Answered step by step

Verified Expert Solution

Question

1 Approved Answer

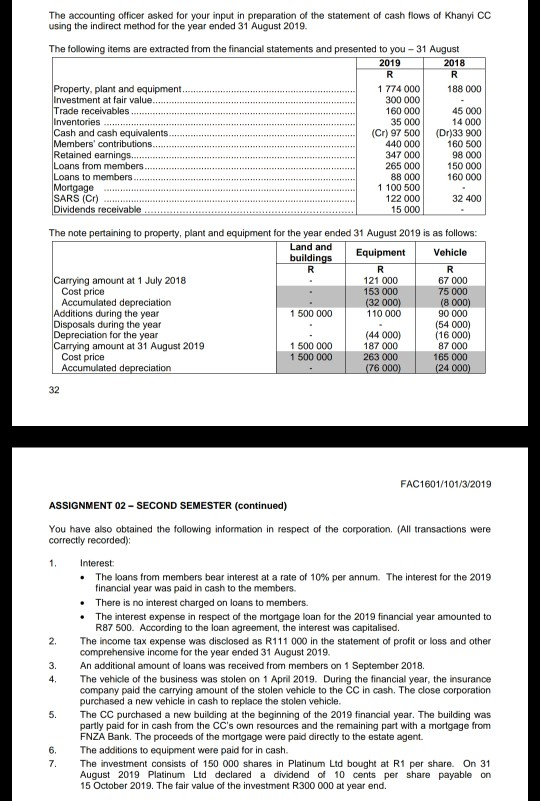

Question 10 The accounting officer asked for your input in preparation of the statement of cash flows of Khanyi CC using the indirect method for

Question 10

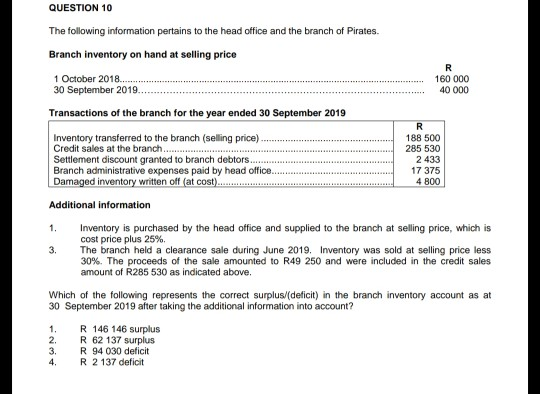

The accounting officer asked for your input in preparation of the statement of cash flows of Khanyi CC using the indirect method for the year ended 31 August 2019. The following items are extracted from the financial statements and presented to you 31 August 2019 1 774 000 300 000 160 000 35 000 188 000 plant and equipment t at fair value 45 000 Trade receivables h and cash equivalents (Cr) 97 500(Dr)33 900 160 500 98 000 150 000 160 000 440 000 347 000 265 000 88 000 1 100 500 122 000 15 000 Retained earnings. s from members to members 32 400 The note pertaining to property, plant and equipment for the year ended 31 August 2019 is as follows: Land andE buildin Equipment Vehicle amount at 1 July 2018 67 000 75 000 (8 000) 90 000 Cost price 153 000 (32000) 110 000 itions during the year Disposals during the year Depreciation for the year 1 500 000 amount at 31 August 2019 1 500 000 1 500 000 187 000 263 000 87 000 165 000 Cost price FAC1601/101/3/2019 ASSIGNMENT 02- SECOND SEMESTER (continued) You have also obtained the following information in respect of the corporation. (All transactions were correctly recorded) The loans from members bear interest at a rate of 10% per annum. The interest for the 2019 * financial year was paid in cash to the members. There is no interest charged on loans to members. .The interest expense in respect of the mortgage loan for the 2019 financial year amounted to R87 500. According to the loan agreement, the interest was capitalised. The income tax expense was disclosed as R111 000 in the statement of profit or loss and other comprehensive income for the year ended 31 August 2019. An additional amount of loans was received from members on 1 September 2018. The vehicle of the business was stolen on 1 April 2019. During the financial year, the insurance company paid the carrying amount of the stolen vehicle to the CC in cash. The close corporation purchased a new vehicle in cash to replace the stolen vehicle. The CC purchased a new building at the beginning of the 2019 financial year. The building was partly paid for in cash from the CC's own resources and the remaining part with a mortgage from FNZA Bank. The proceeds of the mortgage were paid directly to the estate agent The additions to equipment were paid for in cash. The investment consists of 150 000 shares in Platinum Ltd bought at R1 per share. On 31 August 2019 Platinum Ltd declared a dividend of 10 cents per share payable on 15 October 2019. The fair value of the investment R300 000 at year end. 2 3. 4. 5. 6. 7. QUESTION 10 The following information pertains to the head office and the branch of Pirates. Branch inventory on hand at selling price 1 October 2018. 30 September 2019. 160 000 40 000 Transactions of the branch for the year ended 30 September 2019 Inventory transferred to the branch (selling price) Credit sales at the branch Settlement discount granted to branch debtors Branch administrative expenses paid by head office Damaged inventory written off (at c 188 500 285 530 2 433 17 375 4 800 Additional information 1 Inventory is purchased by the head office and supplied to the branch at selling price, which is cost price plus 25%. The branch held a clearance sale during June 2019. Inventory was sold at selling price less 30%. The proceeds of the sale amounted to R49 250 and were included in the credit sales amount of R285 530 as indicated above. 3. Which of the following represents the correct surplus/(deficit) in the branch inventory account as at 30 September 2019 after taking the additional information into account? 1. 2. 3. R 146 146 surplus R 62 137 surplus R 94 030 deficit R 2 137 deficitStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started