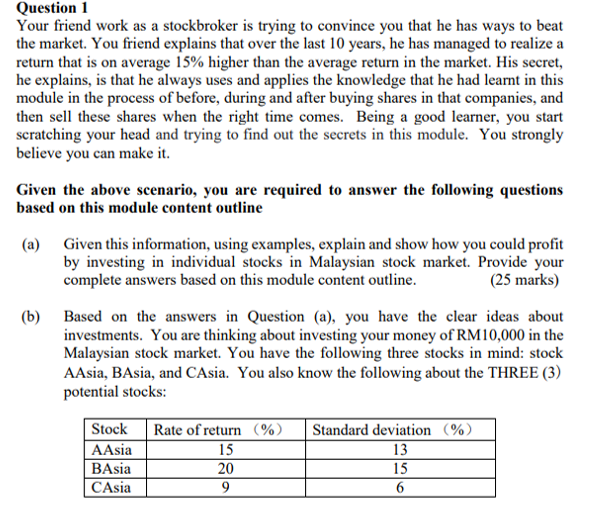

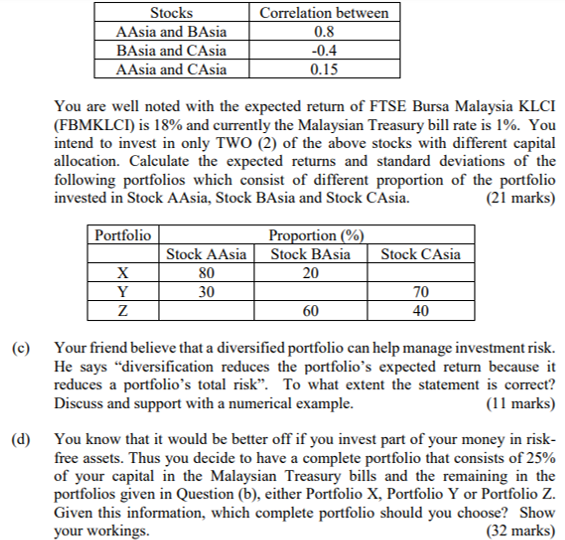

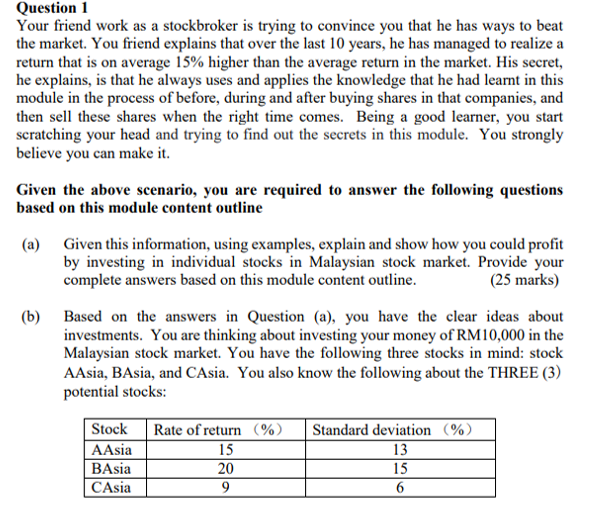

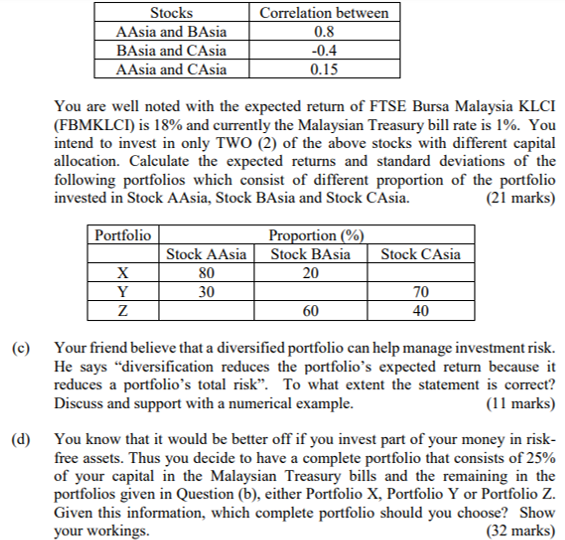

Question 1 Your friend work as a stockbroker is trying to convince you that he has ways to beat the market. You friend explains that over the last 10 years, he has managed to realize a return that is on average 15% higher than the average return in the market. His secret, he explains, is that he always uses and applies the knowledge that he had learnt in this module in the process of before, during and after buying shares in that companies, and then sell these shares when the right time comes. Being a good learner, you start scratching your head and trying to find out the secrets in this module. You strongly believe you can make it. Given the above scenario, you are required to answer the following questions based on this module content outline (a) Given this information, using examples, explain and show how you could profit by investing in individual stocks in Malaysian stock market. Provide your complete answers based on this module content outline. (25 marks) (b) Based on the answers in Question (a), you have the clear ideas about investments. You are thinking about investing your money of RM10,000 in the Malaysian stock market. You have the following three stocks in mind: stock AAsia, BAsia, and CAsia. You also know the following about the THREE (3) potential stocks: You are well noted with the expected return of FTSE Bursa Malaysia KLCI (FBMKLCI) is 18% and currently the Malaysian Treasury bill rate is 1%. You intend to invest in only TWO (2) of the above stocks with different capital allocation. Calculate the expected returns and standard deviations of the following portfolios which consist of different proportion of the portfolio invested in Stock AAsia, Stock BAsia and Stock CAsia. (21 marks) (c) Your friend believe that a diversified portfolio can help manage investment risk. He says "diversification reduces the portfolio's expected return because it reduces a portfolio's total risk". To what extent the statement is correct? Discuss and support with a numerical example. (11 marks) (d) You know that it would be better off if you invest part of your money in riskfree assets. Thus you decide to have a complete portfolio that consists of 25% of your capital in the Malaysian Treasury bills and the remaining in the portfolios given in Question (b), either Portfolio X, Portfolio Y or Portfolio Z. Given this