Answered step by step

Verified Expert Solution

Question

1 Approved Answer

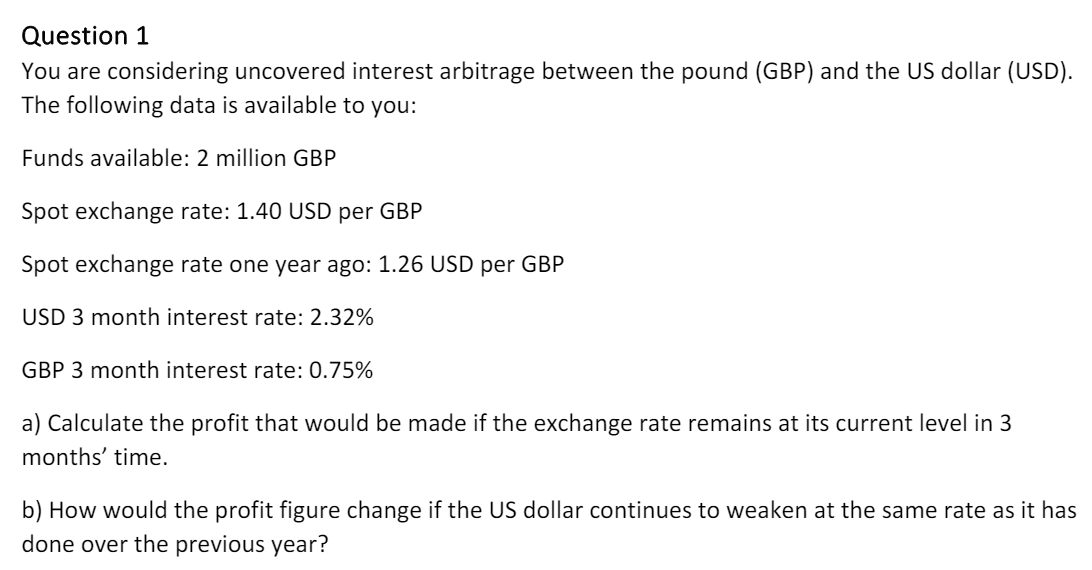

Question 1 You are considering uncovered interest arbitrage between the pound (GBP) and the US dollar (USD). The following data is available to you:

Question 1 You are considering uncovered interest arbitrage between the pound (GBP) and the US dollar (USD). The following data is available to you: Funds available: 2 million GBP Spot exchange rate: 1.40 USD per GBP Spot exchange rate one year ago: 1.26 USD per GBP USD 3 month interest rate: 2.32% GBP 3 month interest rate: 0.75% a) Calculate the profit that would be made if the exchange rate remains at its current level in 3 months' time. b) How would the profit figure change if the US dollar continues to weaken at the same rate as it has done over the previous year?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started