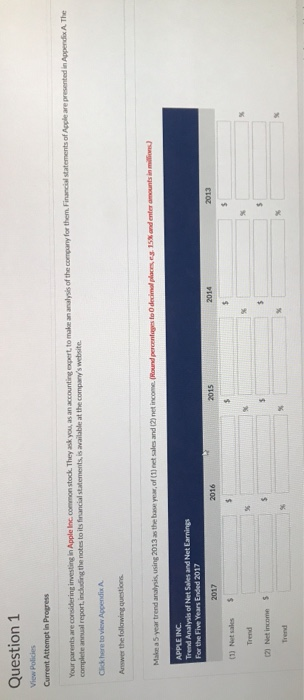

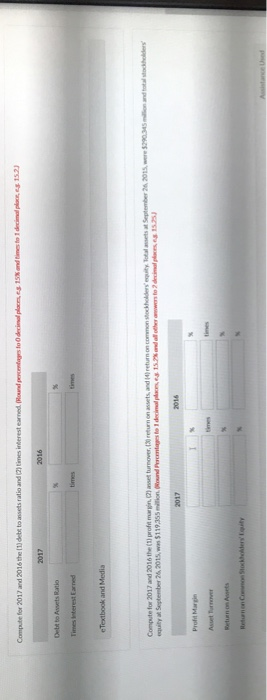

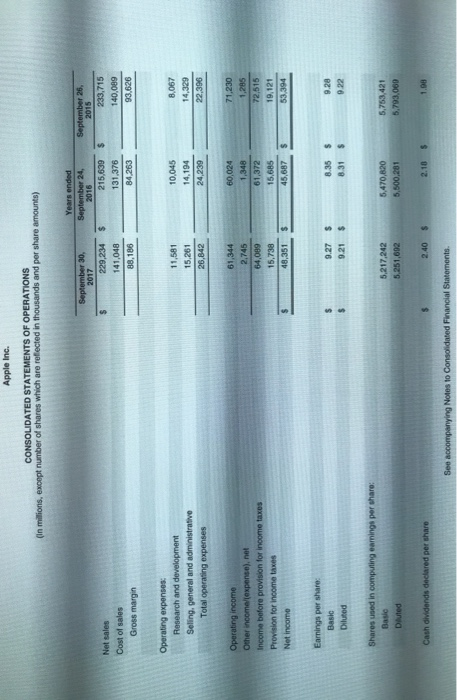

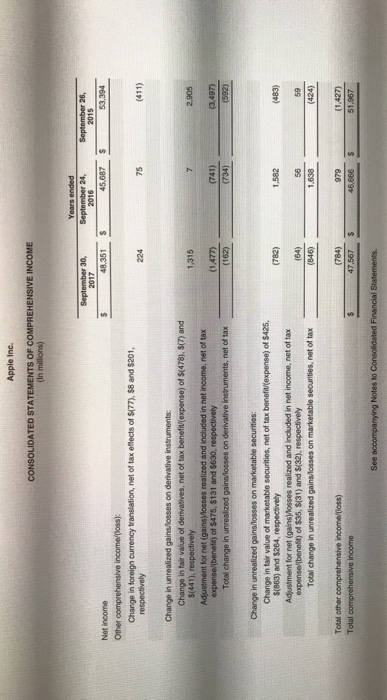

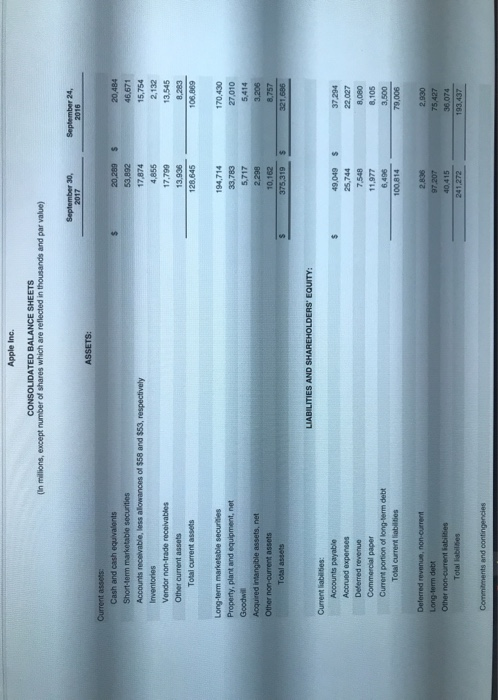

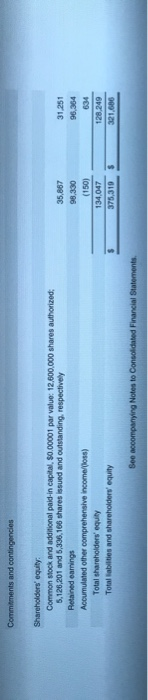

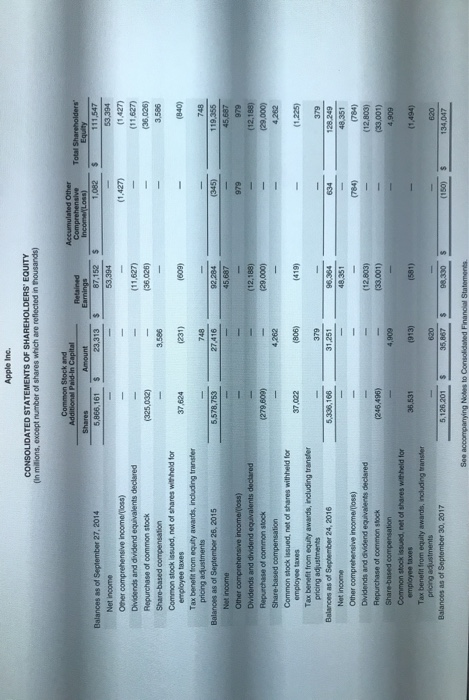

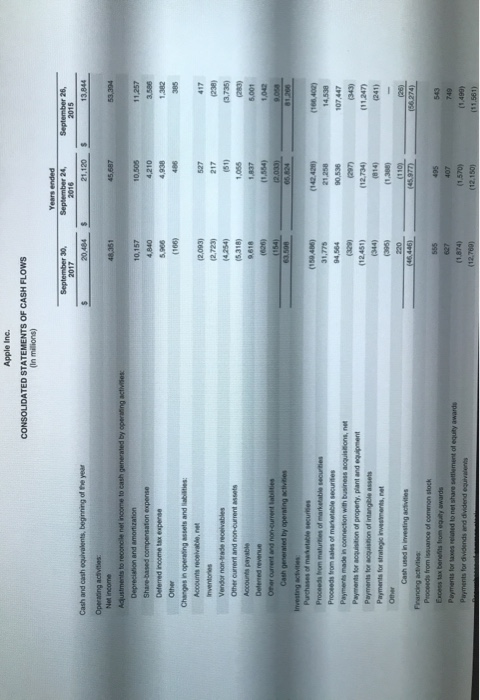

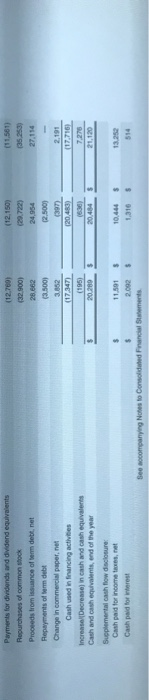

Question 1 View Policies Current Attempt in Progress Your parents are considering investing in Apple Inc. common stock. They ask you, as an accounting expert to make an analysis of the county for them. Financial statements of Apple are presented in Appendix A. The Complete annual report, inching the notes to its financial statements, is available at the company's website Click here to view Appendix Answer the following questions Make a 5 year trend analysis, using 2013 as the base yaw of (1) net sales and 12) net income. (Round percentages to decimal places 15% and enter amounts in mi APPLE INC. Trend Analysis of Net Sales and Net Earnings For the Five Years Ended 2017 2016 (1) Netsales Trend (2) Net income Compute for 2017 and 2016 the 11 debt to assets ratio and times interest earned. (Round pet s to deploy 15% and times to decimo . 152) Delitto Awets Ratio Timestest Earned e Textbook and Media 015. 290.345 Compute for 2017 and 2016 the profitar wity September 2015, was $119.355 milion turnover, (3return s, and e s to 1 decimal return on 15 d teholders este de September 2 15.25 d e Profit Margin Apple Inc. CONSOLIDATED STATEMENTS OF OPERATIONS (In millions, except number of shares which are reflected in thousands and per share amounts) September 30, Years ended September 24, 2016 215.639 $ $ 229,234 141,048 88,186 Net sales Cost of sales Gross margin September 26, 2015 233,715 140,089 93,626 131.376 84 263 Operating expenses Research and development Seling, general and administrative Total operating expenses 11,581 15.261 26,842 10.045 14.194 24,239 8,067 14.329 22,396 Operating income Other income (expense), net Income before provision for income taxes Provision for income taxes Net income 61,344 2,745 64,089 15.738 60,024 1,348 61,372 15,685 45,687 71,230 1,285 72,515 19.121 53394 49,351 $ Earnings per share Basic 9.28 9.27 9.21 $ $ 8.35 8.31 $ $ Diluted 9.22 Shares used in computing earnings per share: Basic Duted 5.217.242 5.251,692 5,470,620 5,500,281 5,753,421 5,793,060 Cash dividends declared per share 2.40 $ 2.18 $ 1.08 See accompanying Notes to Consolidated Financial Statements. Apple Inc. