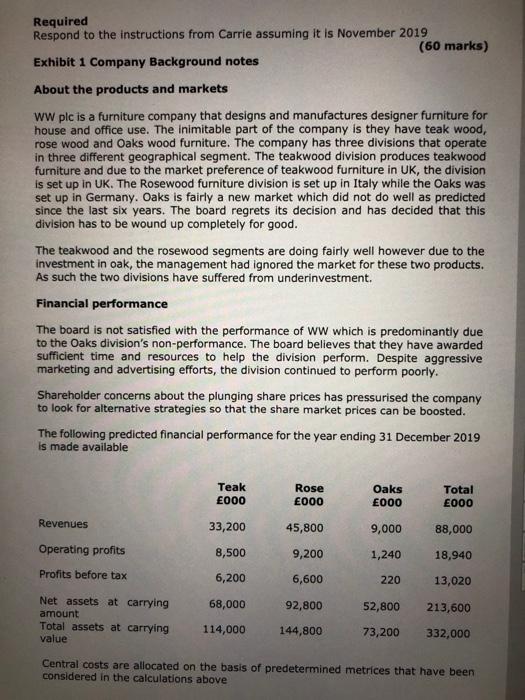

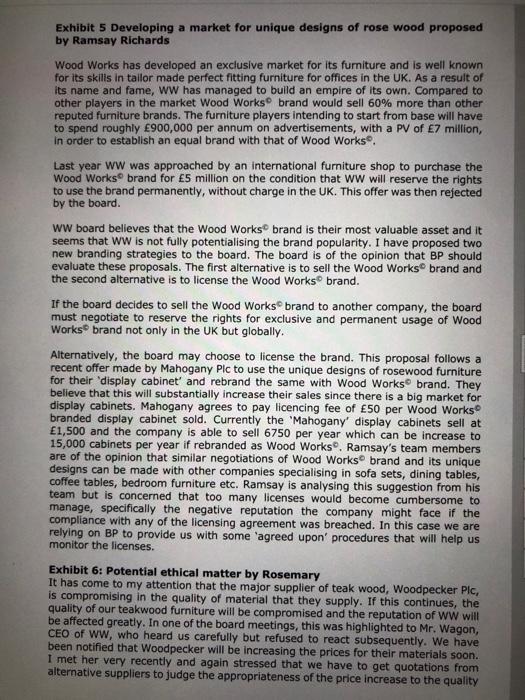

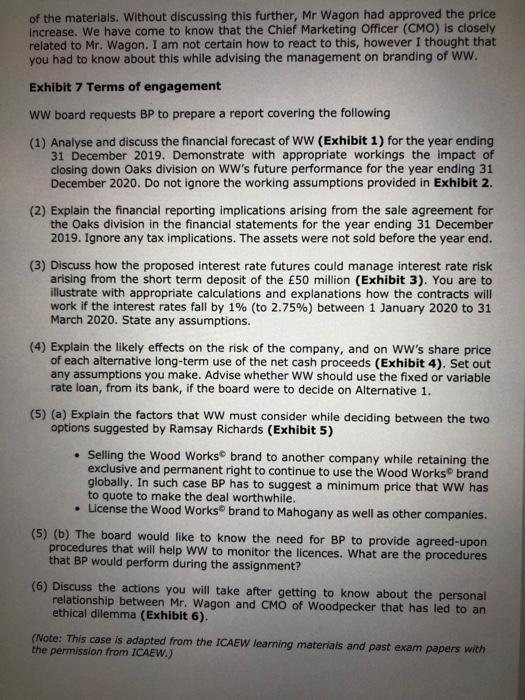

Question 1 Your firm Books and Pencils LLP (BP), an internationally renowned ICAEW Chartered Accountants firm, has undertaken the non-assurance engagement of Wood Works Plc (WW). The company is a listed company with three divisions namely Teak division, Rose division and Oak division. You are Maggie Boh, the senior staff of BP and you received the following mail message from your manager, Carrie Bee. To: Maggie Boh From: Carrie Bee Date: 3 November 2019 Subject: New assignment (WW Plc) We have accepted to assist the Board of Directors (board) WW and you will be joining me in this assignment. Since we have not worked on this client before we may need some background information about the company (Exhibit 1). I had a tele conversation with Rosemary, the finance director of WW regarding the nature of advice. She told me that some of her business segments were performing very weakly. She had a special mention of the Oaks division. The company had opened a new factory in Germany to promote the Oaks business which, unfortunately, did not pick up. The board is now proposing to sell it off and shut down the market totally. You may want more details about this (Exhibit 2). If the company disposes the Oaks division they will have net cash proceeds of 50 million which will have to be re invested immediately in the short-run before we advise the board about long run investment. However, there is a concern about the interest rates for short-run investment and the board has some idea to mitigate the risk (Exhibit 3). As of now the board has very little idea about the long run investment and we will have to provide solutions. I have a couple of idea which I have shared for our discussion (Exhibit 4). Rosemary has requested us to meet the Chief Marketing Officer of Ww, Ramsay Richards, to discuss about promoting the unique designs of rosewood furniture to develop the business. Since ww is closing its Oak division, the management division feels that an alternative market will have to be established. Ramsay has opined that promoting the unique designs of rosewood would work well. We will have to evaluate the strategy and provide our inputs (Exhibit 5). Rosemary has informed me in confidence about an ethical dilemma that she is facing. You may want to read through this very carefully and we will have to address this concern as well (Exhibit 6). The terms of engagement are set out (Exhibit 7) and the company has requested us to provide a report covering all the above issues. Required Respond to the instructions from Carrie assuming it is November 2019 (60 marks) Exhibit 1 Company Background notes About the products and markets WW plc is a furniture company that designs and manufactures designer furniture for house and office use. The inimitable part of the company is they have teak wood, rose wood and Oaks wood furniture. The company has three divisions that operate in three different geographical segment. The teakwood division produces teakwood furniture and due to the market preference of teakwood furniture in UK, the division is set up in UK. The Rosewood furniture division is set up in Italy while the Oaks was set up in Germany. Oaks is fairly a new market which did not do well as predicted since the last six years. The board regrets its decision and has decided that this division has to be wound up completely for good. The teakwood and the rosewood segments are doing fairly well however due to the investment in oak, the management had ignored the market for these two products. As such the two divisions have suffered from underinvestment. Financial performance The board is not satisfied with the performance of WW which is predominantly due to the Oaks division's non-performance. The board believes that they have awarded sufficient time and resources to help the division perform. Despite aggressive marketing and advertising efforts, the division continued to perform poorly. Shareholder concerns about the plunging share prices has pressurised the company to look for alternative strategies so that the share market prices can be boosted. The following predicted financial performance for the year ending 31 December 2019 is made available Teak 000 Rose 000 Oaks 000 Total E000 Revenues 33,200 45,800 9,000 88,000 Operating profits 8,500 9,200 1,240 18,940 Profits before tax 6,200 6,600 220 13,020 68,000 92,800 52,800 213,600 Net assets at carrying amount Total assets at carrying value 114,000 144,800 73,200 332,000 Central costs are allocated on the basis of predetermined metrices that have been considered in the calculations above Exhibit 2 Selling Oaks The