Answered step by step

Verified Expert Solution

Question

1 Approved Answer

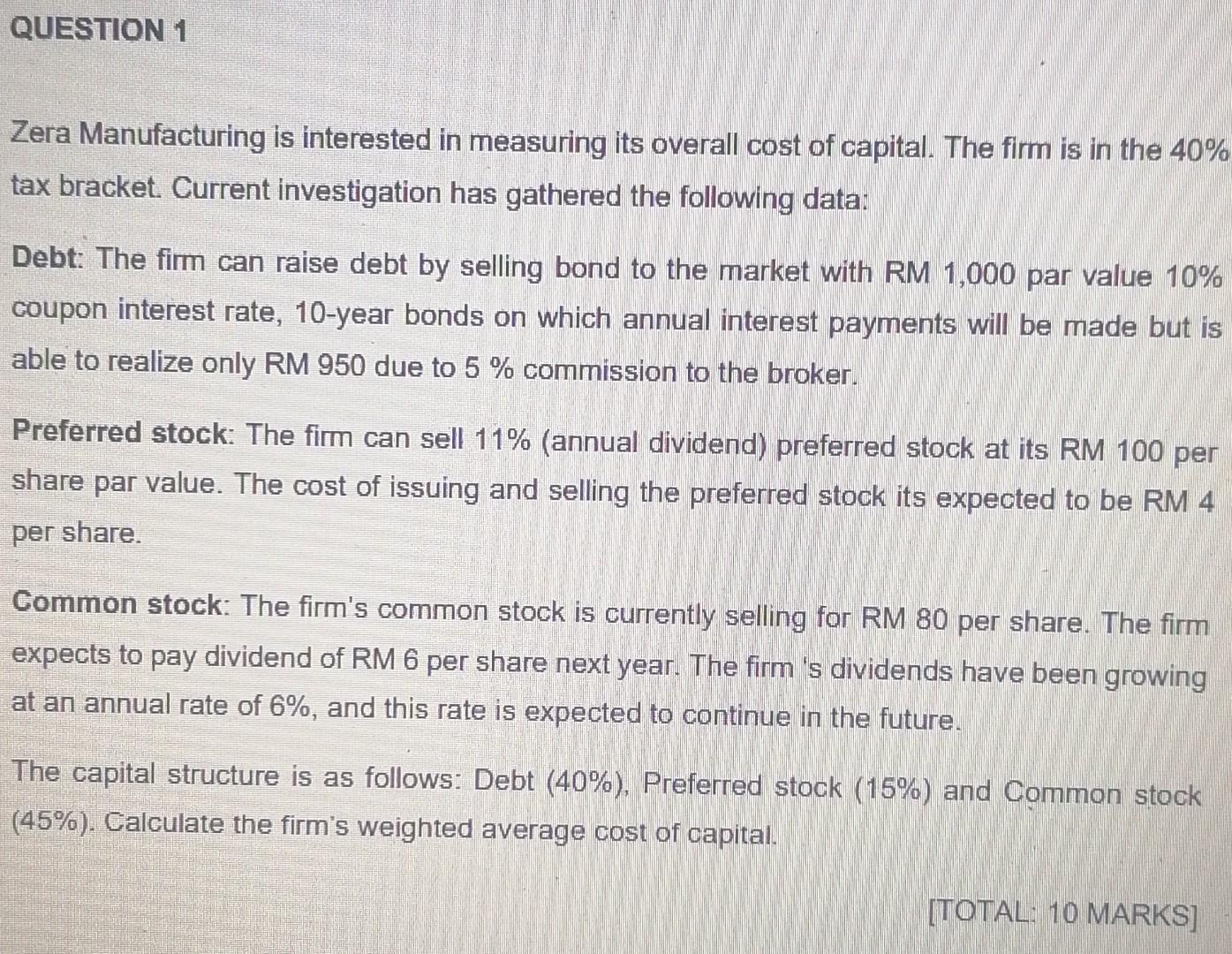

QUESTION 1 Zera Manufacturing is interested in measuring its overall cost of capital. The firm is in the 40% tax bracket Current investigation has gathered

