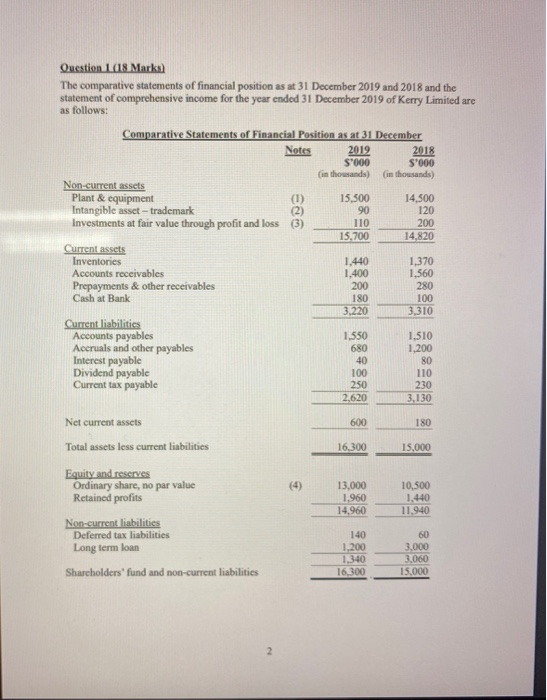

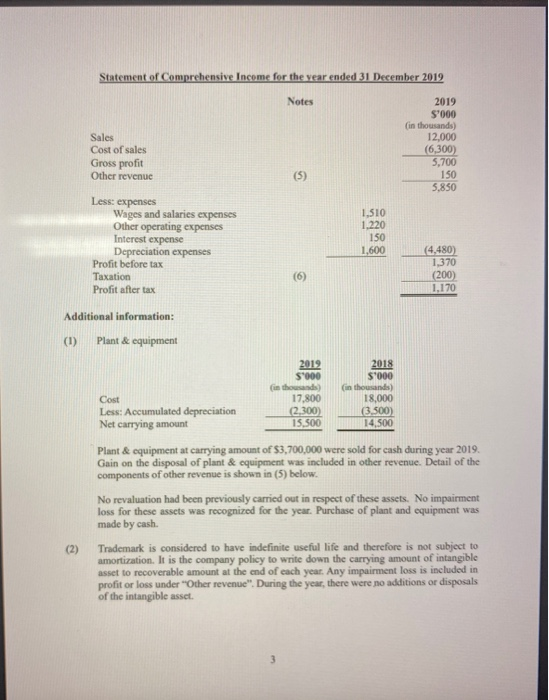

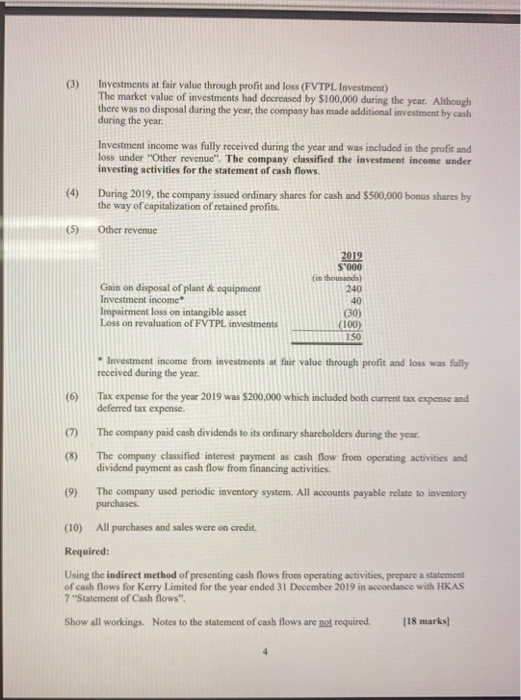

Question 1018 Marks) The comparative statements of financial position as at 31 December 2019 and 2018 and the statement of comprehensive income for the year ended 31 December 2019 of Kerry Limited are as follows: Comparative Statements of Financial Position as at 31 December Notes 2019 2018 S'000 S'000 (in thousands) (in thousands) Non-current assets Plant & equipment 15,500 14,500 Intangible asset - trademark (2) 90 120 Investments at fair value through profit and loss (3) 110 200 15.700 14,820 Current assets Inventories 1.440 1.370 Accounts receivables 1,400 1.560 Prepayments & other receivables 200 280 Cash at Bank 180 100 3,220 3,310 Current liabilities Accounts payables 1,550 1,510 Accruals and other payables 680 1,200 Interest payable 40 80 Dividend payable 100 110 Current tax payable 250 230 2,620 3,130 Net current assets 600 180 Total assets less current liabilities 16,300 15,000 di bavi (4) 13,000 1,960 14,960 10,500 1.440 11.940 Equity and reserves Ordinary share, no par value Retained profits Non-current liabilities Deferred tax liabilities Long term loan Sharcholders' fund and non-current liabilities 140 1,200 1,340 16,300 60 3,000 3,060 15,000 Statement of Comprehensive Income for the year ended 31 December 2019 (200) Notes 2019 S'000 (in thousands) Sales 12,000 Cost of sales (6,300) Gross profit 5,700 Other revenue (5) 150 5.850 Less expenses Wages and salaries expenses 1.510 Other operating expenses 1.220 Interest expense 150 Depreciation expenses 1,600 (4.480) Profit before tax 1,370 Taxation Profit after tax 1,170 Additional information: (1) Plant & equipment 2019 2018 S'000 S'000 in thousands in thousands) Cost 17,800 18,000 Less: Accumulated depreciation (2.300) 3.500) Net carrying amount 15.500 14,500 Plant & equipment at carrying amount of $3,700,000 were sold for cash during year 2019. Gain on the disposal of plant & equipment was included in other revenue. Detail of the components of other revenue is shown in (5) below. No revaluation had been previously carried out in respect of these assets. No impairment loss for these assets was recognized for the year. Purchase of plant and equipment was made by cash (2) Trademark is considered to have indefinite useful life and therefore is not subject to amortization. It is the company policy to write down the carrying amount of intangible asset to recoverable amount at the end of each year. Any impairment loss is included in profit or loss under "Other revenue". During the year, there were no additions or disposals of the intangible asset 3 Investments at fair value through profit and loss (FVTPL Investment) The market value of investments had decreased by $100,000 during the year. Although there was no disposal during the year, the company has made additional investment by cash during the year Investment income was fully received during the year and was included in the profit and loss under "Other revenue". The company classified the investment income under investing activities for the statement of cash flows. During 2019, the company issued ordinary shares for cash and $500,000 bonus shares by the way of capitalization of retained profits. (4) (5) Other revenue Gain on disposal of plant & equipment Investment income Impairment loss on intangible asset Loss on revaluation of FVTPL investments 2019 S'000 in thousands) 240 40 (30) (100) 150 * Investment income from investments at fair value through profit and loss was fully received during the year. (6) Tax expense for the year 2019 was $200,000 which included both current tax expense and deferred tax expense (7) The company paid cash dividends to its ordinary shareholders during the year. The company classified interest payment as cash flow from operating activities and dividend payment as cash flow from financing activities. (9) The company used periodic inventory system. All accounts payable relate to inventory purchases (10) All purchases and sales were on credit. Required: Using the indirect method of presenting cash flows from operating activities, prepare a statement of cash flows for Kerry Limited for the year ended 31 December 2019 in accordance with HKAS 7 "Statement of Cash flows". Show all workings. Notes to the statement of cash flows are not required. (18 marks)