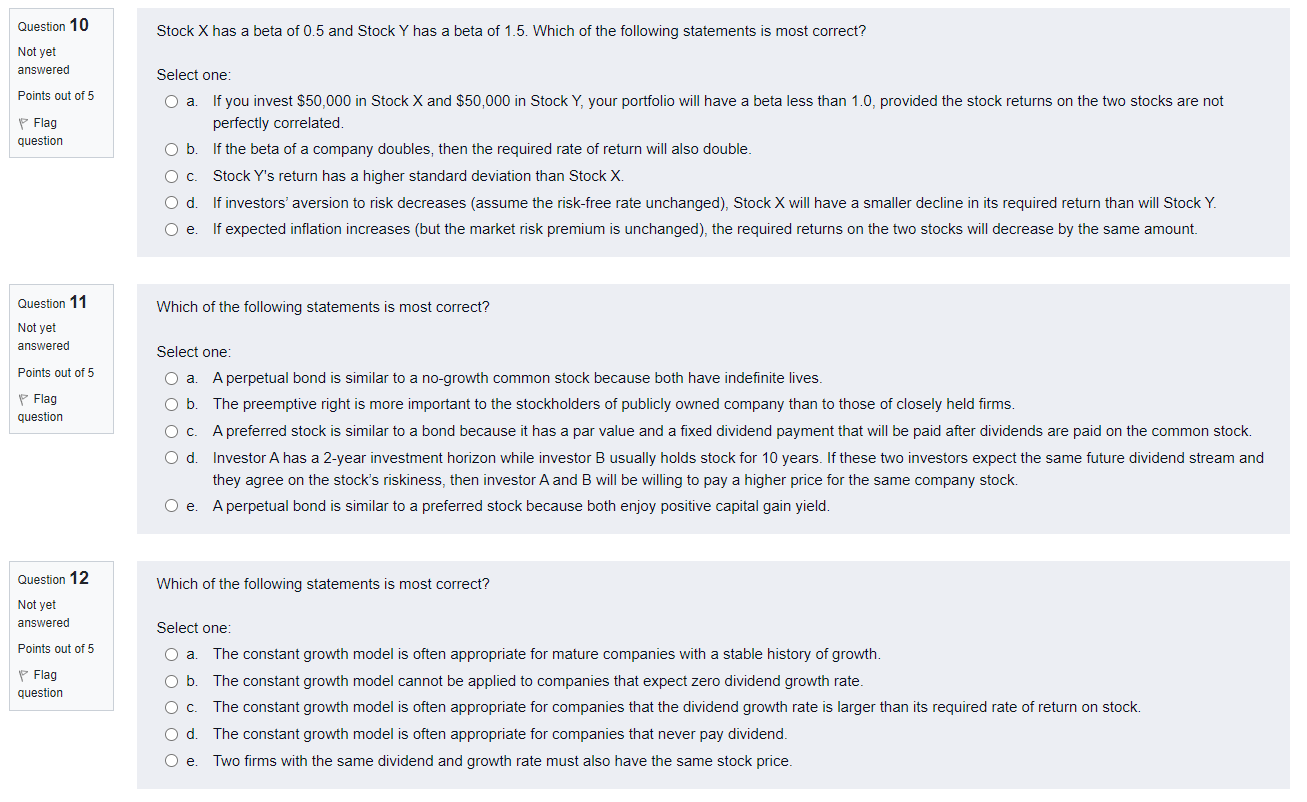

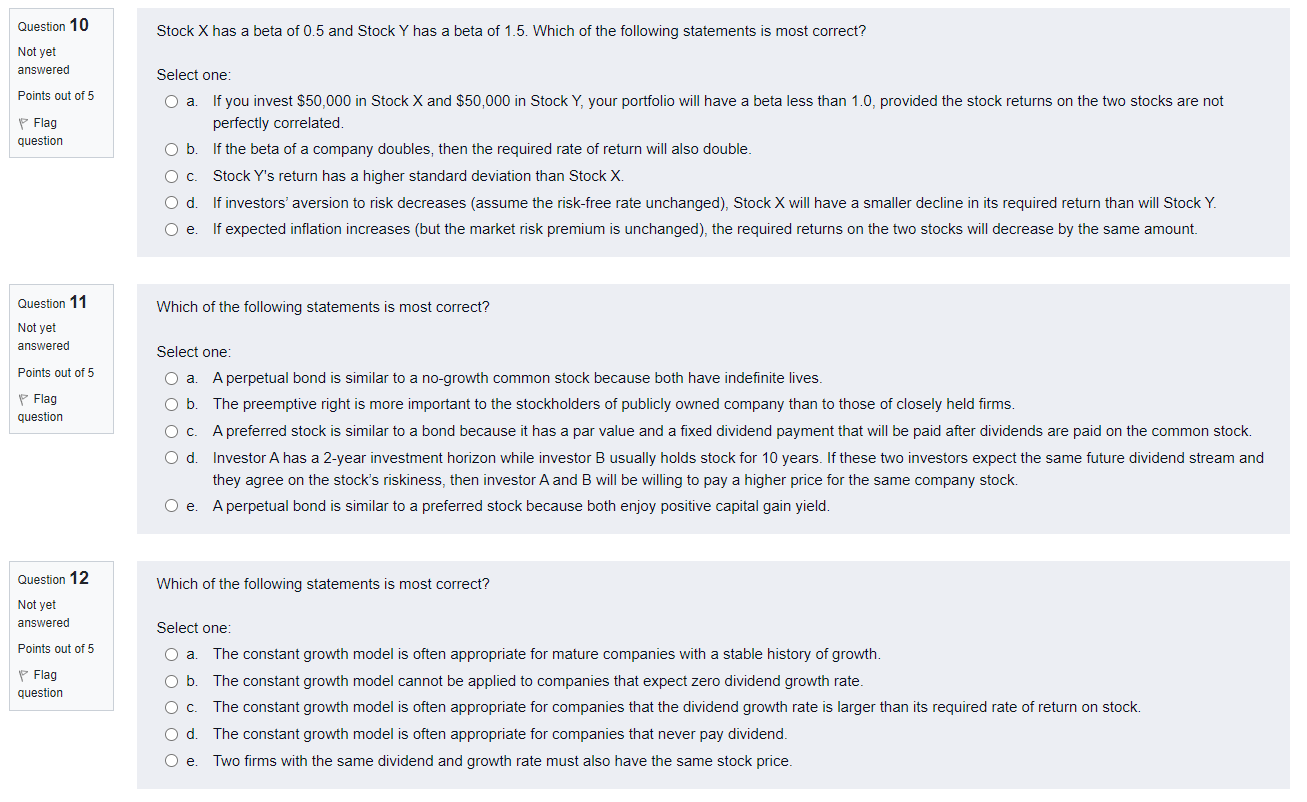

Question 10 Stock X has a beta of 0.5 and Stock Y has a beta of 1.5. Which of the following statements is most correct? Not yet answered Select one: Points out of 5 P Flag question O a If you invest $50,000 in Stock X and $50,000 in Stock Y, your portfolio will have a beta less than 1.0, provided the stock returns on the two stocks are not perfectly correlated. O b. If the beta of a company doubles, then the required rate of return will also double. O C. Stock Y's return has a higher standard deviation than Stock X. O d. If investors' aversion to risk decreases (assume the risk-free rate unchanged), Stock X will have a smaller decline in its required return than will Stock Y. O e. If expected inflation increases (but the market risk premium is unchanged), the required returns on the two stocks will decrease by the same amount. Question 11 Which of the following statements is most correct? Not yet answered Points out of 5 P Flag question Select one: O a. A perpetual bond is similar to a no-growth common stock because both have indefinite lives. Ob. The preemptive right is more important to the stockholders of publicly owned company than to those of closely held firms. O c. A preferred stock is similar to a bond because has a par value and a fixed dividend payment that will be paid after dividends are paid on the common stock. Od Investor A has a 2-year investment horizon while investor B usually holds stock for 10 years. If these two investors expect the same future dividend stream and they agree on the stock's riskiness, then investor A and B will be willing to pay a higher price for the same company stock. O e. A perpetual bond is similar to a preferred stock because both enjoy positive capital gain yield. Question 12 Which of the following statements is most correct? Not yet answered Points out of 5 Flag question Select one: O a. The constant growth model is often appropriate for mature companies with a stable history of growth. Ob The constant growth model cannot be applied to companies that expect zero dividend growth rate. O c. The constant growth model is often appropriate for companies that the dividend growth rate is larger than its required rate of return on stock. O d. The constant growth model is often appropriate for companies that never pay dividend. Oe. Two firms with the same dividend and growth rate must also have the same stock price