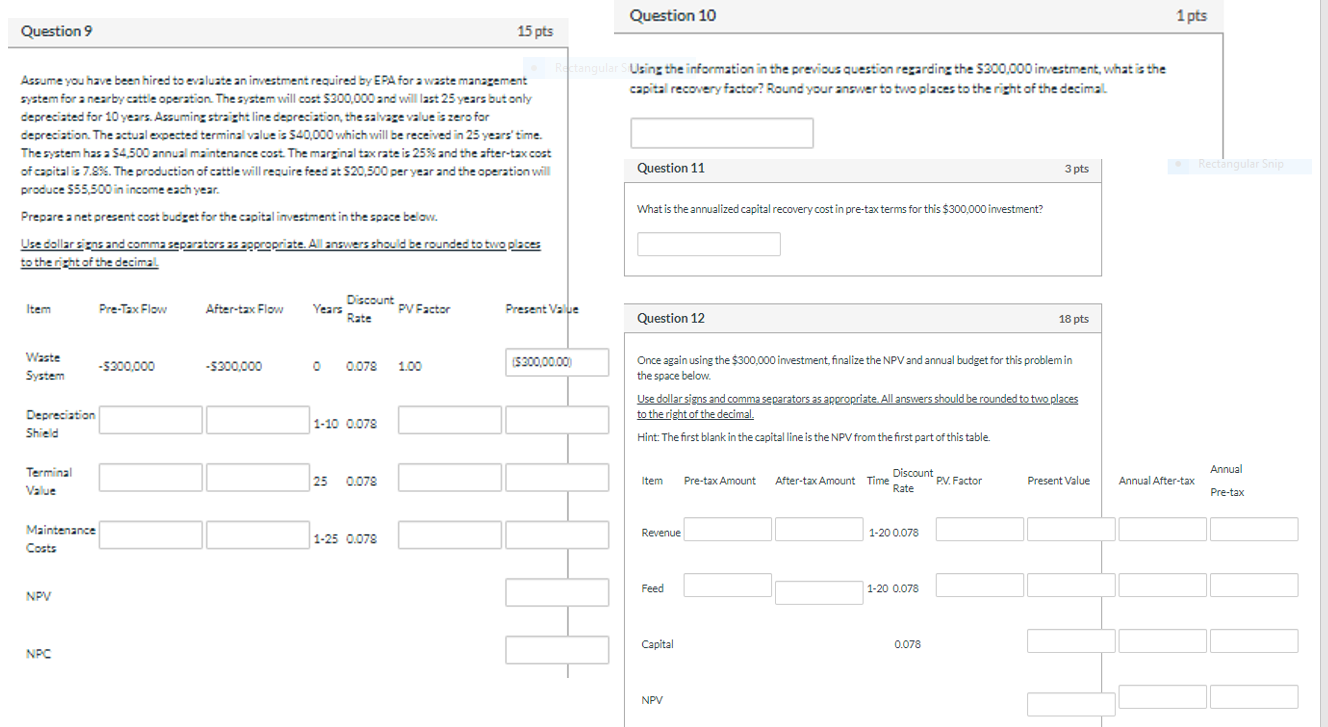

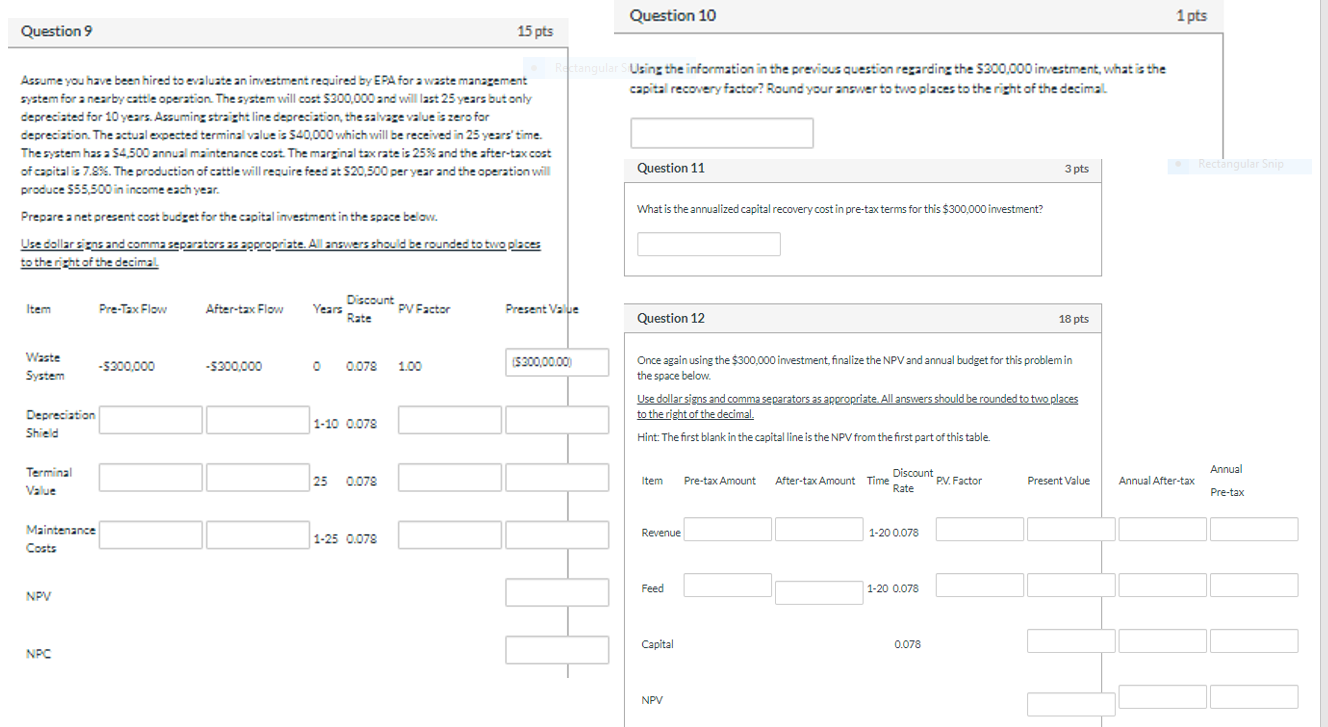

Question 10 1 pts Question 9 15 pts Using the information in the previous question regarding the $300,000 investment, what is the capital recovery factor? Round your answer to two places to the right of the decimal Assume you have been hired to evaluate an investment required by EPA for a waste management system for a nearby cattle operation. The system will cost $300,000 and will last 25 years but only depreciated for 10 years. Assuming straight line depreciation, the salvage value is zero for depreciation. The actual expected terminal value is 540,000 which will be received in 25 years' time. The system has a 54,500 annual maintenance cost. The marginal tax rate is 2596 and the after-tax cost of capitalis 7.895. The production of cattle will require feed at 520,500 per year and the operation will produce 555,500 in income each year. Question 11 3 pts Rectangular Snip What is the annualized capital recovery cost in pre-tax terms for this $300,000 investment? Prepare a net present cost budget for the capital investment in the space below. Use dollars ns and comma separators as appropriate. A answers should be rounded to two places to the nint of the decimal Discount PV Factor Item Pre-Tax Flow After-tax Flow Years Present Value Question 12 18 pts Waste System -5900,000 -5300,000 0 0.078 1.00 15300,00.00) Once again using the $300,000 investment, finalize the NPV and annual budget for this problemin the space below. Use dollar signs and comma separators as areropriate All answers should be rounded to two places to the right of the decimal. Hint: The first blank in the capital line is the NPV from the first part of this table. Depreciation Shield - 1-10 0.078 Annual Terminal Value 25 Discount pv. Factor 0.078 Item Pre-tax Amount After-tax Amount Time "Rate Present Value Annual After-tax Pre-tax Maintenance Costs 1-25 0.078 Revenue 1-20 