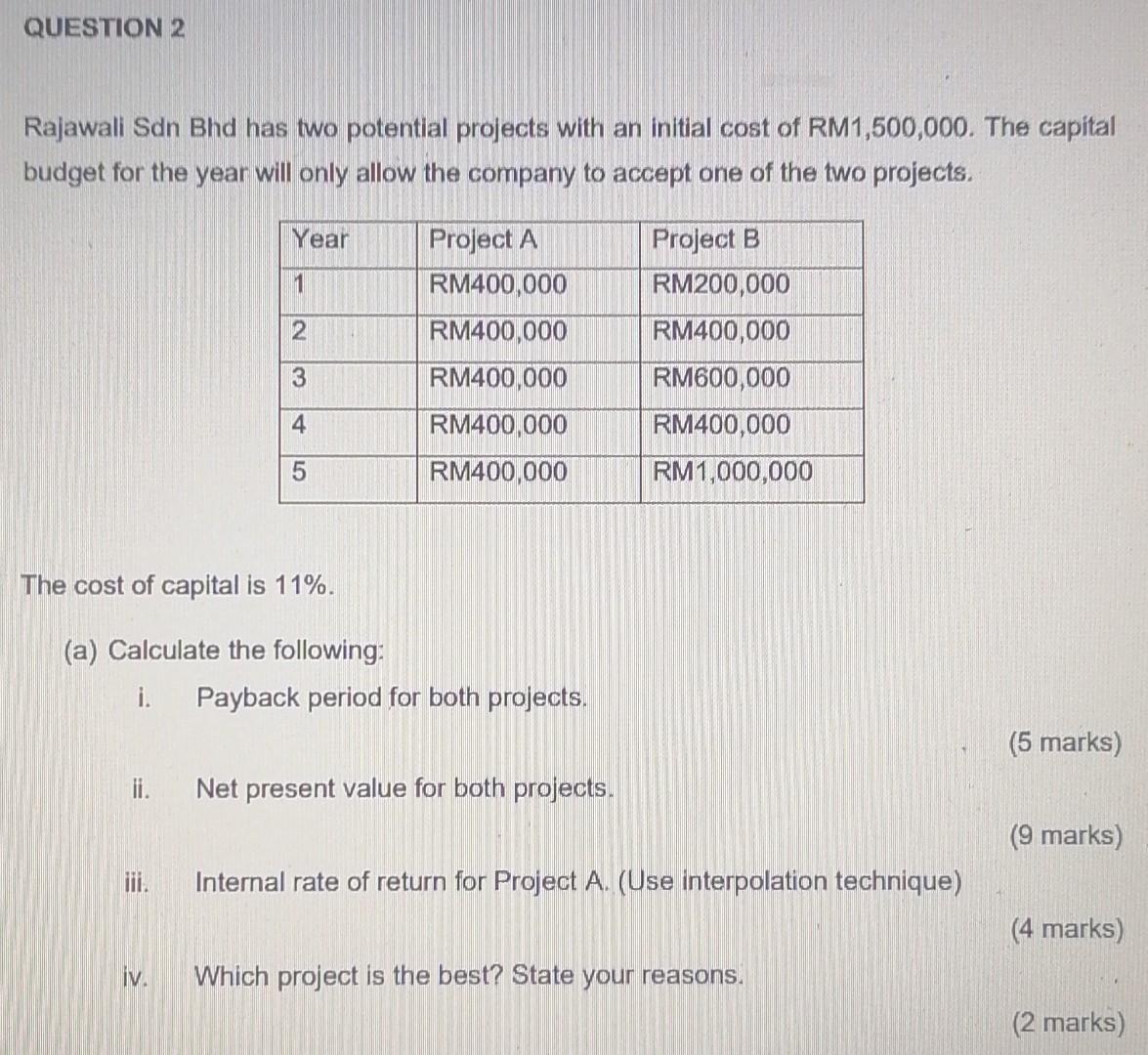

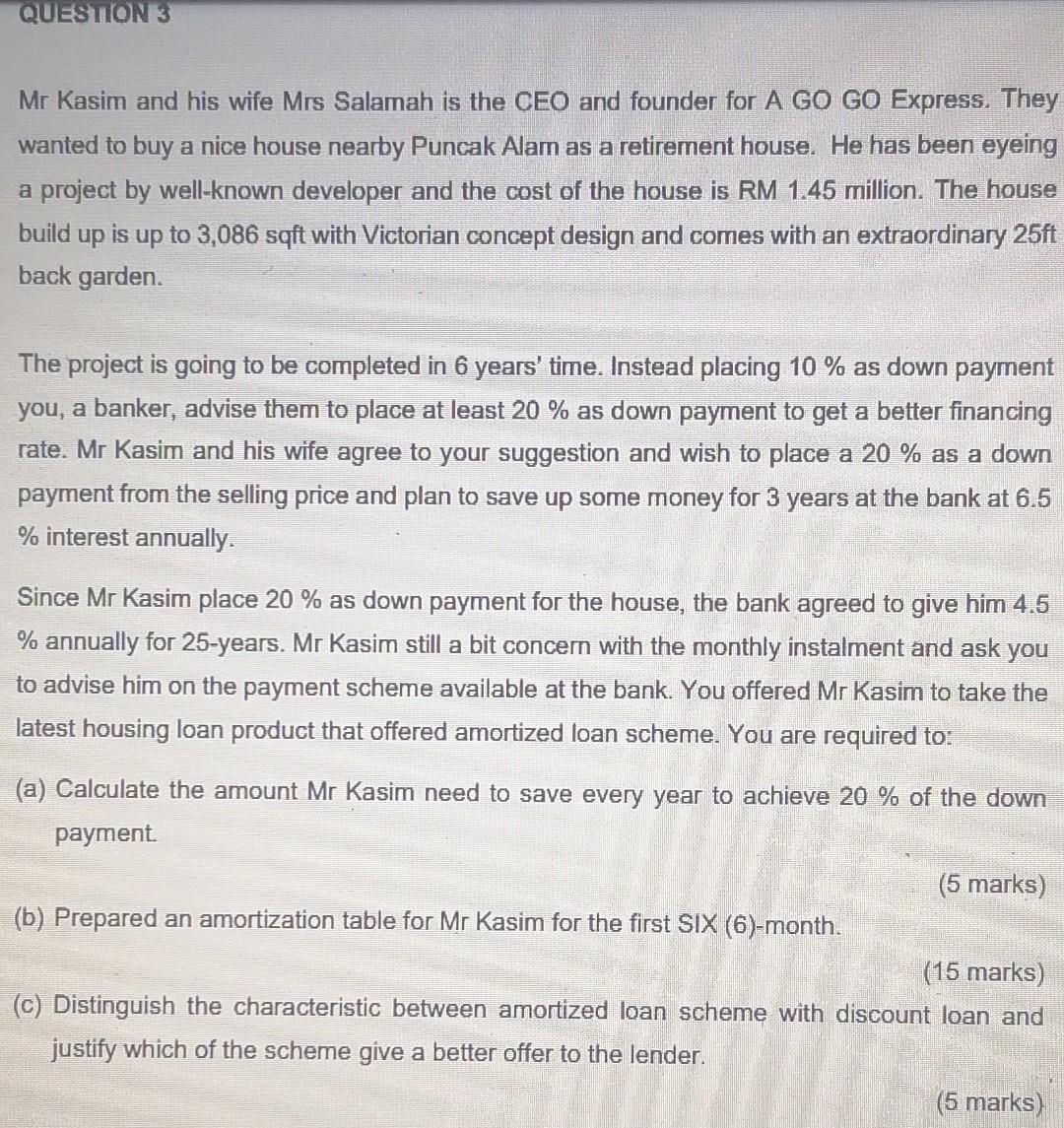

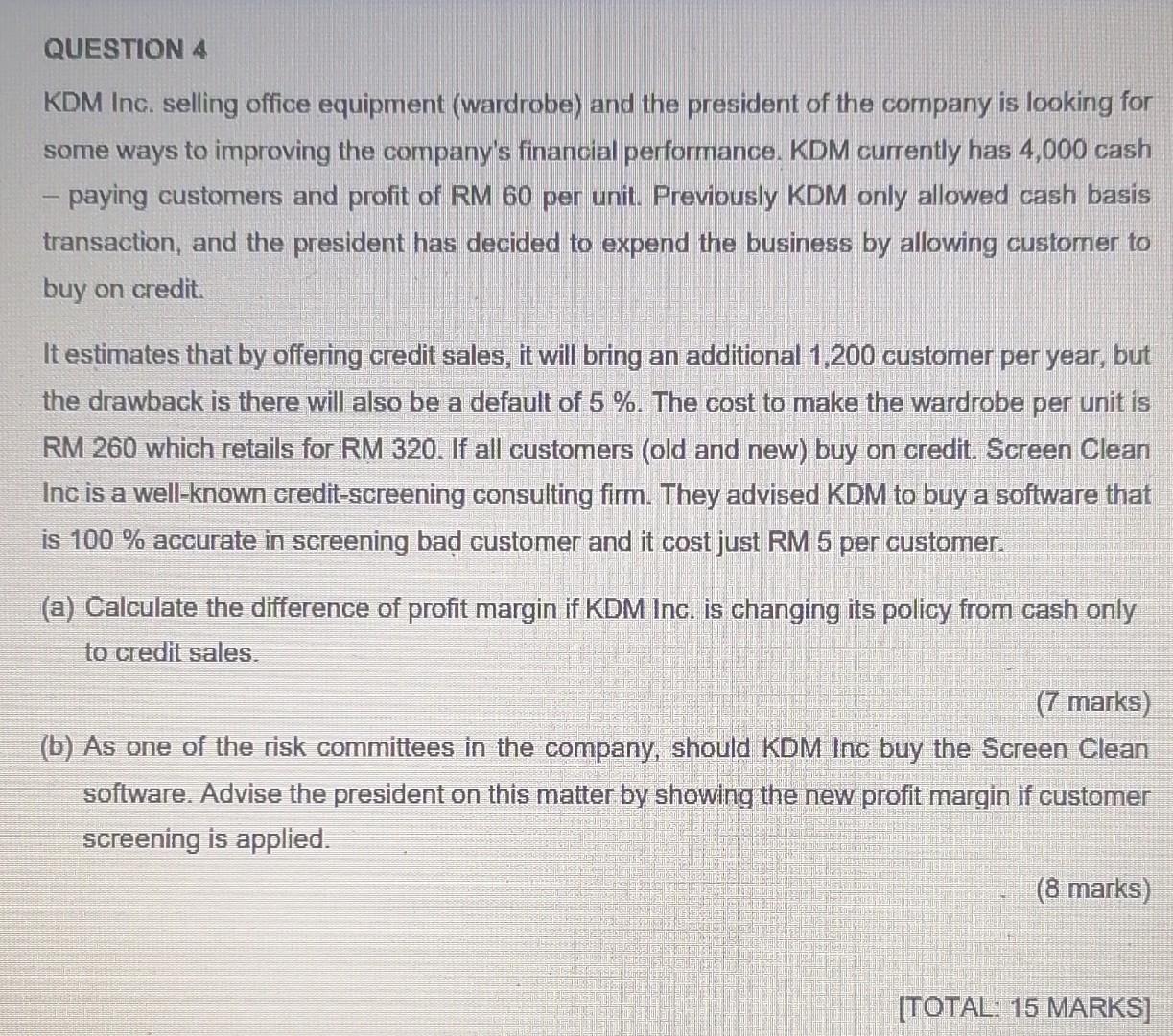

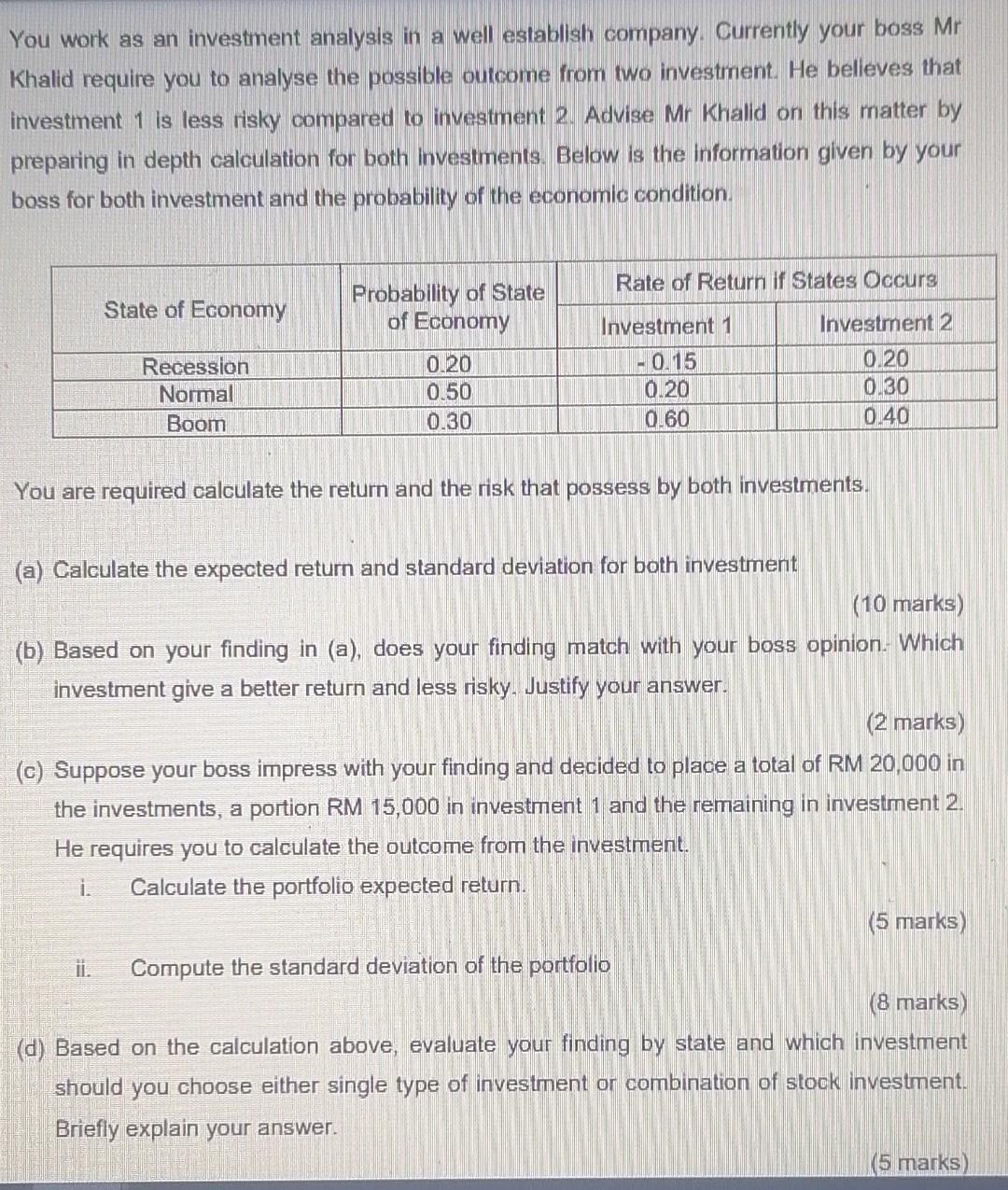

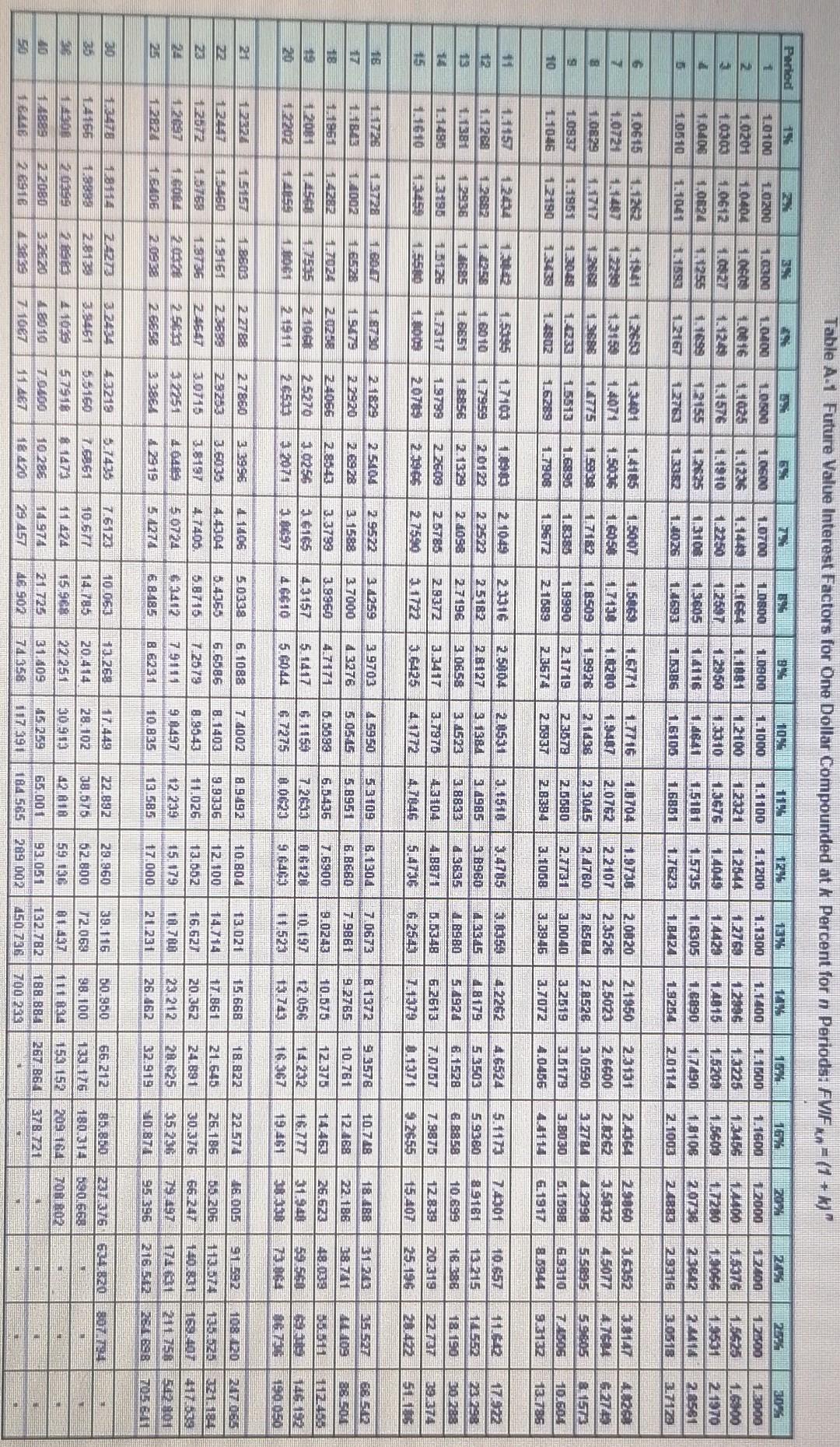

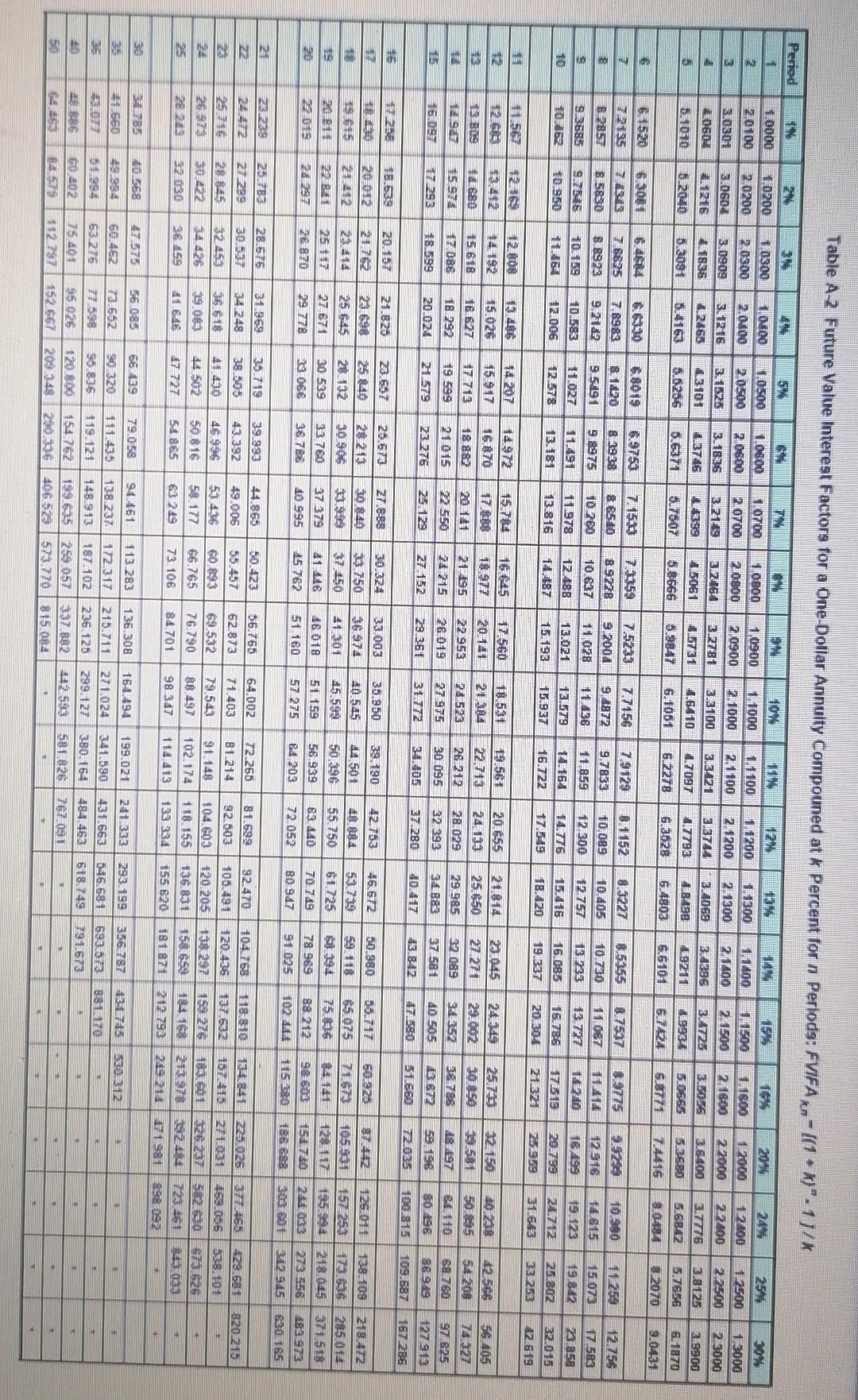

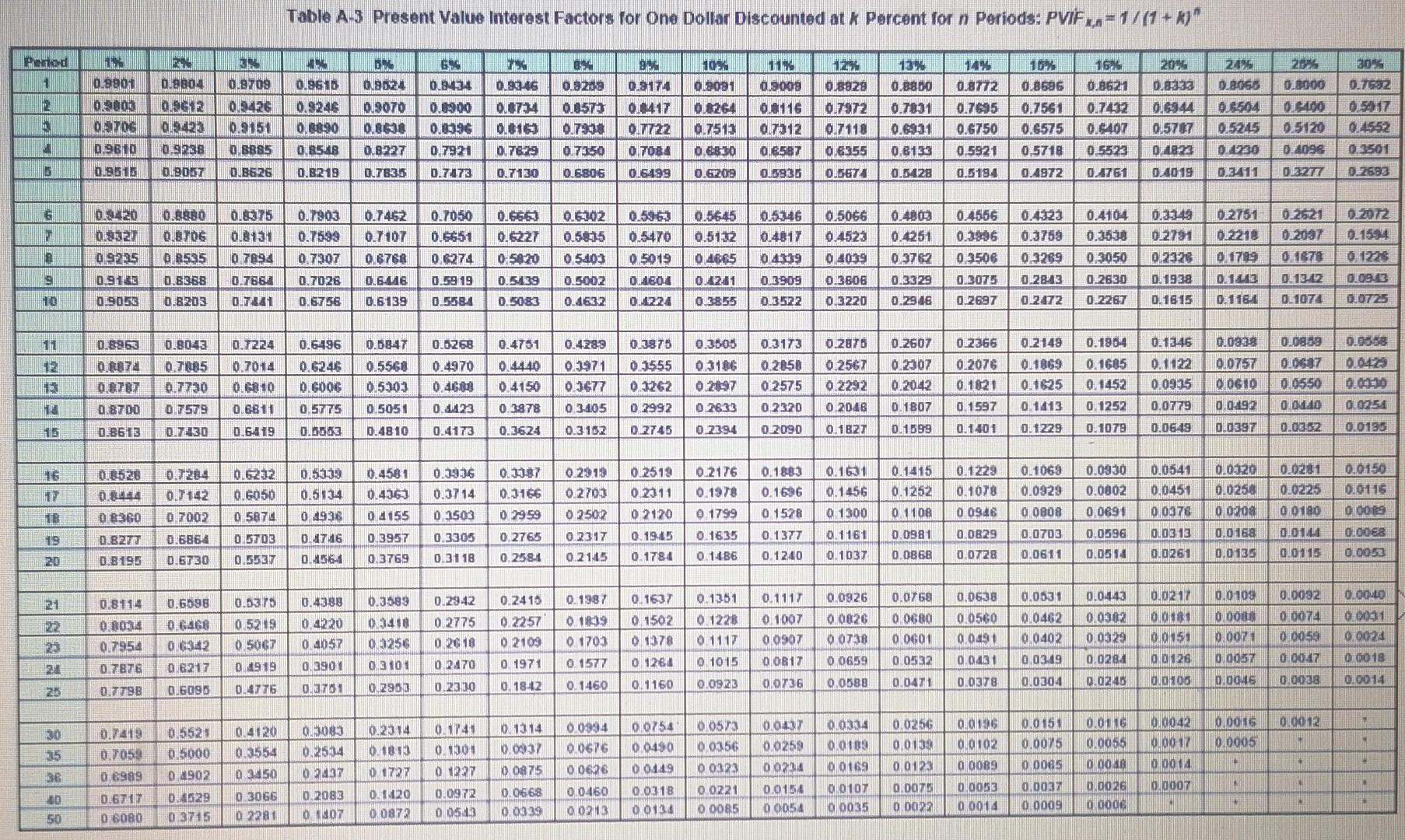

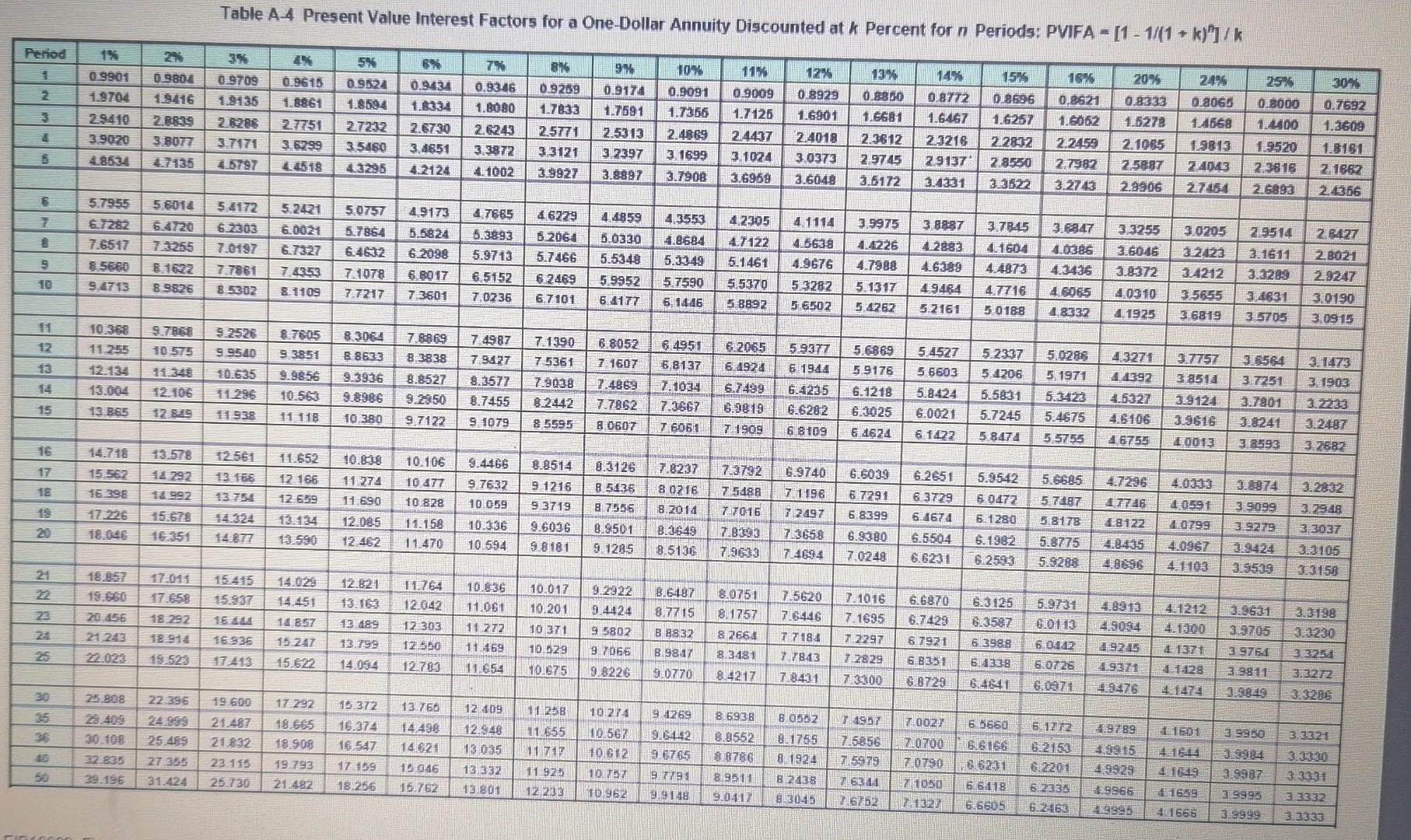

QUESTION 1 Zera Manufacturing is interested in measuring its overall cost of capital. The firm is in the 40% tax bracket Current investigation has gathered the following data: Debt: The firm can raise debt by selling bond to the market with RM 1,000 par value 10% coupon interest rate, 10-year bonds on which annual interest payments will be made but is able to realize only RM 950 due to 5 % commission to the broker. Preferred stock: The firm can sell 11% (annual dividend) preferred stock at its RM 100 per share par value. The cost of issuing and selling the preferred stock its expected to be RM 4 per share. Common stock: The firm's common stock is currently selling for RM 80 per share. The firm expects to pay dividend of RM 6 per share next year. The firm 's dividends have been growing at an annual rate of 6%, and this rate is expected to continue in the future. The capital structure is as follows: Debt (40%). Preferred stock (15%) and Common stock (45%). Calculate the firm's weighted average cost of capital. [TOTAL: 10 MARKS] QUESTION 2 Rajawali Sdn Bhd has two potential projects with an initial cost of RM1,500,000. The capital budget for the year will only allow the company to accept one of the two projects. Year 1 Project A RM400,000 RM400,000 Project B RM200,000 RM400,000 2 3 RM400,000 RM600,000 4 RM400,000 RM400,000 5 RM400,000 RM1,000,000 The cost of capital is 11%. (a) Calculate the following: i. Payback period for both projects. (5 marks) li. Net present value for both projects. (9 marks) lii Internal rate of return for Project A. (Use interpolation technique) (4 marks) iv. Which project is the best? State your reasons. (2 marks) QUESTION 3 Mr Kasim and his wife Mrs Salamah is the CEO and founder for A GO GO Express. They wanted to buy a nice house nearby Puncak Alam as a retirement house. He has been eyeing a project by well-known developer and the cost of the house is RM 1.45 million. The house build | up is up to 3,086 sqft with Victorian concept design and comes with an extraordinary 25ft back garden. The