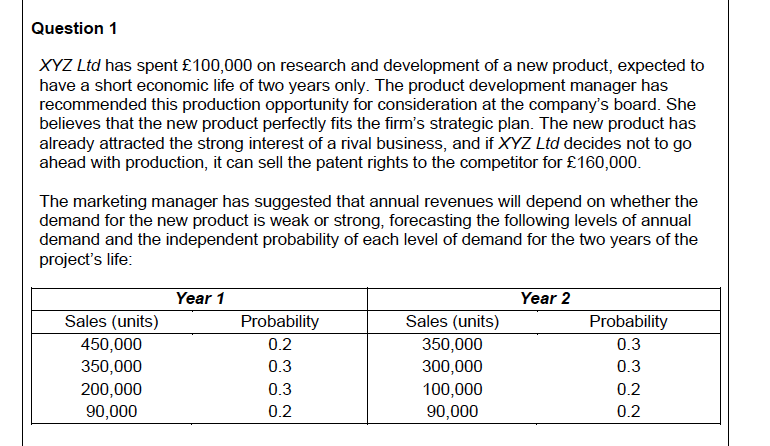

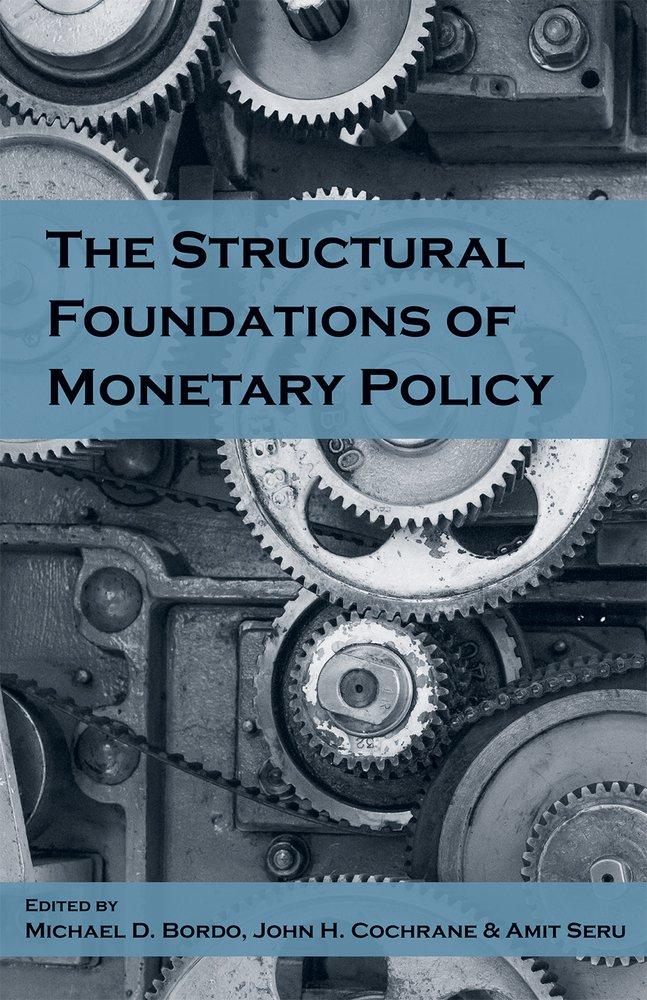

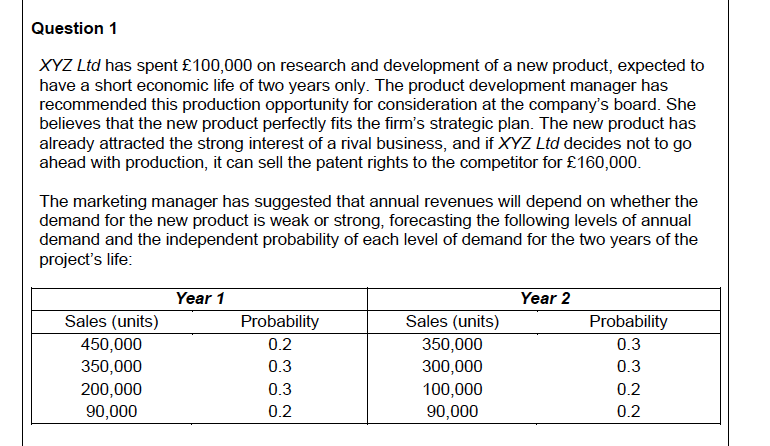

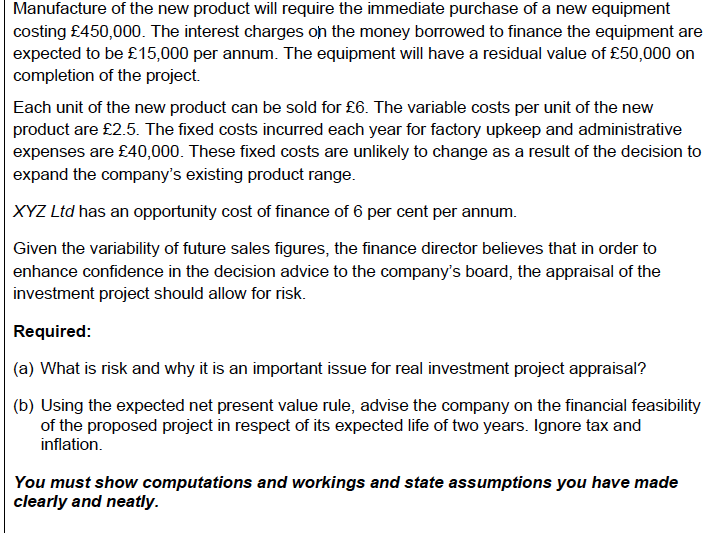

Question 1 XYZ Ltd has spent 100,000 on research and development of a new product, expected to have a short economic life of two years only. The product development manager has recommended this production opportunity for consideration at the company's board. She believes that the new product perfectly fits the firm's strategic plan. The new product has already attracted the strong interest of a rival business, and if XYZ Ltd decides not to go ahead with production, it can sell the patent rights to the competitor for 160,000. The marketing manager has suggested that annual revenues will depend on whether the demand for the new product is weak or strong, forecasting the following levels of annual demand and the independent probability of each level of demand for the two years of the project's life: Year 2 Sales (units) 450,000 350,000 200,000 90,000 Year 1 Probability 0.2 0.3 0.3 0.2 Sales (units) 350,000 300,000 100,000 90,000 Probability 0.3 0.3 0.2 0.2 Manufacture of the new product will require the immediate purchase of a new equipment costing 450,000. The interest charges on the money borrowed to finance the equipment are expected to be 15,000 per annum. The equipment will have a residual value of 50,000 on completion of the project. Each unit of the new product can be sold for 6. The variable costs per unit of the new product are 2.5. The fixed costs incurred each year for factory upkeep and administrative expenses are 40,000. These fixed costs are unlikely to change as a result of the decision to expand the company's existing product range. XYZ Ltd has an opportunity cost of finance of 6 per cent per annum. Given the variability of future sales figures, the finance director believes that in order to enhance confidence in the decision advice to the company's board, the appraisal of the investment project should allow for risk. Required: (a) What is risk and why it is an important issue for real investment project appraisal? (b) Using the expected net present value rule, advise the company on the financial feasibility of the proposed project in respect of its expected life of two years. Ignore tax and inflation. You must