Answered step by step

Verified Expert Solution

Question

1 Approved Answer

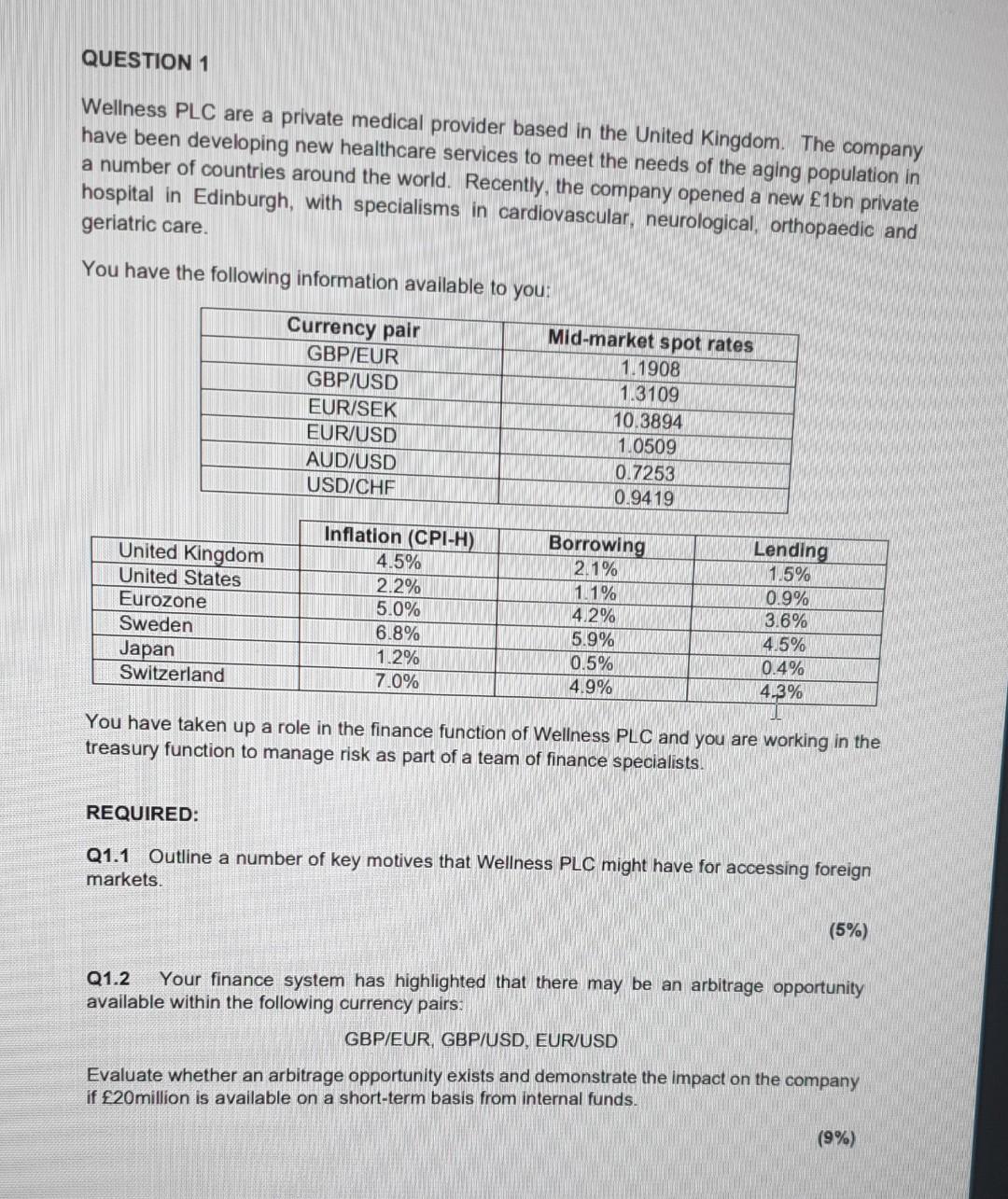

QUESTION 1 Wellness PLC are a private medical provider based in the United Kingdom. The company have been developing new healthcare services to meet the

