Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 What is a company's primary shortcoming in terms of its legitimacy as a corporate entity? a) The owners lack confidentiality because regulations oblige

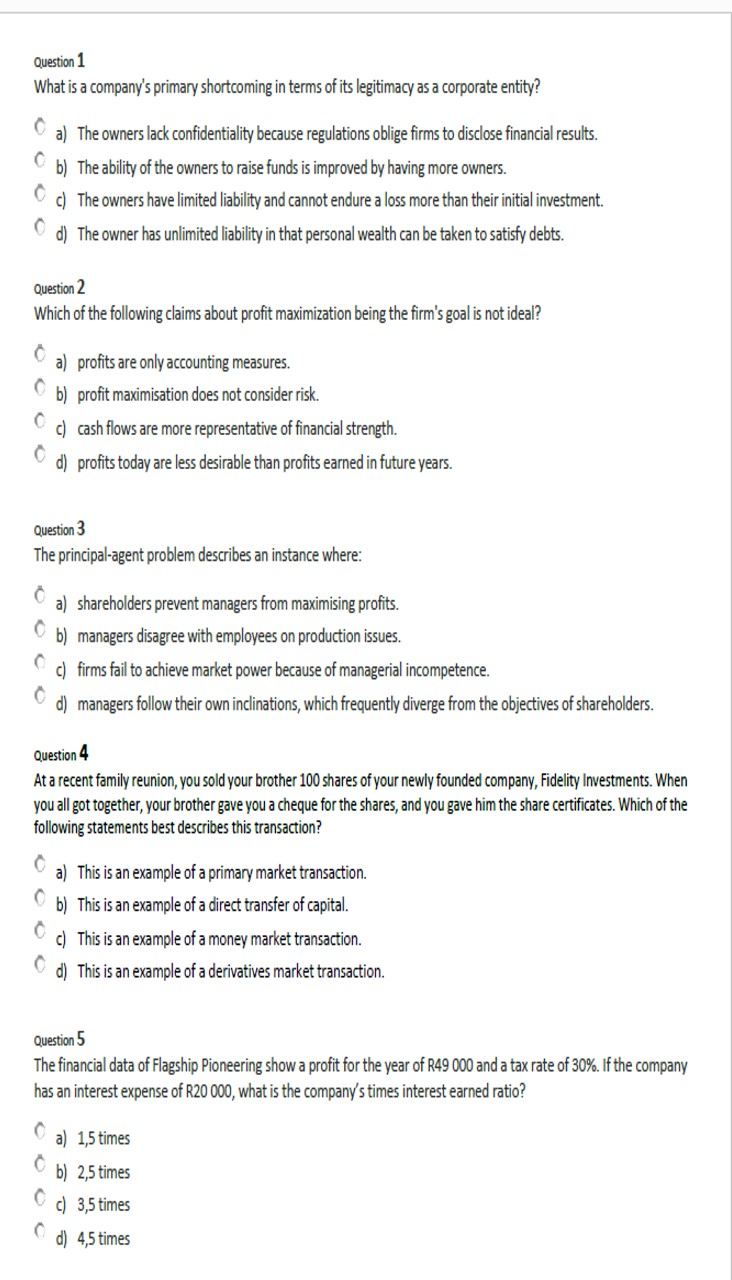

Question 1 What is a company's primary shortcoming in terms of its legitimacy as a corporate entity? a) The owners lack confidentiality because regulations oblige firms to disclose financial results. b) The ability of the owners to raise funds is improved by having more owners. c) The owners have limited liability and cannot endure a loss more than their initial investment. d) The owner has unlimited liability in that personal wealth can be taken to satisfy debts. Question 2 Which of the following claims about profit maximization being the firm's goal is not ideal? a) profits are only accounting measures. b) profit maximisation does not consider risk. c) cash flows are more representative of financial strength. d) profits today are less desirable than profits earned in future years. Question 3 The principal-agent problem describes an instance where: a) shareholders prevent managers from maximising profits. b) managers disagree with employees on production issues. c) firms fail to achieve market power because of managerial incompetence. d) managers follow their own inclinations, which frequently diverge from the objectives of shareholders. Question 4 At a recent family reunion, you sold your brother 100 shares of your newly founded company, Fidelity Investments. When you all got together, your brother gave you a cheque for the shares, and you gave him the share certificates. Which of the following statements best describes this transaction? a) This is an example of a primary market transaction. b) This is an example of a direct transfer of capital. c) This is an example of a money market transaction. d) This is an example of a derivatives market transaction. Question 5 The financial data of Flagship Pioneering show a profit for the year of R49 000 and a tax rate of 30%. If the company has an interest expense of R20000, what is the company's times interest earned ratio? a) 1,5 times b) 2,5 times c) 3,5 times d) 4,5 times

Question 1 What is a company's primary shortcoming in terms of its legitimacy as a corporate entity? a) The owners lack confidentiality because regulations oblige firms to disclose financial results. b) The ability of the owners to raise funds is improved by having more owners. c) The owners have limited liability and cannot endure a loss more than their initial investment. d) The owner has unlimited liability in that personal wealth can be taken to satisfy debts. Question 2 Which of the following claims about profit maximization being the firm's goal is not ideal? a) profits are only accounting measures. b) profit maximisation does not consider risk. c) cash flows are more representative of financial strength. d) profits today are less desirable than profits earned in future years. Question 3 The principal-agent problem describes an instance where: a) shareholders prevent managers from maximising profits. b) managers disagree with employees on production issues. c) firms fail to achieve market power because of managerial incompetence. d) managers follow their own inclinations, which frequently diverge from the objectives of shareholders. Question 4 At a recent family reunion, you sold your brother 100 shares of your newly founded company, Fidelity Investments. When you all got together, your brother gave you a cheque for the shares, and you gave him the share certificates. Which of the following statements best describes this transaction? a) This is an example of a primary market transaction. b) This is an example of a direct transfer of capital. c) This is an example of a money market transaction. d) This is an example of a derivatives market transaction. Question 5 The financial data of Flagship Pioneering show a profit for the year of R49 000 and a tax rate of 30%. If the company has an interest expense of R20000, what is the company's times interest earned ratio? a) 1,5 times b) 2,5 times c) 3,5 times d) 4,5 times Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started