Answered step by step

Verified Expert Solution

Question

1 Approved Answer

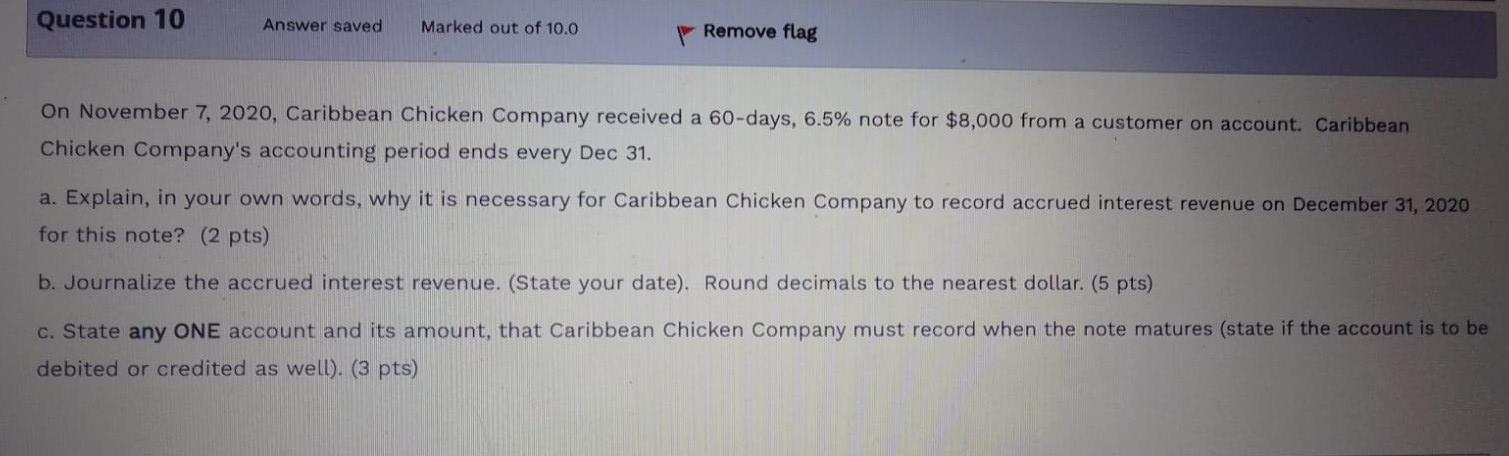

Question 10 Answer saved Marked out of 10.0 Remove flag On November 7, 2020, Caribbean Chicken Company received a 60-days, 6.5% note for $8,000 from

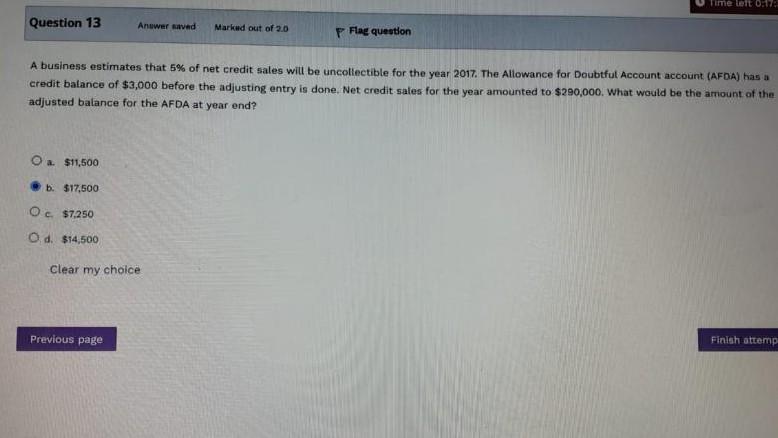

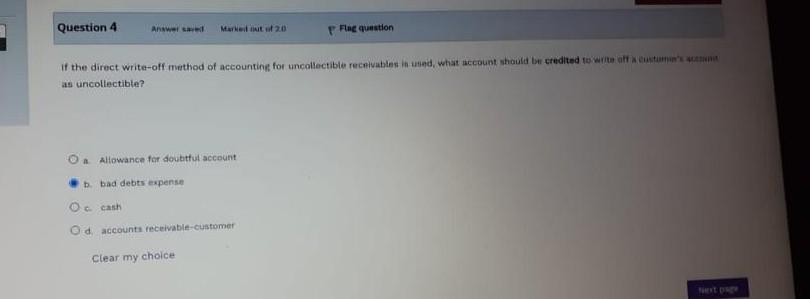

Question 10 Answer saved Marked out of 10.0 Remove flag On November 7, 2020, Caribbean Chicken Company received a 60-days, 6.5% note for $8,000 from a customer on account. Caribbean Chicken Company's accounting period ends every Dec 31. a. Explain, in your own words, why it is necessary for Caribbean Chicken Company to record accrued interest revenue on December 31, 2020 for this note? (2 pts) b. Journalize the accrued interest revenue. (State your date). Round decimals to the nearest dollar. (5 pts) c. State any ONE account and its amount, that Caribbean Chicken Company must record when the note matures (state if the account is to be debited or credited as well). (3 pts) Time tot Question 13 Anuwer saved Marked out of 2.0 F Flag question A business estimates that 5% of net credit sales will be uncollectible for the year 2017. The Allowance for Doubtful Account account (AFDA) has a credit balance of $3,000 before the adjusting entry is done. Net credit sales for the year amounted to $290,000. What would be the amount of the adjusted balance for the AFDA at year end? a. $11,500 b. $17.500 Oc. $7.250 O d. $14,500 Clear my choice Previous page Finish attemp Question 4 Answers Marlent 20 Pue question of the direct write-off method of accounting for uncollectible receivables in used, what account should be credited to write affectum' as uncollectible? O Allowance for doubtfut account bad debts expense a cash Od accounts receivable-customer Clear my choice

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started