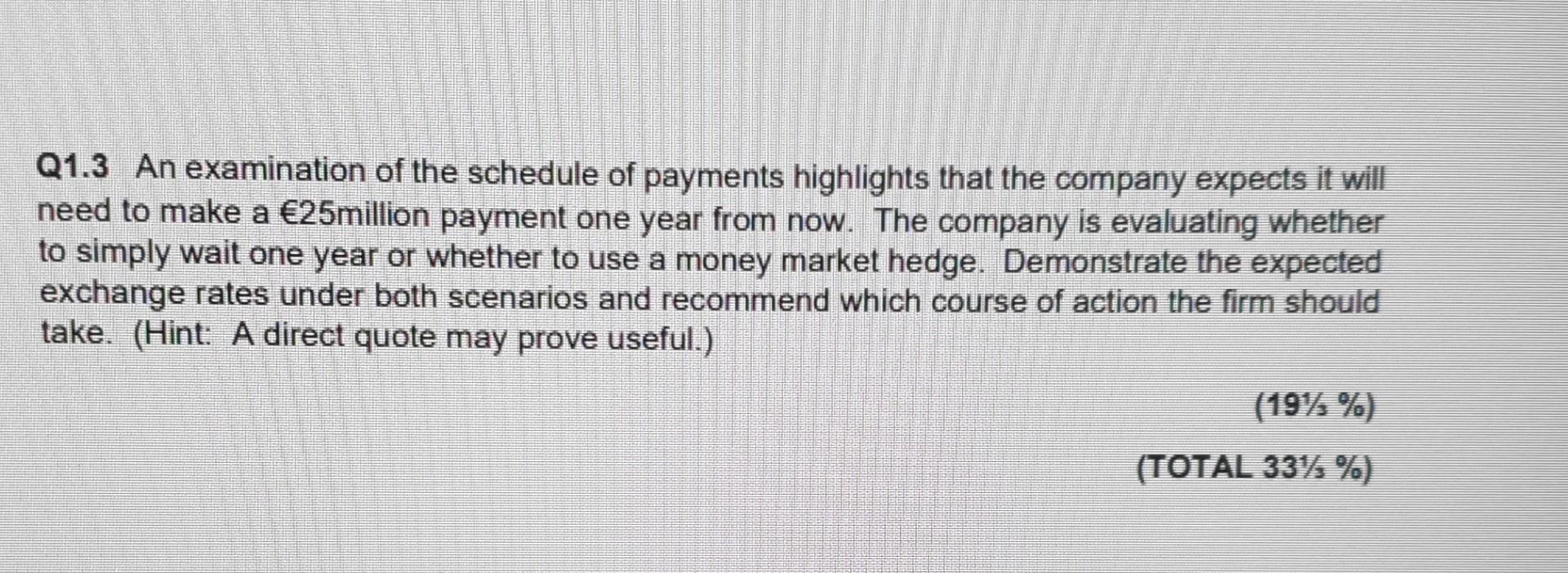

QUESTION 1 Wellness PLC are a private medical provider based in the United Kingdom. The company have been developing new healthcare services to meet the needs of the aging population in a number of countries around the world. Recently, the company opened a new 1bn private hospital in Edinburgh, with specialisms in cardiovascular, neurological, orthopaedic and geriatric care. You have the following information available to you: Currency pair GBP/EUR GBP/USD EUR/SEK EUR/USD AUD/USD USD/CHF Mid-market spot rates 1.1908 1.3109 10.3894 1.0509 0.7253 0.9419 Www United Kingdom United States Eurozone Sweden Japan Switzerland Inflation (CPI-H) 4.5% 2.2% 5.0% 6.8% 1.2% 7.0% Borrowing 2.1% 1.1% 4.2% 5.9% 0.5% 4.9% Lending 1.5% 0.9% 3.6% 4.5% 0.4% 4.3% You have taken up a role in the finance function of Wellness PLC and you are working in the treasury function to manage risk as part of a team of finance specialists. REQUIRED: Q1.1 Outline a number of key motives that Wellness PLC might have for accessing foreign markets. (5%) Q1.2 Your finance system has highlighted that there may be an arbitrage opportunity available within the following currency pairs. GBP/EUR GBP/USD, EUR/USD Evaluate whether an arbitrage opportunity exists and demonstrate the impact on the company if 20million is available on a short-term basis from Internal funds. (9%) Q1.3 An examination of the schedule of payments highlights that the company expects it will need to make a 25million payment one year from now. The company is evaluating whether to simply wait one year or whether to use a money market hedge. Demonstrate the expected exchange rates under both scenarios and recommend which course of action the firm should take. (Hint: A direct quote may prove useful.) (19% %) (TOTAL 33% %) QUESTION 1 Wellness PLC are a private medical provider based in the United Kingdom. The company have been developing new healthcare services to meet the needs of the aging population in a number of countries around the world. Recently, the company opened a new 1bn private hospital in Edinburgh, with specialisms in cardiovascular, neurological, orthopaedic and geriatric care. You have the following information available to you: Currency pair GBP/EUR GBP/USD EUR/SEK EUR/USD AUD/USD USD/CHF Mid-market spot rates 1.1908 1.3109 10.3894 1.0509 0.7253 0.9419 Www United Kingdom United States Eurozone Sweden Japan Switzerland Inflation (CPI-H) 4.5% 2.2% 5.0% 6.8% 1.2% 7.0% Borrowing 2.1% 1.1% 4.2% 5.9% 0.5% 4.9% Lending 1.5% 0.9% 3.6% 4.5% 0.4% 4.3% You have taken up a role in the finance function of Wellness PLC and you are working in the treasury function to manage risk as part of a team of finance specialists. REQUIRED: Q1.1 Outline a number of key motives that Wellness PLC might have for accessing foreign markets. (5%) Q1.2 Your finance system has highlighted that there may be an arbitrage opportunity available within the following currency pairs. GBP/EUR GBP/USD, EUR/USD Evaluate whether an arbitrage opportunity exists and demonstrate the impact on the company if 20million is available on a short-term basis from Internal funds. (9%) Q1.3 An examination of the schedule of payments highlights that the company expects it will need to make a 25million payment one year from now. The company is evaluating whether to simply wait one year or whether to use a money market hedge. Demonstrate the expected exchange rates under both scenarios and recommend which course of action the firm should take. (Hint: A direct quote may prove useful.) (19% %) (TOTAL 33% %)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started