project is going to be completed in 6 years' time. Instead placing 10 % as down payment you, a banker, advise them to place at least 20 % as down payment to get a better financing rate. Mr Kasim and his wife ee to your suggestion and wish to place a 20 % as a down payment from the selling price and plan to save up some money for 3 years at the bank at 6.5 % interest annually. Since Mr Kasim place 20 % as down payment for the house, the bank agreed to give him 4.5 % annually for 25-years. Mr Kasim still bit concern with the monthly instalment and ask you to advise him on the payment scheme available at the bank. You offered Mr Kasim to take the latest housing loan product that offered amortized loan scheme. You are required to: (a) Calculate the amount Mr Kasim need to save every year to achieve 20 % of the down payment (5 marks) (b) Prepared an amortization table for Mr Kasim for the first SIX (6)-month. (15 marks) (c) Distinguish the characteristic between amortized loan scheme with discount loan and justify which of the scheme give a better offer to the lender. (5 marks) QUESTION 4 KDM Inc. selling office equipment (wardrobe) and the president of the company is looking for some ways to improving the company's financial performance. KDM currently has 4,000 cash - paying customers and profit of RM 60 per unit . Previously KDM only allowed cash basis transaction, and the president has decided to expend the business by allowing customer to buy on credit. It estimates that by offering credit sales, it will bring an additional 1,200 customer per year, but the drawback is there will also be a default of 5 %. The cost to make the wardrobe per unit is RM 260 which retails for RM 320. If all customers (old and new) buy on credit. Screen Clean Inc is a well-known credit-screening consulting firm. They advised KDM to buy a software that is 100 % accurate in screening bad customer and it cost just RM 5 per customer. (a) Calculate the difference of profit margin if KDM Inc. is changing its policy from cash only to credit sales. (7 marks) (b) As one of the risk committees in the company, should KDM Inc buy the Screen Clean software. Advise the president on this matter by showing the new profit margin if customer screening is applied. (8 marks) (TOTAL. 