Question

Question 1: What was the bonds issue price? (Round PV factor to 4 decimal places. Round the final answer to the nearest whole dollar.) Question

Question 1: What was the bonds issue price? (Round "PV factor" to 4 decimal places. Round the final answer to the nearest whole dollar.)

Question 2-a: Did the bond sell at a discount or a premium?

Question 2-b: How much was the premium or discount?

Question 3: What amount of cash was paid each year for bond interest?

Question 4: What amount of interest expense should be shown in Year 1, Year 2 and Year 3 on the statement of earnings? (Round "PV factor" to 4 decimal places. Round the final answers to the nearest whole dollar.)

Question 5: What amount(s) should be shown on the statement of financial position for bonds payable at each year-end (Year 1, Year 2, Year 3)? (For year 3, show the balance just before repayment of the bond.) (Round "PV factor" to 4 decimal places. Round the final answers to the nearest whole dollar.)

Question 6: What method of amortization was used? (Effective-interest amortization or Straight-line amortization)

Question 7: Did the company use the preferred method of amortization? (Yes or No)

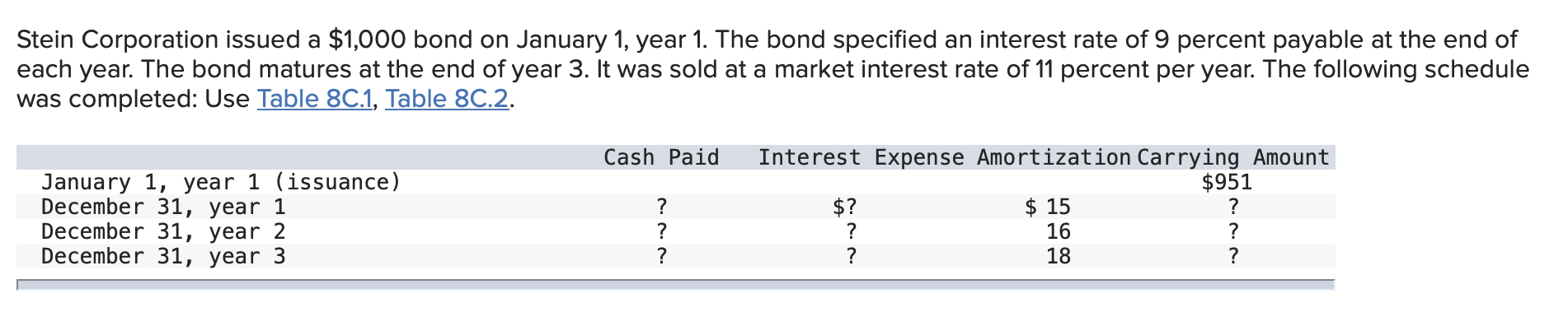

Stein Corporation issued a $1,000 bond on January 1, year 1 . The bond specified an interest rate of 9 percent payable at the end of each year. The bond matures at the end of year 3. It was sold at a market interest rate of 11 percent per year. The following schedule was completed: Use Table 8C.1, Table 8C.2Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started