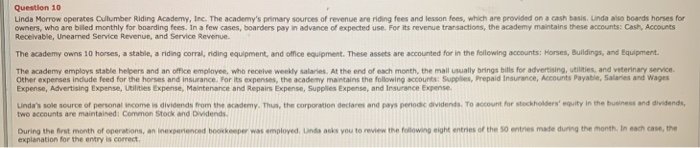

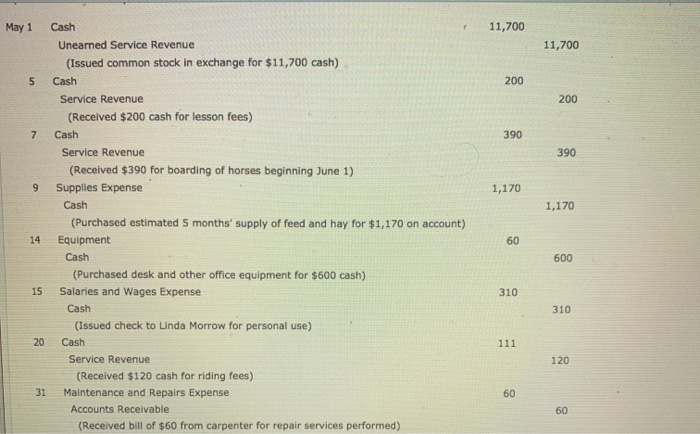

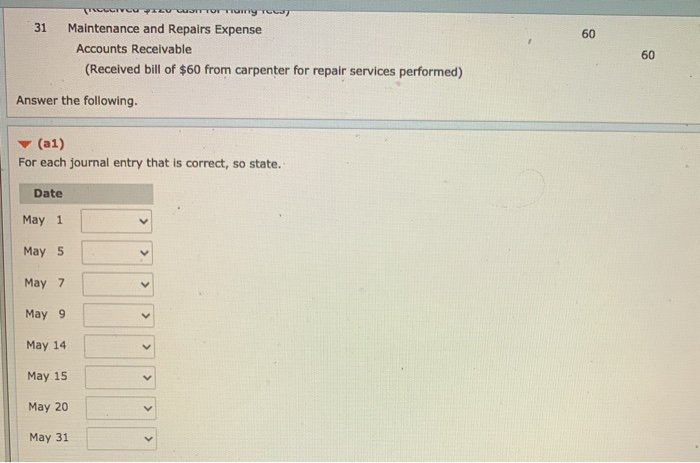

Question 10 Linda Morrow operates Oulumber Riding Academy, Inc. The academy's primary sources of revenue are riding fees and lesson fees, which are provided on a cash basis. Linda also boards horses for owners, who are billed monthly for boarding fees. In a few cases, boarders pay in advance of expected use. For its revenue transactions, the academy maintains these accounts: Cash, Accounts Receivable, Uneared Service Revenue, and Service Revenue The academy owns 10 horses, a stable, a riding corral, riding equipment, and office equipment. These assets are accounted for in the following accounts: Horses, Buildings, and Equipment The academy employs stable helpers and an office employee, who receive weekly salaries. At the end of each month, the mail usually brings bills for advertising, Utilities, and veterinary service Other expenses include feed for the horses and insurance. For its expenses, the academy maintains the following accounts: Supplies, Prepaid Insurance, Accounts Payable, Salaries and Wages Expense, Advertising Expense, Utilities Expense, Maintenance and repairs Expense, Supplies Expense, and Insurance Expense. Unda's sole source of personal income is dividends from the academy. Thus, the corporation declares and pays periodic dividends. To account for stockholders' equity in the business and dividende, two accounts are maintained: Common Stock and Dividends. During the first month of corations, an inexperienced bookkeeper was employed. Unda asks you to review the following eight entries of the 50 entries made during the month. In each case, the explanation for the entry is correct May 1 11,700 11,700 5 200 200 7 390 390 9 1,170 1,170 Cash Unearned Service Revenue (Issued common stock in exchange for $11,700 cash) Cash Service Revenue (Received $200 cash for lesson fees) Cash Service Revenue (Received $390 for boarding of horses beginning June 1) Supplies Expense Cash (Purchased estimated 5 months' supply of feed and hay for $1,170 on account) Equipment Cash (Purchased desk and other office equipment for $600 cash) Salaries and Wages Expense Cash (Issued check to Linda Morrow for personal use) Cash Service Revenue (Received $120 cash for riding fees) Maintenance and Repairs Expense Accounts Receivable (Received bill of $60 from carpenter for repair services performed) 14 60 600 15 310 310 20 111 120 31 60 60 TULIVU 2 LOTO rumy TELJ 60 60 31 Maintenance and Repairs Expense Accounts Receivable (Received bill of $60 from carpenter for repair services performed) Answer the following. (al) For each journal entry that is correct, so state. Date May 1 > May 5 May 7 > May 9 May 14