Answered step by step

Verified Expert Solution

Question

1 Approved Answer

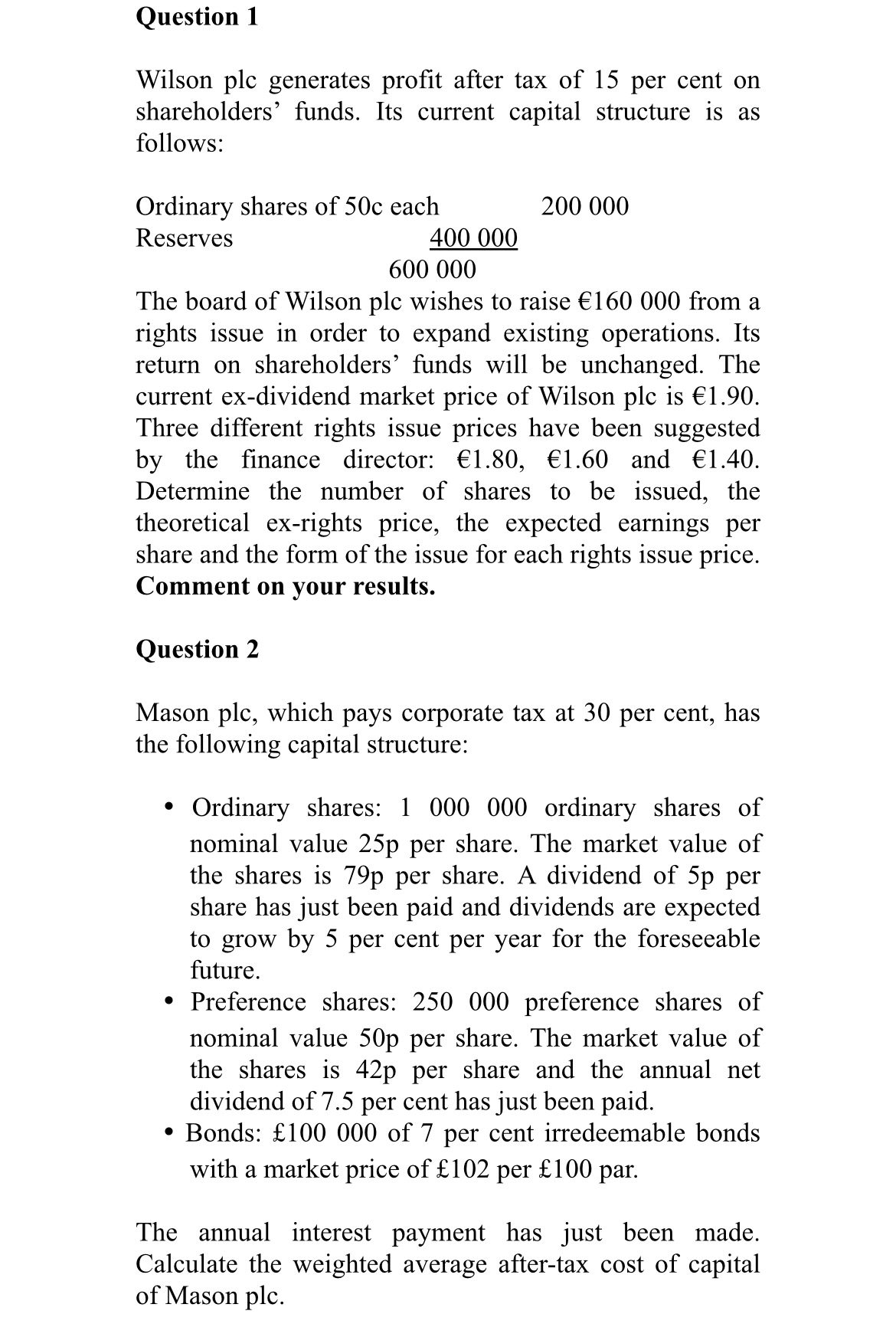

Question 1 Wilson plc generates profit after tax of 1 5 per cent on shareholders' funds. Its current capital structure is as follows: Ordinary shares

Question

Wilson plc generates profit after tax of per cent on shareholders' funds. Its current capital structure is as follows:

Ordinary shares of c each

Reserves

The board of Wilson plc wishes to raise from a rights issue in order to expand existing operations. Its return on shareholders' funds will be unchanged. The current exdividend market price of Wilson plc is Three different rights issue prices have been suggested by the finance director: and Determine the number of shares to be issued, the theoretical exrights price, the expected earnings per share and the form of the issue for each rights issue price. Comment on your results.

Question

Mason plc which pays corporate tax at per cent, has the following capital structure:

Ordinary shares: ordinary shares of nominal value p per share. The market value of the shares is p per share. A dividend of p per share has just been paid and dividends are expected to grow by per cent per year for the foreseeable future.

Preference shares: preference shares of nominal value p per share. The market value of the shares is p per share and the annual net dividend of per cent has just been paid.

Bonds: of per cent irredeemable bonds with a market price of per par.

The annual interest payment has just been made. Calculate the weighted average aftertax cost of capital of Mason plc

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started