15 MARKS] You work as an investment analysis in a well establish company. Currently your boss Mr Khalid require you to analyse the possible outcome from two investment. He believes that investment 1 is less risky compared to investment 2. Advise Mr Khalid on this matter by preparing in depth calculation for both Investments. Below is the information given by your boss for both investment and the probability of the economic condition. Rate of Return if States Occurs State of Economy Probability of State of Economy Investment 1 Recession Normal Boom 0.20 0.50 0.30 - 0.15 0.20 0.60 Investment 2 0.20 0.30 0.40 You are required calculate the return and the risk that possess by both investments. (a) Calculate the expected return and standard deviation for both investment (10 marks) (b) Based on your finding in (a), does your finding match with your boss opinion. Which investment give a better return and less risky. Justify your answer. (2 marks) (c) Suppose your boss impress with your finding and decided to place a total of RM 20,000 in the investments, a portion RM 15,000 in investment 1 and the remaining in investment 2. He requires you to calculate the outcome from the investment. i. Calculate the portfolio expected return. (5 marks) ii. Compute the standard deviation of the portfolio (8 marks) (d) Based on the calculation above, evaluate your finding by state and which investment should you choose either single type of investment or combination of stock investment. Briefly explain your answer. (5 marks Table A.1 Future Value Interest Factors for One Dollar Compounded at k Percent for n Periods: FVIF &m= (1 + k]" Period 123 T 10100 DENT ST TD 1. 1000 1.0700 1.1100 12 160 1.1300 Ai 1.1400 13 100 1.3225 1.0500 1.1236 DD 3 1.0201 T 16 NE 10 STE 5 11.2514 649 1.2769 1.4423 16305 1.21500 1.5625 1.43015 ME 1.3000 1.6500 2 28561 Hi- 12155 13805 1.5603 tw 13103 NE RAM 1280 20738 17090 SE 6 3 ARE 21 219316 12 192514 2.1003 30513 1.0615 1.0723 1:5007 1.77 16 } 1.4071 11.0738 22107 2.3526 2.3131 10 1.5112 999 26352 5 0829 R4 19926 2.1719 23674 18509 1.0704 2.0762 23045 B1 : 2 1438 2.1350 25023 1528 3.2519 3.7072 7. Jet 2.R58 30590 32784 15 1:5513 1990 WAP 19990 1953 12890 1.8380 HDD 6.9310 10 2.1937 2.7731 15 3.6179 4.0456 21689 98 6.1917 3.39.46 74506 923132 27015 4.6524 ROBE 6 1 2:5182 3.150 1995 222522 21531 3.13821 3.