board of WW have decided that there is no alternative but to sell the underperforming Oaks division. There is a ready buyer in Germany, Komfort GmbH with whom negotiations are ongoing. To a great extent the management is about to conclude the deal and the cash agreed on the sale of net assets is 50 million. As this is getting finalised, the board on the other hand are panicking. Issues that are of concern include a. The impact on the future financial performance of WW for the year ended 31 December 2020 as a result of the disposal of Oaks division, specifically on the key ratios. b. The implications on financial statements due to the sale of Oaks division for the year ended 31 December 2019. Working assumption If there is no investment or restructuring, the performance of all three divisions in the year ending 31 December 2020 will not differ from the forecast provided for 31 December 2019 Exhibit 3 Investment option of cash proceeds in short term ww is expecting to receive the net cash proceeds of 50 million by the first quarter of 2020. The sale will most likely happen on 31 March 2020. The money has to be immediately transferred to a fixed-interest bearing short term deposit at lease for three months which will allow us the time to take a decision on the long term investment while also generating additional income. In order to maximise the returns the management must ensure that they do not suffer from dipping Interest rate. A financial market survey conducted recently provides evidence that the interest rates are most likely to drop by 31 March 2020. In order to mitigate the loss from decreased interest rate it would be better to lock the interest rates at 31 December 2019. It is the board's opinion that the LIFFE 3 month sterling interest rate futures (contract size 1,000,000) to eliminate interest rate risk between 31 December 2019 to 31 March 2020. As at 31 December 2019 the board expects that the short term, fixed interest bearing deposit will yield 3.75% return per annum and the March 2020, 3 month sterling interest rate futures contract will be trading at 96.00 Exhibit 4 Long term investment of the net cash proceed of 50 million The board is unfortunately unable to concur to either of the options available to invest the net cash of 50 million in the long run. The board is unable to figure out the risks involved with the investment options available including the impact on the share price. Option 1 There is a proposal to purchase a new equipment in the Rose Division that can help with the manufacture of the uniquely designed rosewood furniture as suggested by the marketing manager. This will also improve the productivity of Rose. It is expected that this investment will generate returns of 9% per annum infinitely. The machine can be procured at a cost of 90 million. Over and above the 50 million in hand, we will have to make financing arrangements for the remaining amount. The finance director has suggested that we can make a borrowing for 40 million repayable at the end of 6 years i.e on 31 March 2026. The current bankers of ww are willing to provide the debt financing. The bank manager has discussed two alternatives. One alternative is to procure the 20 million at a fixed rate of 6% per annum while the other alternative is to procure a floating rate of 12 month LIBOR + 3%. The 12 month LIBOR is currently 3.75%. The board is trying to figure out which is a better source of debt financing. Option 2 The entire 50 million can be used to repay some of the existing long term borrowings Exhibit 5 Developing a market for unique designs of rose wood proposed by Ramsay Richards Wood Works has developed an exclusive market for its furniture and is well known for its skills in tailor made perfect fitting furniture for offices in the UK. As a result of its name and fame, WW has managed to build an empire of its own. Compared to other players in the market Wood Works brand would sell 60% more than other reputed furniture brands. The furniture players intending to start from base will have to spend roughly 900,000 per annum on advertisements, with a PV of 7 million, in order to establish an equal brand with that of Wood Works Last year ww was approached by an international furniture shop to purchase the Wood Works brand for 5 million on the condition that ww will reserve the rights to use the brand permanently, without charge in the UK. This offer was then rejected by the board. ww board believes that the Wood Works brand is their most valuable asset and it seems that ww is not fully potentialising the brand popularity. I have proposed two new branding strategies to the board. The board is of the opinion that BP should evaluate these proposals. The first alternative