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (in millions) September 30. Years ended September 24, 2016 4 5.687 September 26, 2015 59.394 S 48,351 $ Net Income Other comprehensive income/loss): Change in foreign currency translation, net of tax effects of $177), $8 and $201. respectively 1,315 2,905 Change in unrealized gains/losses on derivative instruments: Change in fair value of derivatives, net of tax benefit (expense) of $(478). $(7) and $(441), respectively Adjustment for net gains losses realized and included in net income, net of tax expense benefit) of $475, $131 and $630, respectively Total change in unrealized gainslosses on derivative instruments, net of tax (741) (3.497) (592) (162) (782) Change in unrealized gains/losses on marketable securities: Change in fair value of marketable securities, net of tax benefit (expense) of $425 $(863) and $264, respectively Adjustment for not (gainsosses realized and included in net income, net of tax expense benefit of $35, S(31) and (32), respectively Total change in unrealized gainslosses on marketable securities, net of tax (424) Total other comprehensive income (loss) Total comprehensive income (784) 47,567 (1.427) 51.907 $ $ 46.666 S See accompanying Notes to Consolidated Financial Statements. Commitments and contingencies Shareholders' equity: Common stock and additional paid-in capital, S0.00001 par value: 12,000,000 shares authorized: 5.126.201 and 5,336,166 shares issued and outstanding, respectively Retained earings Accumulated other comprehensive income/loss) Total shareholders' equity Total abilities and shareholders' equity 35,887 98,330 31.251 96,364 634 128.249 321,686 134.047 375,319 See accompanying Notes to Consolidated Financial Statements Apple Inc. CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY (in millions, except number of shares which are reflected in thousands Common Stock and Additional Paid-In Capital Retained Accumulated Other Comprehensive Income Loss) 1,082 5,866,161 S 23,313 53 394 (1.427) Total Shareholders Equity $ 111,547 53,394 (1.427) (11,627) (36,026) 3,586 (11.627) (36 026) (325,002) 37,624 (609) 5,578,753 748 119.355 45,687 45.687 (12.188) (29,000 Balances as of September 27, 2014 Net income Other comprehensive income/loss) Dividends and dividend equivalents declared Repurchase of common stock Share-based compensation Common stock issued, net of shares withheld for employee taxes Tax benefit from equity awards, including transfer pricing adustments Balances as of September 26, 2015 Net income Other comprehensive income (loss) Dividends and dividend equivalents declared Repurchase of common stock Share-based compensation Common stock issued, net of shares withheld for employee taxes Tex benefit from equity