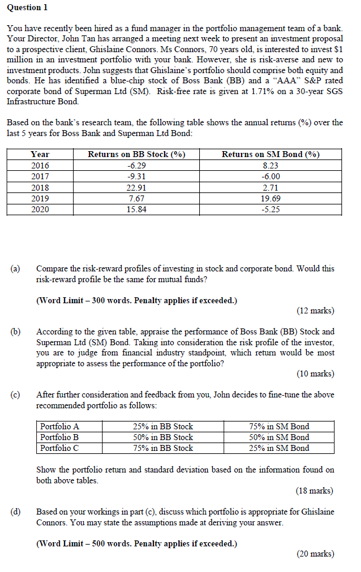

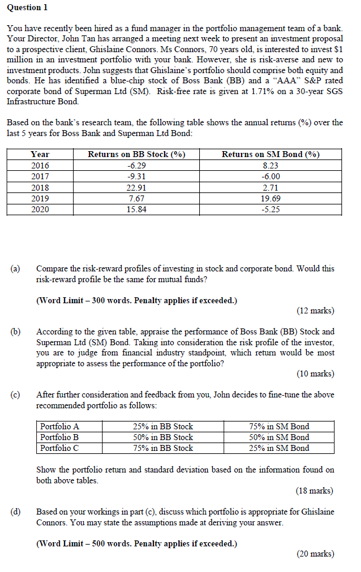

Question 1 You have recently been hired as a fund manager in the portfolio management team of a bank Your Director, John Tan has arranged a meeting next week to present an investment proposal to a prospective client, Ghislaine Connors, Ms Connors, 70 years old, is interested to invest $1 million in an investment portfolio with your bank. However, she is risk-averse and new to investment products. John suggests that Ghislaine's portfolio should comprise both equity and bonds. He has identified a blue-chip stock of Boss Bank (BB) and a "AAA" S&P rated corporate bond of Superman Ltd (SM). Risk-free rate is given at 1.71% on a 30-year SGS Infrastructure Bond Based on the bank's research team, the following table shows the annual retums() over the last 5 years for Boss Bank and Superman Led Bond: Returns on SM Bond (*) 8.23 -600 Year 2016 2017 2018 2019 2020 Returns on BB Stock (6) -6.29 -9.31 22.91 7.67 15.84 2.71 19.69 -5.25 (a) Compare the risk-reward profiles of investing in stock and corporate bond Would this risk-reward profile be the same for mutual funds? (Word Limit - 300 words. Penalty applies if exceeded.) (12 marks) (b) (c) According to the given table, appraise the performance of Boss Bank (BB) Stock and Superman Ltd (SM) Bond. Taking into consideration the risk profile of the investor you are to judge from financial industry standpoint, which retum would be most appropriate to assess the performance of the portfolio? (10 marks) After further consideration and feedback from you, John decides to fine-tune the above recommended portfolio as follows: Portfolio A 25% in BB Stock 75% in SM Bond Portfolio B 50% in BB Stock 50% in Portfolio C 75% in BB Stock 25% in SM Bond (d) Show the portfolio return and standard deviation based on the information found on both above tables (18 marks) Based on your workings in part (c), discuss which portfolio is appropriate for Ghislaine Connors. You may state the assumptions made at deriving your answer (Word Limit - 500 words. Penalty applies if exceeded.) (20 marks) Question 1 You have recently been hired as a fund manager in the portfolio management team of a bank Your Director, John Tan has arranged a meeting next week to present an investment proposal to a prospective client, Ghislaine Connors, Ms Connors, 70 years old, is interested to invest $1 million in an investment portfolio with your bank. However, she is risk-averse and new to investment products. John suggests that Ghislaine's portfolio should comprise both equity and bonds. He has identified a blue-chip stock of Boss Bank (BB) and a "AAA" S&P rated corporate bond of Superman Ltd (SM). Risk-free rate is given at 1.71% on a 30-year SGS Infrastructure Bond Based on the bank's research team, the following table shows the annual retums() over the last 5 years for Boss Bank and Superman Led Bond: Returns on SM Bond (*) 8.23 -600 Year 2016 2017 2018 2019 2020 Returns on BB Stock (6) -6.29 -9.31 22.91 7.67 15.84 2.71 19.69 -5.25 (a) Compare the risk-reward profiles of investing in stock and corporate bond Would this risk-reward profile be the same for mutual funds? (Word Limit - 300 words. Penalty applies if exceeded.) (12 marks) (b) (c) According to the given table, appraise the performance of Boss Bank (BB) Stock and Superman Ltd (SM) Bond. Taking into consideration the risk profile of the investor you are to judge from financial industry standpoint, which retum would be most appropriate to assess the performance of the portfolio? (10 marks) After further consideration and feedback from you, John decides to fine-tune the above recommended portfolio as follows: Portfolio A 25% in BB Stock 75% in SM Bond Portfolio B 50% in BB Stock 50% in Portfolio C 75% in BB Stock 25% in SM Bond (d) Show the portfolio return and standard deviation based on the information found on both above tables (18 marks) Based on your workings in part (c), discuss which portfolio is appropriate for Ghislaine Connors. You may state the assumptions made at deriving your answer (Word Limit - 500 words. Penalty applies if exceeded.) (20 marks)