is to sell the Wood Works brand and the second alternative is to license the Wood Works brand. If the board decides to sell the Wood Works brand to another company, the board must negotiate to reserve the rights for exclusive and permanent usage of Wood Works brand not only in the UK but globally. Alternatively, the board may choose to license the brand. This proposal follows a recent offer made by Mahogany Plc to use the unique designs of rosewood furniture for their display cabinet' and rebrand the same with Wood Works brand. They believe that this will substantially increase their sales since there is a big market for display cabinets. Mahogany agrees to pay licencing fee of 50 per Wood Works branded display cabinet sold. Currently the 'Mahogany display cabinets sell at 1,500 and the company is able to sell 6750 per year which can be increase to 15,000 cabinets per year if rebranded as Wood Works. Ramsay's team members are of the opinion that similar negotiations of Wood Works brand and its unique designs can be made with other companies specialising in sofa sets, dining tables, coffee tables, bedroom furniture etc. Ramsay is analysing this suggestion from his team but is concerned that too many licenses would become cumbersome to manage, specifically the negative reputation the company might face if the compliance with any of the licensing agreement was breached. In this case we are relying on BP to provide us with some 'agreed upon' procedures that will help us monitor the licenses. Exhibit 6: Potential ethical matter by Rosemary It has come to my attention that the major supplier of teak wood, Woodpecker Plc, is compromising in the quality of material that they supply. If this continues, the quality of our teakwood furniture will be compromised and the reputation of WW will be affected greatly. In one of the board meetings, this was highlighted to Mr. Wagon, CEO of Ww, who heard us carefully but refused to react subsequently. We have been notified that Woodpecker will be increasing the prices for their materials soon. I met her very recently and again stressed that we have to get quotations from alternative suppliers to judge the appropriateness of the price increase to the quality of the materials. Without discussing this further, Mr Wagon had approved the price Increase. We have come to know that the Chief Marketing Officer (CMO) is closely related to Mr. Wagon. I am not certain how to react to this, however I thought that you had to know about this while advising the management on branding of ww. Exhibit 7 Terms of engagement ww board requests BP to prepare a report covering the following (1) Analyse and discuss the financial forecast of WW (Exhibit 1) for the year ending 31 December 2019. Demonstrate with appropriate workings the impact of closing down Oaks division on WW's future performance for the year ending 31 December 2020. Do not ignore the working assumptions provided in Exhibit 2. (2) Explain the financial reporting implications arising from the sale agreement for the Oaks division in the financial statements for the year ending 31 December 2019. Ignore any tax implications. The assets were not sold before the year end. (3) Discuss how the proposed interest rate futures could manage interest rate risk arising from the short term deposit of the 50 million (Exhibit 3). You are to illustrate with appropriate calculations and explanations how the contracts will work if the interest rates fall by 1% (to 2.75%) between 1 January 2020 to 31 March 2020. State any assumptions. (4) Explain the likely effects on the risk of the company, and on WW's share price of each alternative long-term use of the net cash proceeds (Exhibit 4). Set out any assumptions you make. Advise whether WW should use the fixed or variable rate loan, from its bank, if the board were to decide on Alternative 1. (5) (a) Explain the factors that ww must consider while deciding between the two options suggested by Ramsay Richards (Exhibit 5) . Selling the Wood Works brand to another company while retaining the exclusive and permanent right to continue to use the Wood Works brand globally. In such case BP has to suggest a minimum price that WW has to quote to make the deal worthwhile. License the Wood Works brand to Mahogany as well as other companies. (5) (b) The board would like to know the need for BP to provide agreed-upon procedures that will help WW to monitor the licences. What are the procedures that BP would perform during the assignment? (6) Discuss the actions you will take after getting to know about the personal relationship between Mr. Wagon and CMO of Woodpecker that has led to an ethical dilemma (Exhibit 6). (Note: This case is adapted from the ICAEW learning