Question

Question 1 Which one of the following statements concerning a sole proprietorship is correct Question 2 One disadvantage of the corporate form of business ownership

Question 1

Which one of the following statements concerning a sole proprietorship is correct

Question 2

One disadvantage of the corporate form of business ownership is the

Question 3

The income of a sole proprietor is taxed at a rate which is higher than the tax rate of a corporation

Question 4

Which one of the following statements is correct?

Question 5

Who are the owners of a corporation?

Question 6

Shareholder A sold shares of Maplewood Cabinets stock to Shareholder B. The stock is listed on the NYSE. This trade occurred in which one of the following?

Question 7

Which of the following legal forms of organization is most expensive to organize?

Question 8

What do you understand by the term agency problem (agency issue)

Question 9

The primary goal of the financial manager is

Question 10

A very effective way to motivate management is to

Question 11

Company ABC has sold its power plant for $950,000 in 2018. They bought this plant in 2011 for $250,000. Which of the following best describes this?

Question 12

The board of directors are elected by

Question 14

In an efficient market

Question 15

A firm has a Times Interest Earned of 12. Which of the following describes this situation best?

Question 16

Which of the following is NOT a financial institution?

Question 17

As a common shareholder which of the following statements is correct

Question 18

What do you understand by limited liability?

Question 19

The total accounts receivables of Tesla were $45,000 in 2017. They are $54,000 in 2018. Which of the following describes this change?

Question 21

A certain project costs $1,000,000 up front, but after that it will generate net cash inflows each year (in perpetuity) of $120,000. The cost of capital is 10%. Calculate the Economic Value Added (EVA) and NPV for the project.

Question 22

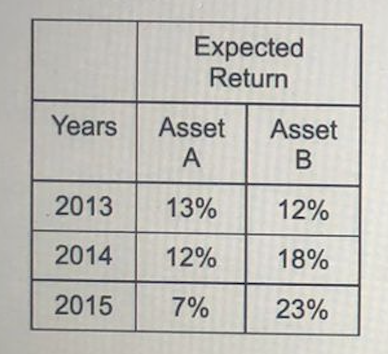

You have been asked for your advice in selecting a portfolio of assets and have been given the following data:

You have been told that you can create a portfolio by investing 40% in Asset A and 60% in Asset B.

- What is the expected return for the portfolio?

- What is the standard deviation for the portfolio?

Question 23

Chanel Inc. has asked you to measure the cost of each specific type of capital as well as the weighted average cost of capital. The weighted average cost is to be measured by using the following weights: 20% long-term debt, 40% preferred stock, and 40% common stock equity (retained earnings, new common stock, or both). The firm's tax rate is 35%.

Debt: The firm can sell for $900 a 10-year, $1,000-par-value bond paying annual interest at a 10% coupon rate. A flotation cost of $25 is required for the bonds.

Preferred stock: Preferred stock can be sold for $90. An additional fee of $5 per share must be paid to the underwriters. The preferred stock gives dividends of $9

Common stock: The firm's common stock is currently selling for $50 per share. Dividends are expected to grow at 3% and the dividend (D1) expected to be paid at the end of the coming year (2021) is $5.

- Calculate the after-tax cost of debt.

- Calculate the cost of preferred stock.

- Calculate the cost of common stock.

- Calculate the WACC.

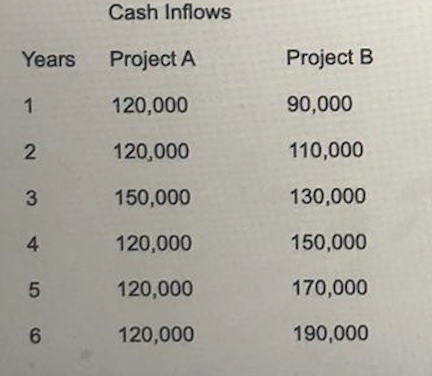

Question 24

A firm is considering two projects, each with an initial investment of $500,000. The company's board of directors has set a maximum 3-year payback requirement. The cash inflows associated with the two projects are shown in the following table. The cost of capital is 12%

- Calculate the payback period for each project. Which project will you choose using this capital budgeting technique, if they are mutually exclusive? Which project will you choose if they are independent? Why?

- Calculate the NPV of each project. Which project will you choose using this capital budgeting technique, if they are mutually exclusive? Which project will you choose if they are independent? Why?

- Derive the IRR of each project. Which project will you choose using this capital budgeting technique, if they are mutually exclusive? Which project will you choose if they are independent? Why?

- Calculate the Profitability Index of each project. Which project will you choose using this capital budgeting technique, if they are mutually exclusive? Which project will you choose if they are independent? Why?

- Which project will you choose overall if they are mutually exclusive?

\begin{tabular}{|c|c|c|} \hline & \multicolumn{2}{|c|}{\begin{tabular}{c} Expected \\ Return \end{tabular}} \\ \hline Years & \begin{tabular}{c} Asset \\ A \end{tabular} & \begin{tabular}{c} Asset \\ B \end{tabular} \\ \hline 2013 & 13% & 12% \\ \hline 2014 & 12% & 18% \\ \hline 2015 & 7% & 23% \\ \hline \end{tabular} Cash Inflows \begin{tabular}{lll} Years & Project A & Project B \\ 1 & 120,000 & 90,000 \\ 2 & 120,000 & 110,000 \\ 3 & 150,000 & 130,000 \\ 4 & 120,000 & 150,000 \\ 5 & 120,000 & 170,000 \\ 6 & 120,000 & 190,000 \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started