awards, including transfer pricing adjustments Balances as of September 24, 2016 Net income Other comprehensive income/oss) Dividends and dividend equivalents declared Repurchase of common stock Share-based compensation Common stock issued, net of shares withheld for employee taxes Tax benefit from equity awards, including transfer pricing adjustments Balances as of September 30, 2017 (12,188) (29,000) 4.262 4262 37,022 (806) (419) (1.225) 379 5,336,166 96.354 48,351 379 128.249 48.351 (784) (12,803) (33,001) 4,909 (12.803) (33.001) (246,496) 4,909 35,531 (913) 620 134,017 5,126,201 $ 35,867 $ 98,330 See accompanying Notes to Consolidated Financial Statements Apple Inc. CONSOLIDATED STATEMENTS OF CASH FLOWS (In millions) Years ended September 24, September 26, September 30. 2017 20.484 $ $ 21.120 $ 13.844 48.351 45,687 53,394 10,157 4,840 10,505 4,210 Cash and cash equivalents, beginning of the year Operating activities Net income Adjustments to reconcile net income to cash generated by operating activities Depreciation and amortization Share-based compensation expense Deferred income tax expense Other Changes in operating assets and liabilities: Accounts receivable Inventories Vendor non- receivables Other current and non-current sets Accounts payable Defensed revenue 11,257 3.585 1,382 385 4,938 417 (2,093) (2.723) 527 217 (238) 1055 9.618 (626) 23 5,001 1,042 (1,554) (150.406) 31,775 (16.40 14.53 32 (297) (12.734) Cash generated by operating activities Investing activities Purchases of matewbe securities Proceeds from matures of marketable souris Proceeds from sales of marble securities Payments made in connection with business nogulsions, not Payments for quisition of property, plant and equipment Payments for ton of intangible assets Payments for strategic investments, net Other Cash used in investing activities Financing activities Proceeds from issuance of common stock Excess tax benefits from egy awards Payments for taxes related to not share settlement of equity awards Payments for dividends and dividend equivalent 344 146,446) (56.274) 566 749 (1.570 (12.150) (12.780) (11,581) (12.150) (11,561) (12.789) (32.900) 27.114 Payments for dividends and dividend equivalents Repurchases of common stock Proceeds from issuance of term debt.net Repayments of a debt Change in commercial paper.net Cash used in financing activities Increase Decrease in cash and cash equivalents Cash and cash equivalents, and of the year 24,954 2,500) 500 3.352 (17.347) 7 278 20.484 Supplemental cash flow disclosure Cash paid for income , net Cash paid for W rest 11.591 See companying Notes to considered Financial Statements