-1523 20122 439 3 B980 4.2262 1.8179 5.4923 TL552 1712 16851 28980 1381 11496 2009 5 3503 6.1528 10 899 3 0658 3.8833 5 18:190 19789 22609 26785 4.88711 12.839 39.374 11610 4 1772 304 4 595348 6.2521 185 12655 5.4736 3.1371 AM 2 9522 3.9703 5950 352527 53109 695 2.6928 B.130.4 6.BE63 63 7 9867 BE 2.1588 Mong CN AT THE m 93578 2 3276 12.468 8 22 186 . H 1961 3.3793 120399 7.6900 228 12.375 26.623 0 56 25270 3.996 43157 6.5436 ER 5.417 10.575 12 0565 10.197 11.523 67275 9 22788 2.7860 33996 50338 6. 1088 002 8.9.192 10.804 03 15.668 18:22 99 108 120 3.9336 44 47200 HOLID 36039 12 13.052 172861 20.362 8.1403 8.8943 9 8497 26. 186 0 11.026 5.4365 5.8715 4 6.6586 72579 7 911 BB23 1251 50724 16.62 ta 7AR 211545 24.891 7.519 12 239 15,179 23 212 2919 5 SE 192 13589 17.000 2129 26.462 1 S92a 7.6121 10060 22.892 17.449 28.102 29.960 52.800 50.950 38.575 39.1116 72.068 BI537 20.444 22 251 85.850 : nEE 11 124 66.212 133 116 156 152 28BET 30-913 59 136 ST 60 31309 74358 259 17:39 8 65.00 16.56% 93.051 289 002 27 450 ZS 13-880 700233 Table A-2 Future Value Interest Factors for a One-Dollar Annuity Compouned at k Percent for n Perloda: FVIFA,n - [(1 = k)".1]/k 10% 1313 IS DODE 20100 3.0307 Luo 2016 12 D3DE 10700 : 1060) 20800 1.1300 LOFT 12000 10300 2.0300 3.0909 1.1836 12400 1.0500 ENG 3.1528 3101 4.45 7.1300 PAN 135 5. 1.1000 2 1000 3.3100 TO 3.12116 25 11200 2.1200 3.3747 09 21600 11% 1-1100 2.1100 3 07097 6.2278 10900 10900 THE 22000 29 14% 11100 21400 13.3 49211 6.6101 1 2500 2:2500 3.8125 % 30 069 11500 2.1500 9 6.7424 1 3000 23000 900 29 5051 205 18198 54163 5 6.7507 16 6. 1061 53 6.4903 5 9.0031 72835 7 8895 77156 9 12 35-155 8 1939 98975 9.591 11.027 2 9.222 10.583 12.006 7.9129 97 7.5233 9 2004 T9 13.021 15.193 13 233 9.3683 0.1152 10.089 12 300 16 17.5.19 15 073 5 19.123 12.756 17-583 23858 32.015 11.978 13 816 13.181 14.164 16.722 16.085 15.937 20.30 172519 316.03 25.802 33253 EREDE 56 405 531 15818 880 0 18 827 18 292 20.024 25650 29.985 17 713 19 599 22 953 19 7 312 4 32 089 37 581 1 2195 27.152 22 550 36 109.687 2 352 10 505 97 825 32393 37 280 404417 7.580 1003315 . 23.657 0 35.950 40.545 5 4 { JO 906 32780 36788 9 33068 1750 5. 9 37 379 40 995 56 939 H703 #1 55.750 72052 89 45 51 159 57 275 E: 78.969 91 025 # MI MAMMA 15 38.505 39.993 43:392 REA 30.537 56.755 S, 18 55.457 14 49.006 51 416 64.002 71.403 79.54) 497 8188 9270 92.503 Us 118.155 133 334 155 620 4 329.681 102. 174 18187 73 106 46.46 76.790 & 219 98 347 112413 199.021 341.590 SB 80 462 63.276 75407 56.085 66.439 4.46 113 283 136.308 16-4.494 73.552 111435 #12 27 1.024 99.836 119. 