Question

Question 1: What is the cost of equity for Sind Abadgar under each option? Question 2: What is the after-tax cost of debt for Sind

Question 1: What is the cost of equity for Sind Abadgar under each option?

Question 2: What is the after-tax cost of debt for Sind Abadgar under each option? Question 3: What is the cost of capital for Sind Abadgar under each option? Question 4: What would happen to (a) the value of the firm; (b) the value of debt and equity; and (c) the stock price under each option, assuming Pakistani stockholders and investors are rational?] Question 5: From perspective of cost of capital, which of the three options would you pick, or would you stay at current capital structure of Sind Abadgar? Question 6: What role would the variability in Sind Abadgar's income play in your recommendation to the CEO? Question7: Would your analysis change if the money under the three options listed above were used to take new investments (instead of repurchasing debt or equity)? Question 8: Intuitively, why doesnt the higher rating in the first option translate into a lower cost of capital? Have you made a mistake? If yes then what should you have done instead?

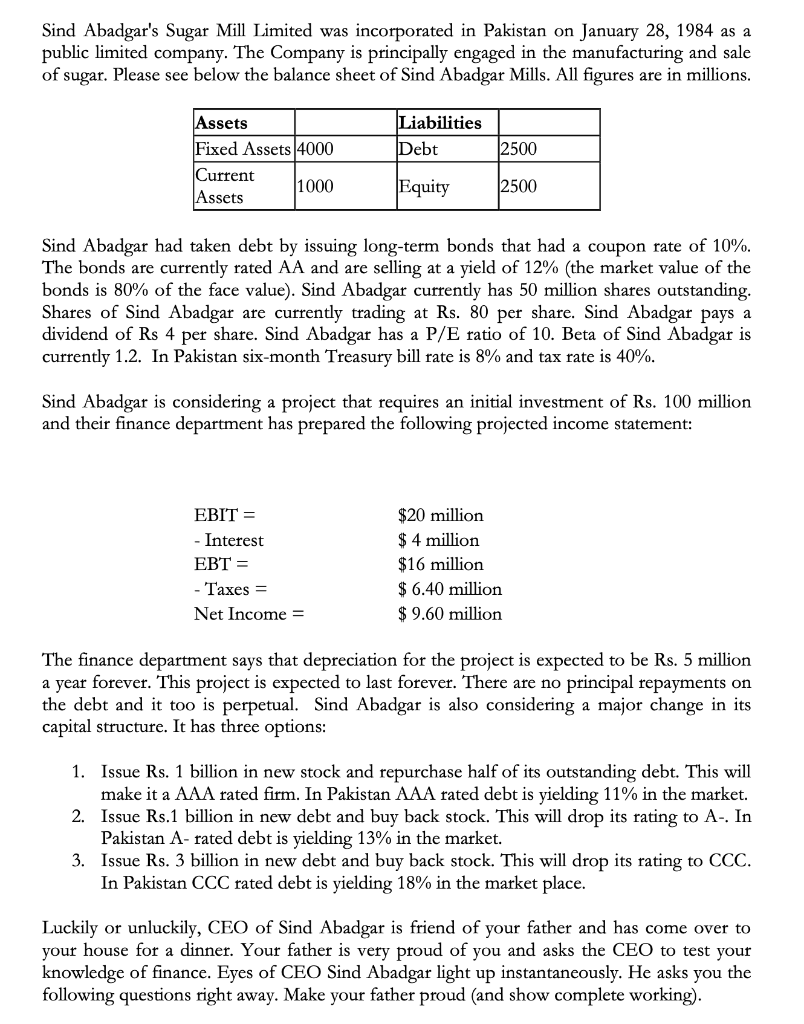

Sind Abadgar's Sugar Mill Limited was incorporated in Pakistan on January 28, 1984 as a public limited company. The Company is principally engaged in the manufacturing and sale of sugar. Please see below the balance sheet of Sind Abadgar Mills. All figures are in millions. Liabilities Debt 2500 Assets Fixed Assets 4000 Current 1000 Assets Equity 2500 Sind Abadgar had taken debt by issuing long-term bonds that had a coupon rate of 10%. The bonds are currently rated AA and are selling at a yield of 12% (the market value of the bonds is 80% of the face value). Sind Abadgar currently has 50 million shares outstanding. Shares of Sind Abadgar are currently trading at Rs. 80 per share. Sind Abadgar pays a dividend of Rs 4 per share. Sind Abadgar has a P/E ratio of 10. Beta of Sind Abadgar is currently 1.2. In Pakistan six- month Treasury bill rate is 8% and tax rate is 40%. Sind Abadgar is considering a project that requires an initial investment of Rs. 100 million and their finance department has prepared the following projected income statement: EBIT = - Interest EBT = - Taxes = Net Income = $20 million $ 4 million $16 million $ 6.40 million $ 9.60 million The finance department says that depreciation for the project is expected to be Rs. 5 million a year forever. This project is expected to last forever. There are no principal repayments on the debt and it too is perpetual. Sind Abadgar is also considering a major change in its capital structure. It has three options: 1. Issue Rs. 1 billion in new stock and repurchase half of its outstanding debt. This will make it a AAA rated firm. In Pakistan AAA rated debt is yielding 11% in the market. 