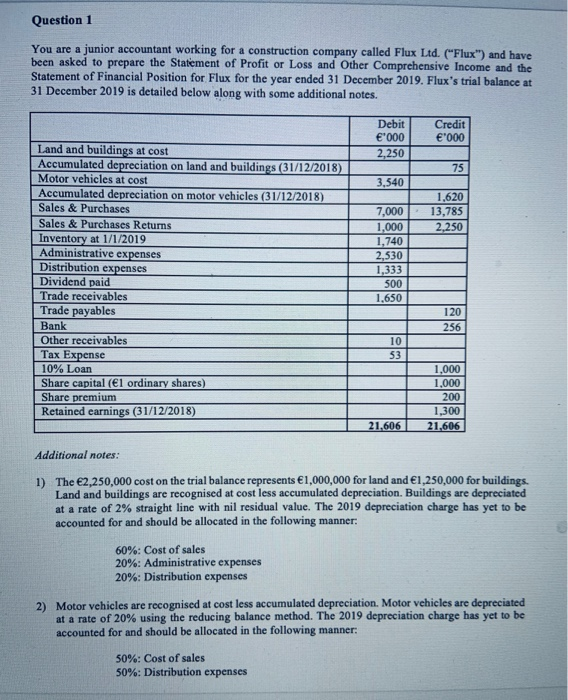

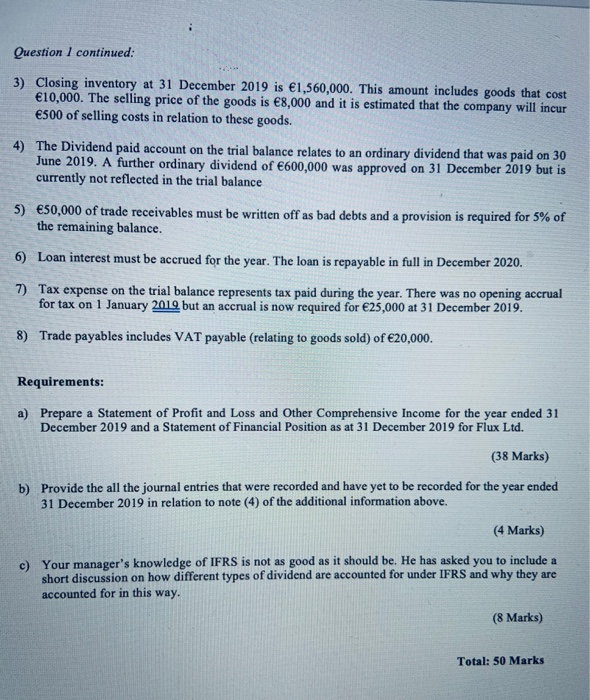

Question 1 You are a junior accountant working for a construction company called Flux Ltd. ("Flux") and have been asked to prepare the Statement of Profit or Loss and Other Comprehensive Income and the Statement of Financial Position for Flux for the year ended 31 December 2019. Flux's trial balance at 31 December 2019 is detailed below along with some additional notes. Debit 000 2,250 Credit E'000 75 3.540 1.620 13,785 2.250 Land and buildings at cost Accumulated depreciation on land and buildings (31/12/2018) Motor vehicles at cost Accumulated depreciation on motor vehicles (31/12/2018) 2010) Sales & Purchases Sales & Purchases Returns Inventory at 1/1/2019 Administrative expenses Distribution expenses Dividend paid Trade receivables Trade payables Bank Other receivables Tax Expense 10% Loan Share capital (El ordinary shares) Share premium Retained earnings (31/12/2018) 7,000 1,000 1,740 2,530 1,333 500 1.650 120 L 10 53 1.000 1.000 200 1,300 21.606 21.606 Additional notes: 1) The 2,250,000 cost on the trial balance represents 1,000,000 for land and 1,250,000 for buildings Land and buildings are recognised at cost less accumulated depreciation. Buildings are depreciated at a rate of 2% straight line with nil residual value. The 2019 depreciation charge has yet to be accounted for and should be allocated in the following manner: 60%: Cost of sales 20%: Administrative expenses 20%: Distribution expenses 2) Motor vehicles are recognised at cost less accumulated depreciation. Motor vehicles are depreciated at a rate of 20% using the reducing balance method. The 2019 depreciation charge has yet to be accounted for and should be allocated in the following manner: 50%: Cost of sales 50%: Distribution expenses Question I continued: 3) Closing inventory at 31 December 2019 is 1,560,000. This amount includes goods that cost 10,000. The selling price of the goods is 8,000 and it is estimated that the company will incur 500 of selling costs in relation to these goods. 4) The Dividend paid account on the trial balance relates to an ordinary dividend that was paid on 30 June 2019. A further ordinary dividend of 600,000 was approved on 31 December 2019 but is currently not reflected in the trial balance 5) 50,000 of trade receivables must be written off as bad debts and a provision is required for 5% of the remaining balance. 6) Loan interest must be accrued for the year. The loan is repayable in full in December 2020. 7) Tax expense on the trial balance represents tax paid during the year. There was no opening accrual for tax on 1 January 2019, but an accrual is now required for 25,000 at 31 December 2019. 8) Trade payables includes VAT payable (relating to goods sold) of 20,000. Requirements: a) Prepare a Statement of Profit and Loss and Other Comprehensive Income for the year ended 31 December 2019 and a Statement of Financial Position as at 31 December 2019 for Flux Ltd. (38 Marks) b) Provide the all the journal entries that were recorded and have yet to be recorded for the year ended 31 December 2019 in relation to note (4) of the additional information above. (4 Marks) c) Your manager's knowledge of IFRS is not as good as it should be. He has asked you to include a short discussion on how different types of dividend are accounted for under IFRS and why they are accounted for in this way. (8 Marks) Total: 50 Marks