121 118.913 187.102 236.125 289. 127 10 152.667 209 216 054 293199 356.787 1563 HEERS 8 # DEL Table A-3 Present Value Interest Factors for One Dollar Discounted at & Percent for n Periods: PVIF,=1/(1 + x)" , Penod 89 9 120 2009 30% 0.7592 0.9434 0.9346 0.2174 1 0.9901 03800 00706 0.9810 2 0.9804 0.9612 0.3422 0.9338 3 0.9709 0.3426 0.9151 0.8885 0.9610 0.9246 0.8890 0.85.18 BAN 0.9024 0.9070 0.868 0.8227 11 019009 OJO11G 0.7.12 0.920-9 0.8573 0.7930 0.0300 0.8096 0.7921 102 Q13091 01264 0.7513 0.6830 0.6209 02417 0.1122 0.7084 0.8929 0.7972 0.7110 0.6355 13% O.BBDO 0.7831 0.6931 0.8133 0.6428 0.8772 0.7695 0.6750 0.5921 10% 0.8586 0.7561 0.6575 0.5718 16% 0.8621 0.7432 0.6407 0.5523 0.4761 2014 0.8333 0.6944 0.5787 0.4823 0.8060 0.5504 0.5245 2025 0.8000 0 $400 0.5120 0.4098 0.32TT 0.816 0.7679 0.7150 0.8587 0.0230 0.4552 0.3501 0.2693 0.96 0.9057 0.8528 0.8219 DUTB35 0.7473 0.7130 006.806 0.6499 0.5835 0.5674 0.5194 0.4972 0.4019 0.3411 6 8420 0.832 019235 0.8880 0.8TOG DR535 0.8375 0.8131 OTA94 0.7903 0.7599 0.7307 0.7026 0.7050 0.6651 0.6274 0.4556 0.3896 0.7452 0.7 107 0.6768 0.6.2016 0.6139 0.6667 0.6227 0:58:20 0.5139 0.5083 0.6302 0.5835 05403 0.5002 0.4632 0.5963 0.5470 05019 041604 0.5346 0.4817 0 4139 02072 0.1544 0.5066 0.4523 0.4039 0.5645 0.5132 04665 0.1241 0.3855 0.4323 0.3753 0.3269 3 0.4803 0.4251 0 3762 0.3329 0.29.46 0.4104 0.3530 0.3050 0.2630 0.3349 0.2731 0.2328 0.2621 02097 O1670 0.2761 012218 0.1789 0.1413 0.116.4 0.3506 DIST 0.786.4 0.58 19 0.28.43 0.1938 0.8368 0.8203 0.3909 03:22 013606 0.3220 0.3075 0.2697 0.09433 0.0725 10 0.9053 0.7341 0.6756 0.5384 0.4224 0.2472 0.2267 0.1815 0.1074 0.6847 0.0268 0.4289 0.3875 12 D18863 Q8874 DETOT 0.8043 0.7685 0.7730 0.7579 0.7430 0.7224 0.7014 0.6810 0 B811 0.6496 0.6246 0.6006 0.5568 035303 0.5051 0.4970 0.4688 0.4423 0.4751 0.40 0.4150 0.3878 0.3971 0.3677 0 3.405 0.1555 0.3262 0 2992 0.3503 03186 0.2897 0.2633 0.3173 0.2858 0.2575 0.2878 0.2567 0.2292 02048 0.2607 0.2307 0.2042 0.2366 0.2076 0.1821 0.2149 0.1869 0.1625 0 1413 0.1964 0.1685 0.1452 0.1346 0.1122 0.0935 0.0779 0.0649 0.0938 0,0757 DOSTO 0.0.492 0.0859 0.0687 0.0550 0 0 0.0352 0.0558 0.0023 0.01030 0.0254 O BZDO 0.5775 0.2320 O. 1807 0 1597 0.1252 0.1079 15 0.8613 0.6419 0.5083 0.4810 0.4173 0.3624 0.3 102 0.2745 0.7394 02090 0.1827 0.1699 0.1401 