show computations and workings and state assumptions you have made clearly and neatly. Question 1 XYZ Ltd has spent 100,000 on research and development of a new product, expected to have a short economic life of two years only. The product development manager has recommended this production opportunity for consideration at the company's board. She believes that the new product perfectly fits the firm's strategic plan. The new product has already attracted the strong interest of a rival business, and if XYZ Ltd decides not to go ahead with production, it can sell the patent rights to the competitor for 160,000. The marketing manager has suggested that annual revenues will depend on whether the demand for the new product is weak or strong, forecasting the following levels of annual demand and the independent probability of each level of demand for the two years of the project's life: Year 2 Sales (units) 450,000 350,000 200,000 90,000 Year 1 Probability 0.2 0.3 0.3 0.2 Sales (units) 350,000 300,000 100,000 90,000 Probability 0.3 0.3 0.2 0.2 Manufacture of the new product will require the immediate purchase of a new equipment costing 450,000. The interest charges on the money borrowed to finance the equipment are expected to be 15,000 per annum. The equipment will have a residual value of 50,000 on completion of the project. Each unit of the new product can be sold for 6. The variable costs per unit of the new product are 2.5. The fixed costs incurred each year for factory upkeep and administrative expenses are 40,000. These fixed costs are unlikely to change as a result of the decision to expand the company's existing product range. XYZ Ltd has an opportunity cost of finance of 6 per cent per annum. Given the variability of future sales figures, the finance director believes that in order to enhance confidence in the decision advice to the company's board, the appraisal of the investment project should allow for risk. Required: (a) What is risk and why it is an important issue for real investment project appraisal? (b) Using the expected net present value rule, advise the company on the financial feasibility of the proposed project in respect of its expected life of two years. Ignore tax and inflation. You must show computations and workings and state assumptions you have made clearly and neatly