0.078 Feed 1-20 0.078 NPV Capital 0.078 NPC Question 10 1 pts Question 9 15 pts Using the information in the previous question regarding the $300,000 investment, what is the capital recovery factor? Round your answer to two places to the right of the decimal Assume you have been hired to evaluate an investment required by EPA for a waste management system for a nearby cattle operation. The system will cost $300,000 and will last 25 years but only depreciated for 10 years. Assuming straight line depreciation, the salvage value is zero for depreciation. The actual expected terminal value is 540,000 which will be received in 25 years' time. The system has a 54,500 annual maintenance cost. The marginal tax rate is 2596 and the after-tax cost of capitalis 7.895. The production of cattle will require feed at 520,500 per year and the operation will produce 555,500 in income each year. Question 11 3 pts Rectangular Snip What is the annualized capital recovery cost in pre-tax terms for this $300,000 investment? Prepare a net present cost budget for the capital investment in the space below. Use dollars ns and comma separators as appropriate. A answers should be rounded to two places to the nint of the decimal Discount PV Factor Item Pre-Tax Flow After-tax Flow Years Present Value Question 12 18 pts Waste System -5900,000 -5300,000 0 0.078 1.00 15300,00.00) Once again using the $300,000 investment, finalize the NPV and annual budget for this problemin the space below. Use dollar signs and comma separators as areropriate All answers should be rounded to two places to the right of the decimal. Hint: The first blank in the capital line is the NPV from the first part of this table. Depreciation Shield - 1-10 0.078 Annual Terminal Value 25 Discount pv. Factor 0.078 Item Pre-tax Amount After-tax Amount Time "Rate Present Value Annual After-tax Pre-tax Maintenance Costs 1-25 0.078 Revenue 1-20 0.078 Feed 1-20 0.078 NPV Capital 0.078 NPC