Question: Question 10 Consider a Siamese Twins company, called XY, with its two parts X and Y. X and Y are listed both in the

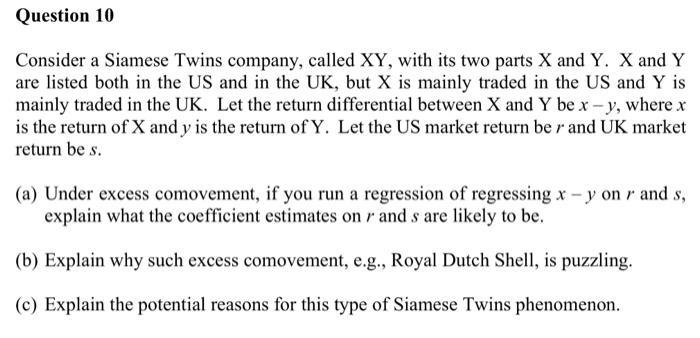

Question 10 Consider a Siamese Twins company, called XY, with its two parts X and Y. X and Y are listed both in the US and in the UK, but X is mainly traded in the US and Y is mainly traded in the UK. Let the return differential between X and Y be x - y, where x is the return of X and y is the return of Y. Let the US market return ber and UK market return be s. (a) Under excess comovement, if you run a regression of regressing x-y on r and s, explain what the coefficient estimates on r and s are likely to be. (b) Explain why such excess comovement, e.g., Royal Dutch Shell, is puzzling. (c) Explain the potential reasons for this type of Siamese Twins phenomenon.

Step by Step Solution

3.28 Rating (154 Votes )

There are 3 Steps involved in it

a Under excess com ove ment the coefficient estimates on r and s are likely to be positive and ... View full answer

Get step-by-step solutions from verified subject matter experts