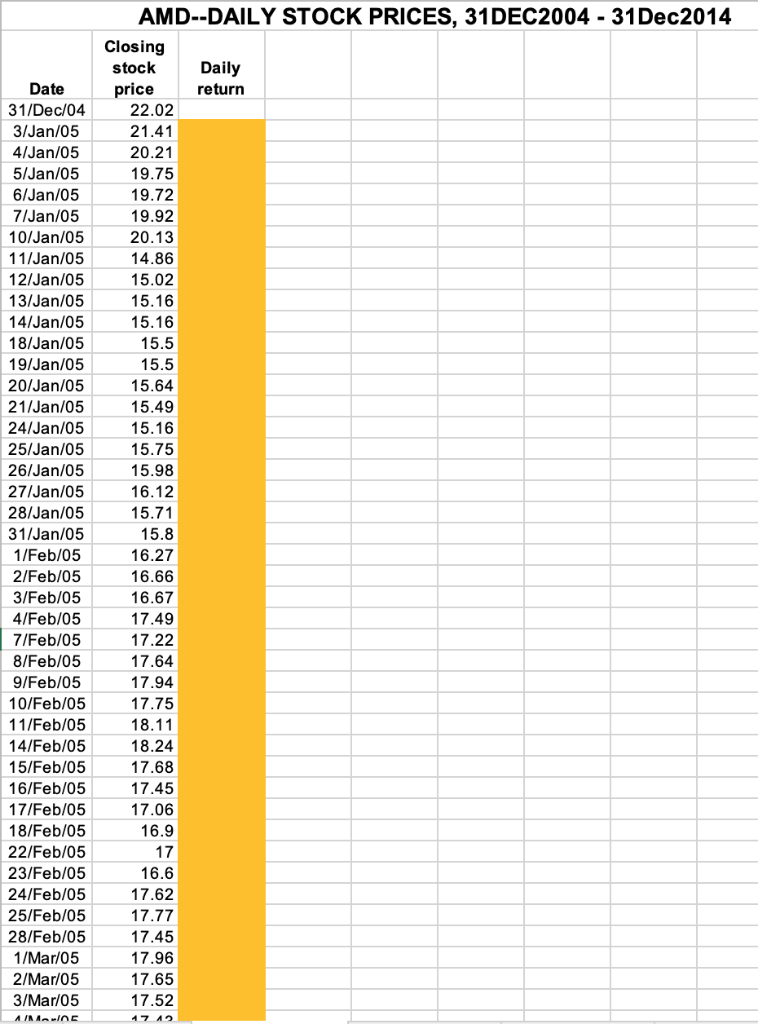

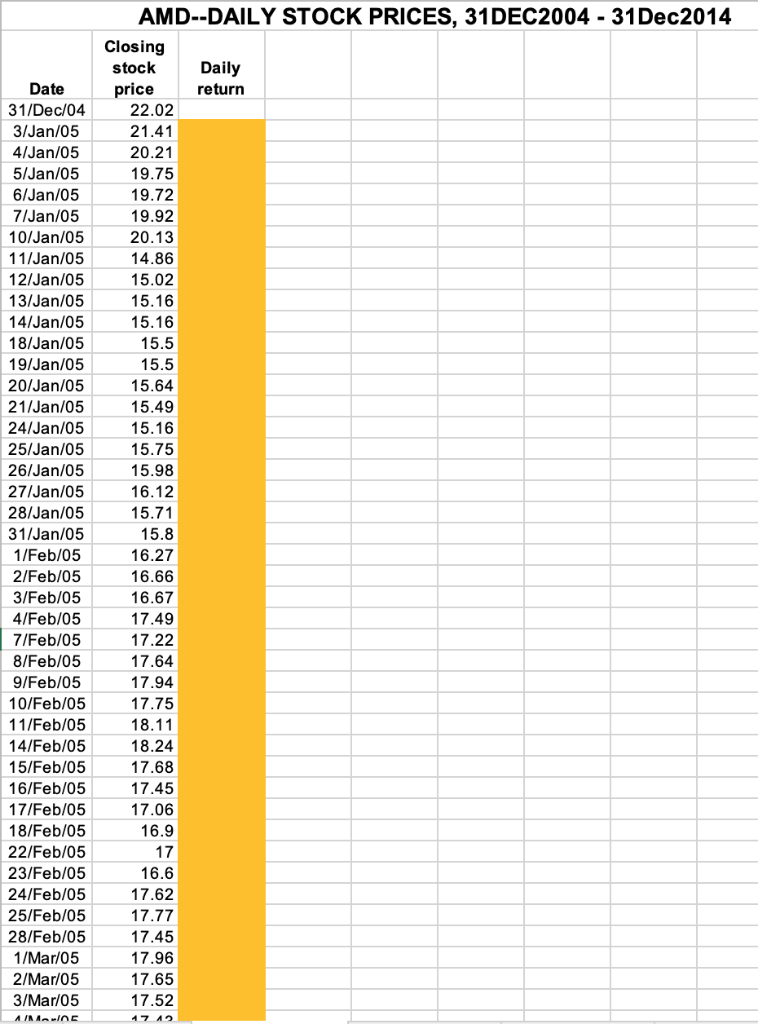

Question# 1 You will find a template for daily adjusted closing price for AMD corporation's stock from 12/31/2004 to 12/31/2014 Compute the daily stock returns and graph them (as we did in class). b. Use the Excel function Frequency to build a frequency distribution of the stock returns between - 9% and 9% (1% incremental) and graph this distribution (as we did in class). a. AMD--DAILY STOCK PRICES, 31DEC2004 - 31Dec2014 Closing Daily stock Date return price 22.02 31/Dec/0.4 21.41 3/Jan/05 4/Jan/05 20.21 19.75 5/Jan/05 6/Jan/05 19.72 19.92 7/Jan/05 10/Jan/05 20.13 14.86 11/Jan/05 15.02 15.16 15.16 12/Jan/05 13/Jan/05 14/Jan/05 18/Jan/05 15.5 15.5 19/Jan/05 15.64 15.49 15.16 20/Jan/0.5 21/Jan/05 24/Jan/05 25/Jan/05 15.75 15.98 26/Jan/0:5 16.12 27/Jan/05 28/Jan/05 15.71 31/Jan/05 15.8 16.27 16.66 16.67 1/Feb/05 2/Feb/05 3/Feb/05 17.49 17.22 17.64 17.94 4/Feb/05 7/Feb/05 8/Feb/05 9/Feb/05 10/Feb/05 17.75 18.11 11/Feb/05 18.24 17.68 14/Feb/05 15/Feb/05 16/Feb/05 17/Feb/05 17.45 17.06 16.9 18/Feb/05 17 22/Feb/05 16.6 23/Feb/05 17.62 24/Feb/05 25/Feb/05 17.45 28/Feb/05 