Question

Question 1 You are required to apply the theory covered in class to a real-life situation. You are to gather daily closing prices for African

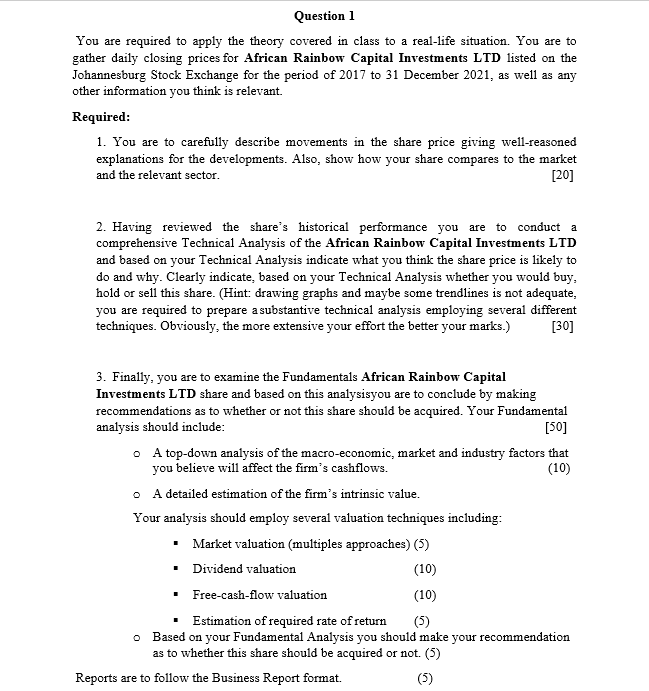

Question 1 You are required to apply the theory covered in class to a real-life situation. You are to gather daily closing prices for African Rainbow Capital Investments LTD listed on the Johannesburg Stock Exchange for the period of 2017 to 31 December 2021, as well as any other information you think is relevant. Required: 1. You are to carefully describe movements in the share price giving well-reasoned explanations for the developments. Also, show how your share compares to the market and the relevant sector. [20] 2. Having reviewed the shares historical performance you are to conduct a comprehensive Technical Analysis of the African Rainbow Capital Investments LTD and based on your Technical Analysis indicate what you think the share price is likely to do and why. Clearly indicate, based on your Technical Analysis whether you would buy, hold or sell this share. (Hint: drawing graphs and maybe some trendlines is not adequate, you are required to prepare a substantive technical analysis employing several different techniques. Obviously, the more extensive your effort the better your marks.) [30] 3. Finally, you are to examine the Fundamentals African Rainbow Capital Investments LTD share and based on this analysis you are to conclude by making recommendations as to whether or not this share should be acquired. Your Fundamental analysis should include: [50] o A top-down analysis of the macro-economic, market and industry factors that you believe will affect the firms cashflows. (10) o A detailed estimation of the firms intrinsic value. Your analysis should employ several valuation techniques including: Market valuation (multiples approaches) (5) Dividend valuation (10) Free-cash-flow valuation (10) Estimation of required rate of return (5) o Based on your Fundamental Analysis you should make your recommendation as to whether this share should be acquired or not. (5) Reports are to follow the Business Report format. (5)

a Question 1 You are required to apply the theory covered in class to a real-life situation. You are to gather daily closing prices for African Rainbow Capital Investments LTD listed on the Johannesburg Stock Exchange for the period of 2017 to 31 December 2021, as well as any other information you think is relevant. Required: 1. You are to carefully describe movements in the share price giving well-reasoned explanations for the developments. Also, show how your share compares to the market and the relevant sector. [20] 2. Having reviewed the share's historical performance you are to conduct a comprehensive Technical Analysis of the African Rainbow Capital Investments LTD and based on your Technical Analysis indicate what you think the share price is likely to do and why. Clearly indicate, based on your Technical Analysis whether you would buy, hold or sell this share. (Hint: drawing graphs and maybe some trendlines is not adequate, you are required to prepare a substantive technical analysis employing several different techniques. Obviously, the more extensive your effort the better your marks.) [30] 3. Finally, you are to examine the Fundamentals African Rainbow Capital Investments LTD share and based on this analysisyou are to conclude by making recommendations as to whether or not this share should be acquired. Your Fundamental analysis should include: [50] 0 A top-down analysis of the macro-economic, market and industry factors that you believe will affect the firm's cashflows. (10) A detailed estimation of the firm's intrinsic value. Your analysis should employ several valuation techniques including: Market valuation (multiples approaches) (5) Dividend valuation (10) Free-cash-flow valuation (10) Estimation of required rate of return (5) Based on your Fundamental Analysis you should make your recommendation as to whether this share should be acquired or not. (5) Reports are to follow the Business Report format. (5) a Question 1 You are required to apply the theory covered in class to a real-life situation. You are to gather daily closing prices for African Rainbow Capital Investments LTD listed on the Johannesburg Stock Exchange for the period of 2017 to 31 December 2021, as well as any other information you think is relevant. Required: 1. You are to carefully describe movements in the share price giving well-reasoned explanations for the developments. Also, show how your share compares to the market and the relevant sector. [20] 2. Having reviewed the share's historical performance you are to conduct a comprehensive Technical Analysis of the African Rainbow Capital Investments LTD and based on your Technical Analysis indicate what you think the share price is likely to do and why. Clearly indicate, based on your Technical Analysis whether you would buy, hold or sell this share. (Hint: drawing graphs and maybe some trendlines is not adequate, you are required to prepare a substantive technical analysis employing several different techniques. Obviously, the more extensive your effort the better your marks.) [30] 3. Finally, you are to examine the Fundamentals African Rainbow Capital Investments LTD share and based on this analysisyou are to conclude by making recommendations as to whether or not this share should be acquired. Your Fundamental analysis should include: [50] 0 A top-down analysis of the macro-economic, market and industry factors that you believe will affect the firm's cashflows. (10) A detailed estimation of the firm's intrinsic value. Your analysis should employ several valuation techniques including: Market valuation (multiples approaches) (5) Dividend valuation (10) Free-cash-flow valuation (10) Estimation of required rate of return (5) Based on your Fundamental Analysis you should make your recommendation as to whether this share should be acquired or not. (5) Reports are to follow the Business Report formatStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started