Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 Zayith Ghana Ltd is into the production of Zalu. However, at a recent Board meeting, there was a proposal for the production of

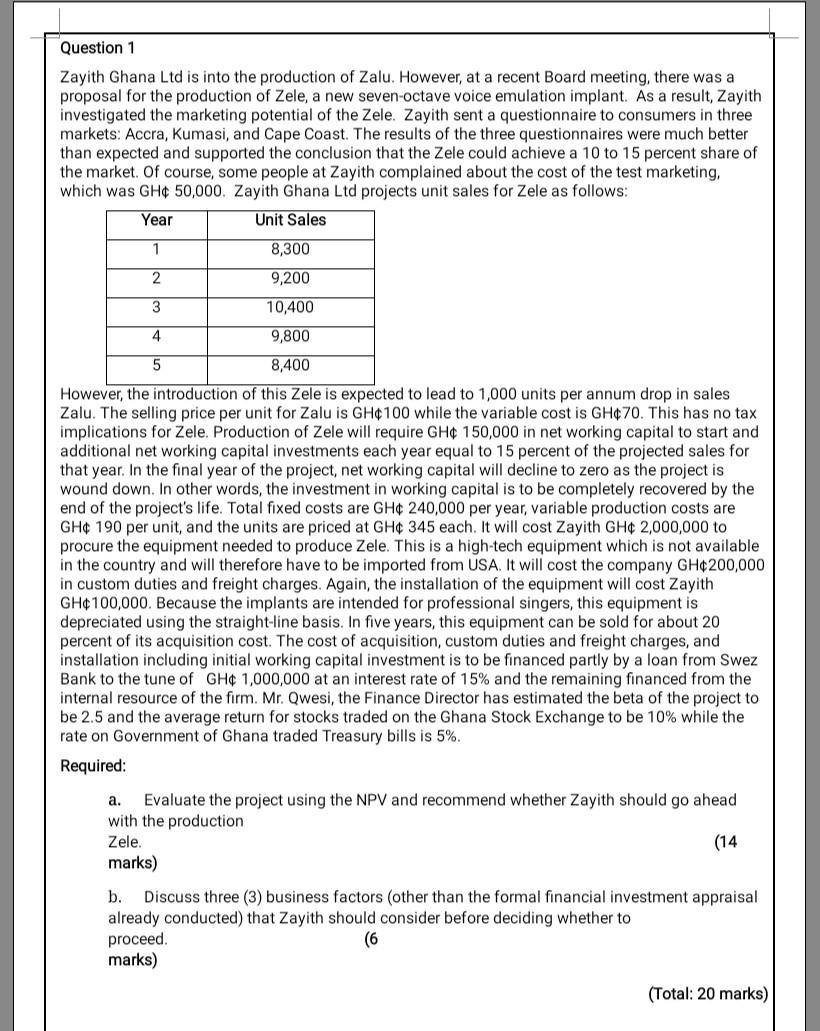

Question 1 Zayith Ghana Ltd is into the production of Zalu. However, at a recent Board meeting, there was a proposal for the production of Zele, a new seven-octave voice emulation implant. As a result, Zayith investigated the marketing potential of the Zele. Zayith sent a questionnaire to consumers in three markets: Accra, Kumasi, and Cape Coast. The results of the three questionnaires were much better than expected and supported the conclusion that the Zele could achieve a 10 to 15 percent share of the market. Of course, some people at Zayith complained about the cost of the test marketing, which was GH 50,000. Zayith Ghana Ltd projects unit sales for Zele as follows: Year Unit Sales 1 8,300 2 9,200 3 10,400 4 9,800 5 8,400 However, the introduction of this Zele is expected to lead to 1,000 units per annum drop in sales Zalu. The selling price per unit for Zalu is GH100 while the variable cost is GH70. This has no tax implications for Zele. Production of Zele will require GH 150,000 in net working capital to start and additional net working capital investments each year equal to 15 percent of the projected sales for that year. In the final year of the project, net working capital will decline to zero as the project is wound down. In other words, the investment in working capital is to be completely recovered by the end of the project's life. Total fixed costs are GH 240,000 per year, variable production costs are GH 190 per unit, and the units are priced at GH 345 each. It will cost Zayith GH 2,000,000 to procure the equipment needed to produce Zele. This is a high-tech equipment which is not available in the country and will therefore have to be imported from USA. It will cost the company GH200,000 in custom duties and freight charges. Again, the installation of the equipment will cost Zayith GH100,000. Because the implants are intended for professional singers, this equipment is depreciated using the straight-line basis. In five years, this equipment can be sold for about 20 percent of its acquisition cost. The cost of acquisition, custom duties and freight charges, and installation including initial working capital investment is to be financed partly by a loan from Swez Bank to the tune of GH 1,000,000 at an interest rate of 15% and the remaining financed from the internal resource of the firm. Mr. Qwesi, the Finance Director has estimated the beta of the project to be 2.5 and the average return for stocks traded on the Ghana Stock Exchange to be 10% while the rate on Government of Ghana traded Treasury bills is 5%. Required: a. Evaluate the project using the NPV and recommend whether Zayith should go ahead with the production Zele. (14 marks) b. Discuss three (3) business factors (other than the formal financial investment appraisal already conducted) that Zayith should consider before deciding whether to proceed. (6 marks) (Total: 20 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started