17.96 1/Mar/05 17.65 2/Mar/05 17.52 3/Mar/05 Question# 1 You will find a template for daily adjusted closing price for AMD corporation's stock from 12/31/2004 to 12/31/2014 Compute the daily stock returns and graph them (as we did in class). b. Use the Excel function Frequency to build a frequency distribution of the stock returns between - 9% and 9% (1% incremental) and graph this distribution (as we did in class). a. AMD--DAILY STOCK PRICES, 31DEC2004 - 31Dec2014 Closing Daily stock Date return price 22.02 31/Dec/0.4 21.41 3/Jan/05 4/Jan/05 20.21 19.75 5/Jan/05 6/Jan/05 19.72 19.92 7/Jan/05 10/Jan/05 20.13 14.86 11/Jan/05 15.02 15.16 15.16 12/Jan/05 13/Jan/05 14/Jan/05 18/Jan/05 15.5 15.5 19/Jan/05 15.64 15.49 15.16 20/Jan/0.5 21/Jan/05 24/Jan/05 25/Jan/05 15.75 15.98 26/Jan/0:5 16.12 27/Jan/05 28/Jan/05 15.71 31/Jan/05 15.8 16.27 16.66 16.67 1/Feb/05 2/Feb/05 3/Feb/05 17.49 17.22 17.64 17.94 4/Feb/05 7/Feb/05 8/Feb/05 9/Feb/05 10/Feb/05 17.75 18.11 11/Feb/05 18.24 17.68 14/Feb/05 15/Feb/05 16/Feb/05 17/Feb/05 17.45 17.06 16.9 18/Feb/05 17 22/Feb/05 16.6 23/Feb/05 17.62 24/Feb/05 25/Feb/05 17.45 28/Feb/05 17.96 1/Mar/05 17.65 2/Mar/05 17.52 3/Mar/05