2. Issue Rs.1 billion in new debt and buy back stock. This will drop its rating to A-. In Pakistan A-rated debt is yielding 13% in the market. 3. Issue Rs. 3 billion in new debt and buy back stock. This will drop its rating to CCC. In Pakistan CCC rated debt is yielding 18% in the market place. Luckily or unluckily, CEO of Sind Abadgar is friend of your father and has come over to your house for a dinner. Your father is very proud of you and asks the CEO to test your knowledge of finance. Eyes of CEO Sind Abadgar light up instantaneously. He asks you the following questions right away. Make your father proud (and show complete working). Sind Abadgar's Sugar Mill Limited was incorporated in Pakistan on January 28, 1984 as a public limited company. The Company is principally engaged in the manufacturing and sale of sugar. Please see below the balance sheet of Sind Abadgar Mills. All figures are in millions. Liabilities Debt 2500 Assets Fixed Assets 4000 Current 1000 Assets Equity 2500 Sind Abadgar had taken debt by issuing long-term bonds that had a coupon rate of 10%. The bonds are currently rated AA and are selling at a yield of 12% (the market value of the bonds is 80% of the face value). Sind Abadgar currently has 50 million shares outstanding. Shares of Sind Abadgar are currently trading at Rs. 80 per share. Sind Abadgar pays a dividend of Rs 4 per share. Sind Abadgar has a P/E ratio of 10. Beta of Sind Abadgar is currently 1.2. In Pakistan six- month Treasury bill rate is 8% and tax rate is 40%. Sind Abadgar is considering a project that requires an initial investment of Rs. 100 million and their finance department has prepared the following projected income statement: EBIT = - Interest EBT = - Taxes = Net Income = $20 million $ 4 million $16 million $ 6.40 million $ 9.60 million The finance department says that depreciation for the project is expected to be Rs. 5 million a year forever. This project is expected to last forever. There are no principal repayments on the debt and it too is perpetual. Sind Abadgar is also considering a major change in its capital structure. It has three options: 1. Issue Rs. 1 billion in new stock and repurchase half of its outstanding debt. This will make it a AAA rated firm. In Pakistan AAA rated debt is yielding 11% in the market. 2. Issue Rs.1 billion in new debt and buy back stock. This will drop its rating to A-. In Pakistan A-rated debt is yielding 13% in the market. 3. Issue Rs. 3 billion in new debt and buy back stock. This will drop its rating to CCC. In Pakistan CCC rated debt is yielding 18% in the market place. Luckily or unluckily, CEO of Sind Abadgar is friend of your father and has come over to your house for a dinner. Your father is very proud of you and asks the CEO to test your knowledge of finance. Eyes of CEO Sind Abadgar light up instantaneously. He asks you the following questions right away. Make your father proud (and show complete working)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started