0.1229 0.0397 0.0195 08528 16 IT 0.11284 0.142 0.6232 0.6050 0.5119 0.5134 04936 DBLES OB360 0.4581 0.4363 04155 0.3936 0.3714 0 3503 0.187 0.3166 02959 0.2013 0.2703 02502 0.2513 0.2011 02120 0.2176 0.1978 0 1799 0.1883 0.1696 0 1528 0.1377 0.1069 0.0929 0.1631 0.1456 0 1300 0.1161 0.1415 0.1252 01108 0.1229 0.1078 0 0946 0.0330 0.0002 0 0891 000281 0.0225 O 0180 0.0541 0.0451 0 0376 0.03.18 0.0261 0.0-320 0.025 0 0208 0.0168 0.0134 0.0150 0.0115 0 0009 0.0068 0.0053 0 587 18 0 7002 0 0808 0.0703 0.5703 0.827 119 0.3957 0.6864 0.2765 0.3305 0.01.14 0.19.15 0.0829 0.1635 0.0981 0.0596 0.1746 0.456-1 0.2317 0.21:15 20 0.5537 0.3118 0.67130 0.3769 0.2581 0 1784 0.1:6B6 0.1240 0.0868 0.1037 0.8.195 0.0115 0.0728 0.05.14 0.0611 0.0531 0.0443 0.1637 0.0217 21 0.0032 0.8114 0.4388 0.3375 0.529 0.5067 0 1919 0.3583 03418 03256 0.2942 0.2775 0 2618 0.2416 0.2257 0.2103 0.6598 0.6068 0642 0 6217 0.6096 0.4220 0.4057 0.3901 0.1987 01809 01703 0. 1577 0.1460 0.1351 0 1228 0 1117 0 1015 0.1117 0.1007 0 0907 00817 0.0768 0.0680 0.0601 0.0926 0.0826 O 0738 O 0659 00302 0.0329 0.0638 0.0560 0.0491 0.0431 001 05 01502 0 1378 01264 10.1160 0.0462 0.0402 0.03.09 0.0074 00059 0.00ULO 0.0031 0.0024 0.7954 07876 0.0 103 ODOS 0007 O 0057 0 1971 0.0532 0.0047 O 026 0.0284 03101 02470 0.0018 ele 0.1842 OLOT36 0.0888 0.0378 0.0471 0.0248 0.01804 0.0923 0.000 1038 0.00416 0.2903 0.2330 0.001 D.TT9B 0.4776 0.3701 25 00437 0.0136 0.0012 0.7418 0.7059 30 35 36 0.0042 0.0017 04120 0.3554 0 3450 0.3083 0.2534 0237 0.0016 0.0005 0.2314 0.1813 01727 0.075.4 0.0490 00449 0.1314 0.0037 0 0875 0.0934 0.0676 0 06:26 0.0-460 0 0213 0.741 0304 01227 0.0972 0 05:43 0.5523 0.5000 0902 D.4529 037215 0.0304 0.0103 O 0169 0 0573 0.0356 00323 0.0221 0 0085 0.0256 0.0139 0.0123 0.0258 00234 0.0 151 0.0075 0 0065 O DONA 0 6989 0.01 0.0055 0 0028 0.0026 0.0006 0.0102 00089 0.0003 ODOH 0.00071 30 0.6717 D 6DBO 0.3066 02281 0,2083 0807 0.120 00872 0.0668 00339 0.0318 O 0134 0.015 01005A O 0107 00035 O DO7 O 0022 0.0037 0.0009 50 Table A-4 Present Value Interest Factors for a One-Dollar Annuity Discounted at k Percent for n Periods: PVIFA - (1 - 1/(1 + k)"]/k Period 0.9709 143 151 2099 0.9901 0.9615 7 0.93.46 1.8080 3046 DS? 1.8594 846 0.9259 1.7833 19 13416 9 0.9434 1.8334 2.6730 3.4651 124 9 06 1.7591 2.5313 3.7397 3.8897 0.9091 1.7356 3 1699 3.7908 0.7592 1.3609 13% 2.3812 2.9715 3.6172 0909 