders' Equity Current liabilities $ 56000 Long-term liabilities 111000 Stockholders' equity-common 153000 Total Liabilities and Stockholders' Equity $320000 Income Statement Sales revenue Cost of goods sold Gross margin 104000 64000 40000 Income Statement Sales revenue Cost of goods sold Gross margin Operating expenses Net income 104000 64000 40000 32000 $ 8000 6500 Number of shares of common stock Market price of common stock Dividends per share on common stock Cash provided by operations $20 0.50 $38000 What is the accounts receivable turnover for this company? 0.9 times 3.1 times 6.4 times O 2.6 times Question 2 View Policies Current Attempt in Progress The following information pertains to Sheffield Company. Assume that all balance sheet amounts represent both average and ending balance figures. Assume that all sales were on credit. Assets Cash and short term investments Accounts receivable (net) Inventory Property, plant and equipment Total Assets $39000 25000 21000 213000 $298000 Liabilities and Stockholders' Equity Current liabilities $ 58000 Long-term liabilities 88000 Stockholders' equity-common 152000 Total Liabilities and Stockholders' Equity $298000 Income Statement Sales revenue Cost of goods sold Gross margin Onerating synenses $ 84400 44300 40100 18048 OLILIOIULIJ LOUIL CONTOH 1200 Total Liabilities and Stockholders' Equity $298000 Income Statement Sales revenue Cost of goods sold Gross margin Operating expenses Net income $84400 44300 40100 18048 $22052 Number of shares of common stock Market price of common stock Dividends per share on common stock Cash provided by operations 6600 $20 0.90 $30800 What is the return on assets for this company? 7.4% 10.0% 11.7% O 27.3% Question 18 --11 View Policies Current Attempt in Progress Coronado Corporation had net income of $1690000 and paid dividends to common stockholders of $500000 in 2017. The weighted average number of shares outstanding in 2017 was 338000 shares. Coronado Corporation's common stock is selling for $60 per share on the NASDAQ. Coronado Corporation's price earnings ratio is 5.0 times. 12.0 times 7.5 times. 3.5 times

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started