materials and past exam papers with the permission from ICAEW.) Question 1 Your firm Books and Pencils LLP (BP), an internationally renowned ICAEW Chartered Accountants firm, has undertaken the non-assurance engagement of Wood Works Plc (WW). The company is a listed company with three divisions namely Teak division, Rose division and Oak division. You are Maggie Boh, the senior staff of BP and you received the following mail message from your manager, Carrie Bee. To: Maggie Boh From: Carrie Bee Date: 3 November 2019 Subject: New assignment (WW Plc) We have accepted to assist the Board of Directors (board) WW and you will be joining me in this assignment. Since we have not worked on this client before we may need some background information about the company (Exhibit 1). I had a tele conversation with Rosemary, the finance director of WW regarding the nature of advice. She told me that some of her business segments were performing very weakly. She had a special mention of the Oaks division. The company had opened a new factory in Germany to promote the Oaks business which, unfortunately, did not pick up. The board is now proposing to sell it off and shut down the market totally. You may want more details about this (Exhibit 2). If the company disposes the Oaks division they will have net cash proceeds of 50 million which will have to be re invested immediately in the short-run before we advise the board about long run investment. However, there is a concern about the interest rates for short-run investment and the board has some idea to mitigate the risk (Exhibit 3). As of now the board has very little idea about the long run investment and we will have to provide solutions. I have a couple of idea which I have shared for our discussion (Exhibit 4). Rosemary has requested us to meet the Chief Marketing Officer of Ww, Ramsay Richards, to discuss about promoting the unique designs of rosewood furniture to develop the business. Since ww is closing its Oak division, the management division feels that an alternative market will have to be established. Ramsay has opined that promoting the unique designs of rosewood would work well. We will have to evaluate the strategy and provide our inputs (Exhibit 5). Rosemary has informed me in confidence about an ethical dilemma that she is facing. You may want to read through this very carefully and we will have to address this concern as well (Exhibit 6). The terms of engagement are set out (Exhibit 7) and the company has requested us to provide a report covering all the above issues. Required Respond to the instructions from Carrie assuming it is November 2019 (60 marks) Exhibit 1 Company Background notes About the products and markets WW plc is a furniture company that designs and manufactures designer furniture for house and office use. The inimitable part of the company is they have teak wood, rose wood and Oaks wood furniture. The company has three divisions that operate in three different geographical segment. The teakwood division produces teakwood furniture and due to the market preference of teakwood furniture in UK, the division is set up in UK. The Rosewood furniture division is set up in Italy while the Oaks was set up in Germany. Oaks is fairly a new market which did not do well as predicted since the last six years. The board regrets its decision and has decided that this division has to be wound up completely for good. The teakwood and the rosewood segments are doing fairly well however due to the investment in oak, the management had ignored the market for these two products. As such the two divisions have suffered from underinvestment. Financial performance The board is not satisfied with the performance of WW which is predominantly due to the Oaks division's non-performance. The board believes that they have awarded sufficient time and resources to help the division perform. Despite aggressive marketing and advertising efforts, the division continued to perform poorly. Shareholder concerns about the plunging share prices has pressurised the company to look for alternative strategies so that the share market prices can be boosted. The following predicted financial performance for the year ending 31 December 2019 is made available Teak 000 Rose 000 Oaks 000 Total E000 Revenues 33,200 45,800 9,000 88,000 Operating profits 8,500 9,200 1,240 18,940 Profits before tax 6,200 6,600 220 13,020 68,000 92,800 52,800 213,600 Net assets at carrying amount Total assets at carrying value 114,000 144,800 73,200 332,000 Central costs are allocated on the basis of predetermined metrices that have been considered in the calculations above Exhibit 2 Selling Oaks The board of WW have decided that there is no alternative but to