information, which complete portfolio should you choose? Show your workings. (32 marks) Question 1 Your friend work as a stockbroker is trying to convince you that he has ways to beat the market. You friend explains that over the last 10 years, he has managed to realize a return that is on average 15% higher than the average return in the market. His secret, he explains, is that he always uses and applies the knowledge that he had learnt in this module in the process of before, during and after buying shares in that companies, and then sell these shares when the right time comes. Being a good learner, you start scratching your head and trying to find out the secrets in this module. You strongly believe you can make it. Given the above scenario, you are required to answer the following questions based on this module content outline (a) Given this information, using examples, explain and show how you could profit by investing in individual stocks in Malaysian stock market. Provide your complete answers based on this module content outline. (25 marks) (b) Based on the answers in Question (a), you have the clear ideas about investments. You are thinking about investing your money of RM10,000 in the Malaysian stock market. You have the following three stocks in mind: stock AAsia, BAsia, and CAsia. You also know the following about the THREE (3) potential stocks: You are well noted with the expected return of FTSE Bursa Malaysia KLCI (FBMKLCI) is 18% and currently the Malaysian Treasury bill rate is 1%. You intend to invest in only TWO (2) of the above stocks with different capital allocation. Calculate the expected returns and standard deviations of the following portfolios which consist of different proportion of the portfolio invested in Stock AAsia, Stock BAsia and Stock CAsia. (21 marks) (c) Your friend believe that a diversified portfolio can help manage investment risk. He says "diversification reduces the portfolio's expected return because it reduces a portfolio's total risk". To what extent the statement is correct? Discuss and support with a numerical example. (11 marks) (d) You know that it would be better off if you invest part of your money in riskfree assets. Thus you decide to have a complete portfolio that consists of 25% of your capital in the Malaysian Treasury bills and the remaining in the portfolios given in Question (b), either Portfolio X, Portfolio Y or Portfolio Z. Given this information, which complete portfolio should you choose? Show your workings. (32 marks)