1.7 126 24437 3.1024 3.9020 4863 0.8929 1.6901 2.4018 3.0373 3.6048 3.3872 4.1002 0.8333 1.5278 2.1085 1667 213216 -2.9137 2.1331 0.8696 1.6257 22 2.8550 3.352 0.8621 1.6062 2.2459 20W 2 24946 20 1.4668 19 274043 27154 2 0.8000 466 19520 2.3818 2.6893 7.5797 1 39927 2.9906 718 56014 5.7955 6.7282 7.6517 13.3255 55 6.0027 7.4353 5.0757 6.7863 E 07 F1 85302 47665 5.3993 5.9713 6.51152 7 0236 46229 5 2064 5.7466 9 6 7101 5.0330 5.5348 5.9952 64177 4.3553 4.8684 5.3349 5.77590 4 2305 4.7122 5.1461 5.5370 5 8892 3.9975 26 4.7988 5.1317 13 8887 28-83 4.6389 4 1114 4.8638 53282 *O7 4.0386 4.4135 3.0205 312023 12 17 4.1604 4.4873 50188 | 3.9372 7 3601 2.9514 1.1611 3.3289 34631 3.5705 2 28021 2.9247 3.0190 3.0915 89836 6 10:46 52161 1.8337 67 40310 1925 3.5655 2699 12 10 575 99340 8.3064 32 11255 123134 5.4.527 7.8869 8 3838 9. 3851 7.190 75361 7.9038 12 10.635 360 7.4987 7.9427 8.3577 8.7455 9 1079 F1 74869 7.7862 3 8514 8.8527 4951 6.8137 7.1034 SET 7 6061 12065 1974 0 3. 1473 3. 1903 5.9377 35 5 5.6869 5 9176 6.1218 6.925 9 413271 TE 5.2337 54206 5.5831 5.7245 58474 5.028 5.1971 5.4675 5.5755 15 327801 14 9.7122 15 5.8424 6.0021 577 1938 19124 19616 10.380 8 5595 ) 3.2497 3.7682 10013 8.8514 # 6.97440 18 10.106 * 10.828 9 7632 10.059 5.9542 9 12 16 16. 398 11 274 11 690 12.085 2.462 # 60472 93719 168 3.3126 P126 8 7555 8.9501 9. 128-5 7.8237 3 3.5136 7.3782 77016 FB 759 32948 1725 # 6.6039 167291 6.8399 6.9380 74 3 9099 3.9279 198 7 2497 14 6.2651 63229 5 6.5504 6.6231 12BE 0591 5.6685 5 7487 5.8178 5. 5 5.9288 11.158 10 14 9.6036 191 33037 13.590 10 594 6. 1982 420967 3105 3.9539 11764 10.636 144451 10.017 10 201 92922 9424 7.5620 TELLE , 2.0751 81757 PEE , 6.7429 1882 21.903 8.6487 8.77 15 B 8837 194 7 11272 E 24 2 489 14.054 12 303 12 550 3.3230 G.3587 16 3988 ETH 7.1016 7.1695 22829 7.0300 5797 11169 10 572 7 7183 TEL 1802 9.7066 1924 1 2.300 11371 23 8.3481 BE 333750 10.675 100 8.4217 701 6 B351 27 R 30 9 22396 19 600 12409 10 27 9 128 11.955 8.6938 9 ? 0 PES 0.0552 99 25.489 27 355 31424 32.935 2996 17 292 18.665 18.908 19 793 21 482 23 115 25 730 13372 16.374 168547 17 139 18.256 14 498 14 621 10 10.567 29 13035 13.332 1 9.6442 B.155 (2 1957 7.5856 75979 11 B2 19 779 pe 81951 19.0117 11925 12233 19 199 10.7 1998 1.9966 -- 612150 6.2335 OD 11132 51 - 11559 045 -995 33332 3.3333 11666

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started