sell the underperforming Oaks division. There is a ready buyer in Germany, Komfort GmbH with whom negotiations are ongoing. To a great extent the management is about to conclude the deal and the cash agreed on the sale of net assets is 50 million. As this is getting finalised, the board on the other hand are panicking. Issues that are of concern include a. The impact on the future financial performance of WW for the year ended 31 December 2020 as a result of the disposal of Oaks division, specifically on the key ratios. b. The implications on financial statements due to the sale of Oaks division for the year ended 31 December 2019. Working assumption If there is no investment or restructuring, the performance of all three divisions in the year ending 31 December 2020 will not differ from the forecast provided for 31 December 2019 Exhibit 3 Investment option of cash proceeds in short term ww is expecting to receive the net cash proceeds of 50 million by the first quarter of 2020. The sale will most likely happen on 31 March 2020. The money has to be immediately transferred to a fixed-interest bearing short term deposit at lease for three months which will allow us the time to take a decision on the long term investment while also generating additional income. In order to maximise the returns the management must ensure that they do not suffer from dipping Interest rate. A financial market survey conducted recently provides evidence that the interest rates are most likely to drop by 31 March 2020. In order to mitigate the loss from decreased interest rate it would be better to lock the interest rates at 31 December 2019. It is the board's opinion that the LIFFE 3 month sterling interest rate futures (contract size 1,000,000) to eliminate interest rate risk between 31 December 2019 to 31 March 2020. As at 31 December 2019 the board expects that the short term, fixed interest bearing deposit will yield 3.75% return per annum and the March 2020, 3 month sterling interest rate futures contract will be trading at 96.00 Exhibit 4 Long term investment of the net cash proceed of 50 million The board is unfortunately unable to concur to either of the options available to invest the net cash of 50 million in the long run. The board is unable to figure out the risks involved with the investment options available including the impact on the share price. Option 1 There is a proposal to purchase a new equipment in the Rose Division that can help with the manufacture of the uniquely designed rosewood furniture as suggested by the marketing manager. This will also improve the productivity of Rose. It is expected that this investment will generate returns of 9% per annum infinitely. The machine can be procured at a cost of 90 million. Over and above the 50 million in hand, we will have to make financing arrangements for the remaining amount. The finance director has suggested that we can make a borrowing for 40 million repayable at the end of 6 years i.e on 31 March 2026. The current bankers of ww are willing to provide the debt financing. The bank manager has discussed two alternatives. One alternative is to procure the 20 million at a fixed rate of 6% per annum while the other alternative is to procure a floating rate of 12 month LIBOR + 3%. The 12 month LIBOR is currently 3.75%. The board is trying to figure out which is a better source of debt financing. Option 2 The entire 50 million can be used to repay some of the existing long term borrowings Exhibit 5 Developing a market for unique designs of rose wood proposed by Ramsay Richards Wood Works has developed an exclusive market for its furniture and is well known for its skills in tailor made perfect fitting furniture for offices in the UK. As a result of its name and fame, WW has managed to build an empire of its own. Compared to other players in the market Wood Works brand would sell 60% more than other reputed furniture brands. The furniture players intending to start from base will have to spend roughly 900,000 per annum on advertisements, with a PV of 7 million, in order to establish an equal brand with that of Wood Works Last year ww was approached by an international furniture shop to purchase the Wood Works brand for 5 million on the condition that ww will reserve the rights to use the brand permanently, without charge in the UK. This offer was then rejected by the board. ww board believes that the Wood Works brand is their most valuable asset and it seems that ww is not fully potentialising the brand popularity. I have proposed two new branding strategies to the board. The board is of the opinion that BP should evaluate these proposals. The first alternative is to sell the Wood Works brand and the second alternative is to license the Wood Works brand. If the board decides to sell the Wood Works brand to another company, the board must negotiate to reserve the rights for exclusive and permanent usage of Wood Works brand not only in the UK but globally. Alternatively, the board may choose to license the brand. This proposal follows a recent offer made by Mahogany Plc to use the unique designs of rosewood furniture for their display cabinet' and rebrand the same with Wood Works brand. They believe that this will substantially increase their sales since there is a big market for display cabinets. Mahogany agrees to pay licencing fee of 50 per Wood Works branded display cabinet sold. Currently the 'Mahogany display cabinets sell at 1,500 and the company is able to sell 6750 per year which can be increase to 15,000 cabinets per year if rebranded as Wood Works. Ramsay's team members are of the opinion that similar negotiations of Wood Works brand and its unique designs can be made with other companies specialising in sofa sets, dining tables, coffee tables, bedroom furniture etc. Ramsay is analysing this suggestion from his team but is concerned that too many licenses would become cumbersome to manage, specifically the negative reputation the company might face if the compliance with any of the licensing agreement was breached. In this case we are relying on BP to provide us with some 'agreed upon' procedures that will help us monitor the licenses. Exhibit 6: Potential ethical matter by Rosemary It has come to my attention that the major supplier of teak wood, Woodpecker Plc, is compromising in the quality of material that they supply. If this continues, the quality of our teakwood furniture will be compromised and the reputation of WW will be affected greatly. In one of the board meetings, this was highlighted to Mr. Wagon, CEO of Ww, who heard us carefully but refused to react subsequently. We have been notified that Woodpecker will be increasing the prices for their materials soon. I met her very recently and again stressed that we have to get quotations from alternative suppliers to judge the appropriateness of the price increase to the quality of the materials. Without discussing this further, Mr Wagon had approved the price Increase. We have come to know that the Chief Marketing Officer (CMO) is closely related to Mr. Wagon. I am not certain how to react to this, however I thought that you had to know about this while advising the management on branding of ww. Exhibit 7 Terms of engagement ww board requests BP to prepare a report covering the following (1) Analyse and discuss the financial forecast of WW (Exhibit 1) for the year ending 31 December 2019. Demonstrate with appropriate workings the impact of closing down Oaks division on WW's future performance for the year ending 31 December 2020. Do not ignore the working assumptions provided in Exhibit 2. (2) Explain the financial reporting implications arising from the sale agreement for the Oaks division in the financial statements for the year ending 31 December 2019. Ignore any tax implications. The assets were not sold before the year end. (3) Discuss how the proposed interest rate futures could manage interest rate risk arising from the short term deposit of the 50 million (Exhibit 3). You are to illustrate with appropriate calculations and explanations how the contracts will work if the interest rates fall by 1% (to 2.75%) between 1 January 2020 to 31 March 2020. State any assumptions. (4) Explain the likely effects on the risk of the company, and on WW's share price of each alternative long-term use of the net cash proceeds (Exhibit 4). Set out any assumptions you make. Advise whether WW should use the fixed or variable rate loan, from its bank, if the board were to decide on Alternative 1. (5) (a) Explain the factors that ww must consider while deciding between the two options suggested by Ramsay Richards (Exhibit 5) . Selling the Wood Works brand to another company while retaining the exclusive and permanent right to continue to use the Wood Works brand globally. In such case BP has to suggest a minimum price that WW has to quote to make the deal worthwhile. License the Wood Works brand to Mahogany as well as other companies. (5) (b) The board would like to know the need for BP to provide agreed-upon procedures that will help WW to monitor the licences. What are the procedures that BP would perform during the assignment? (6) Discuss the actions you will take after getting to know about the personal relationship between Mr. Wagon and CMO of Woodpecker that has led to an ethical dilemma (Exhibit 6). (Note: This case is adapted from the ICAEW learning materials and past exam papers with the permission from ICAEW.)